There are some risk considerations that we should be aware of when we are spending down our assets. The majority of the folks are at a stage where they focus on wealth accumulation, but, what I realize is that the considerations when you reach the stage of withdrawing part of your wealth from your wealth assets are very different.

The failure to understand this may cause a serious impact on your retirement or financial independence plan. In this article, we try to define what is the sequence of return risks and their impact on your plan or considerations that you need to put in place due to this risk.

Generic spending considerations for your wealth fund

Most would see their wealth objectives to meet a particular spending goal in the future when they stop working. We can call this stage retirement or financial independence. You spend a large part of your time when your human capital is productive to earn wages and you prudently build up wealth so that you can retire.

When it comes time to spend it there are such considerations. How much do you need annually and how would inflation affect your purchasing power. How do you make sure you do not outlive your assets that provide the annual spending cash flow.

On the part of the wealth fund, there are considerations such as how much you have build-up, and how safe you want the cash flow during retirement to be versus a higher spending % with the risk that your assets will run out. The size of your fund will also determine the assets and instruments you use to meet your spending needs.

If you have accumulated $5 mil and require $40,000 over 30 years, you do not need to take on above-average risk to the type of assets you use, but, if you have accumulated $500,000 and need $25,000 over 30 years, your assets will not last you unless it grows during these 30 years when you need to spend them down.

This would usually entail a paper portfolio of stocks and bonds with a particular asset allocation mix (e.g. 50% stocks, 50% bonds). You need to consider controlling the volatility versus the rate of return necessary to ensure you meet your minimum spending floor.

How Your Geometric Returns Will Grow without Withdrawing Cash Flow

When you have part of your assets in stocks, you have to contend with volatility.

When you are building up your wealth fund, this volatility is acceptable because you have a longer-term horizon for the volatility to work itself out and hopefully, resolve on an upward bias trajectory.

In terms of the geometric sequence of returns, they don’t matter that much.

Consider that A and B have $1 at the start. For the next 5 years, A’s geometric return profile is as follows:

- +10%

- +30%

- -50%

- +40%

- +5%

B’s geometric return profile is as follows:

- -50%

- +10%

- +5%

- +30%

- +40%

A’s $1 at the end of the 5 years is: $1 x 1.1 x 1.3 x 0.5 x 1.4 x 1.05 = $1.051

B’s $1 at the end of the 5 years is: $1 x 0.5 x 1.1 x 1.05 x 1.3 x 1.4 = $1.051

Different rate of return profile but they end up at the same compounded value.

How Your Geometric Returns will Grow when you Withdraw Cash Flow

The following illustration give an example of geometric returns but this time with withdrawal

The key difference here is that the systematic withdrawal deprives the fund from having the same amount of assets to comeback after the initial bad years. This becomes escalated if, the person needs to keep up with inflation and embeds an escalating 2-3% more withdrawal per year. Here is another example

The interesting thing is that in both examples, it takes only 3 years of consecutive less than 30% down years to wreck havoc. We know that you can have another 2000-2002 serious bear market that illustrate the same situation.

The Inflation of Your Spending Factors Into Sequence of Return Risks

One of the big misconceptions many people have is that they estimate the worst-case scenario where your money will not survive to be huge, or prolong bear markets.

However, the data shows that the toughest market to live through are the periods where the inflation rate is rather high.

The sequence of return is not just a profile of the sequence of your returns but also its interaction with other flows to your portfolio value. And in retirement, there is constant spending from your portfolio to worry about.

When the spending rate picks up during a high inflation period, even a good rate of return cannot prevent your portfolio from running out of money.

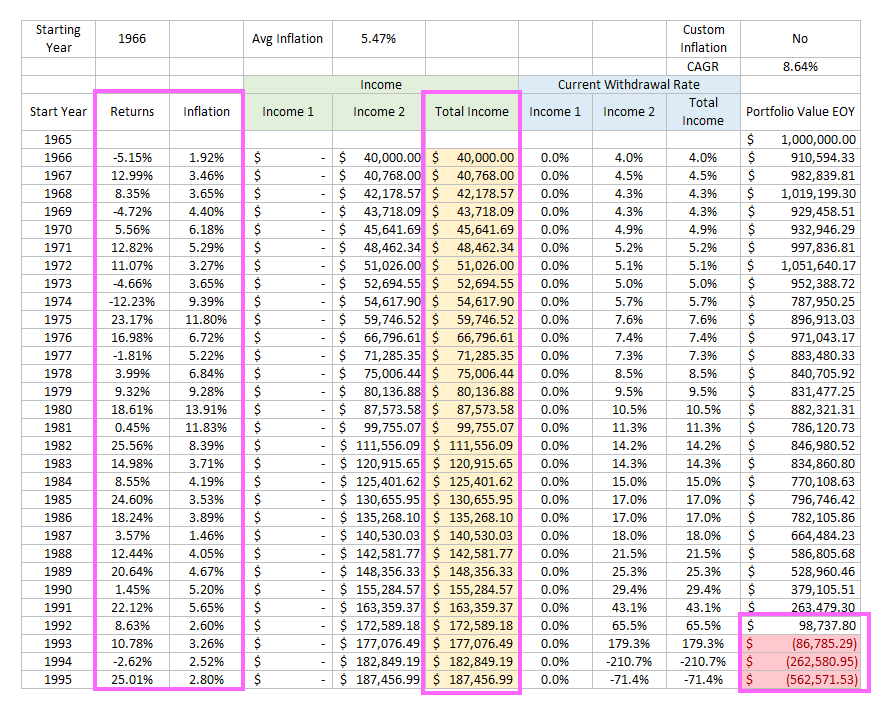

Consider the case of this retiree who lived through a period where the returns and inflation rate is similar to 1966 to 1995:

The retiree starts with $1 million and spends $40,000 in the initial year. For subsequent years, the retiree will adjust the previous year’s spending with last year’s inflation rate.

During this period the inflation averages 5.47% a year.

This is probably the toughest inflation period in US past history.

The rate of return during this period averages 8.64%.

As you can see, at the end of year 27, the retiree ran out of money.

The interesting thing is that the worst calendar year rate of return during this period was just -12.2% and that only happen in year 9! What killed the portfolio was the high inflation rate.

This is something to think about.

The Impact of Sequence of Return on Your Financial Independence

So now we know we have to factor in the inflation sequences into looking at the sequence of return.

A very big determinant of whether you have enough wealth assets to last the duration you require depends very much on the first few years not being bad. Monevator has this good summary of the 4 possible scenarios we will face in a 30-year retirement:

- An early secular bear (a market cycle that lasts for 20 years) at the start of your retirement or financial independence followed by a late secular bull is a big problem as illustrated

- An early secular bull market followed by a late bear is not a big problem as your assets would have appreciated adequately to buffer for the future bear

- A secular bear that lasts the entire 30-year duration of your retirement or financial independence will be shitty no matter how you look at it

- A secular bull that lasts the entire 30-year duration of your retirement or financial independence is a really good situation to have

So #1 and #3 is the one we should be careful about.

With that in mind what are some of the solutions, we can explore to alleviate the negative sequence of return risks in financial independence?

Start with a More Conservative Constant Inflation-Adjusting Spending Rate

I find that the best solution if you do not wish to be flexible with your spending, or cannot be flexible with your spending, is to start with a relatively conservative starting spending or safe withdrawal rate.

There are not a lot of other options because of the delicate interaction between inflation and portfolio returns.

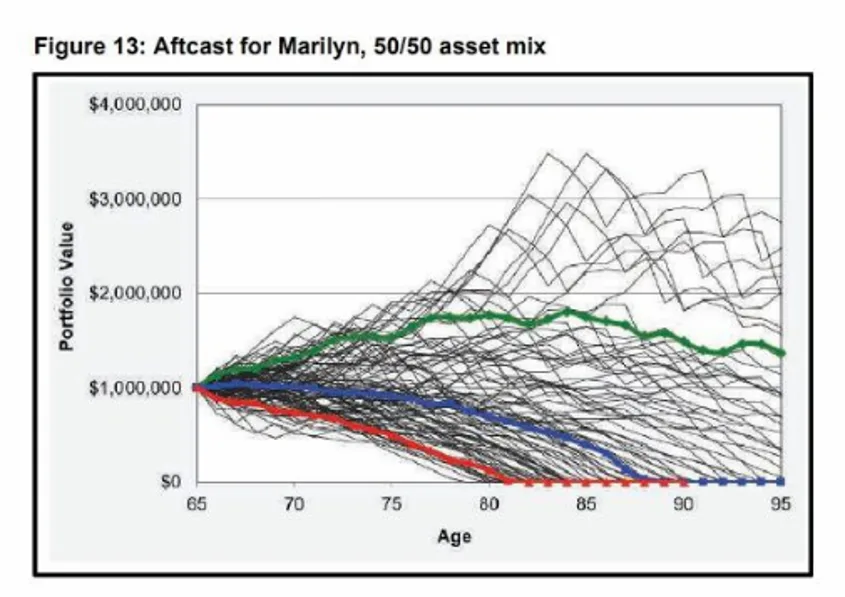

You can imagine that you are like Marilyn and Jane who are trying to make their 50% equity 50% bond portfolio last during their retirement, and they could, in theory, live through one of the many, many different market return and inflation sequences:

In some sequences, Marilyn will have a good outcome and her money would last. The blue line represents the median sequence and the red line represents a rather unlucky sequence (the gree represents a rather lucky sequence)

If Marilyn lives through a median sequence, she will run out of money.

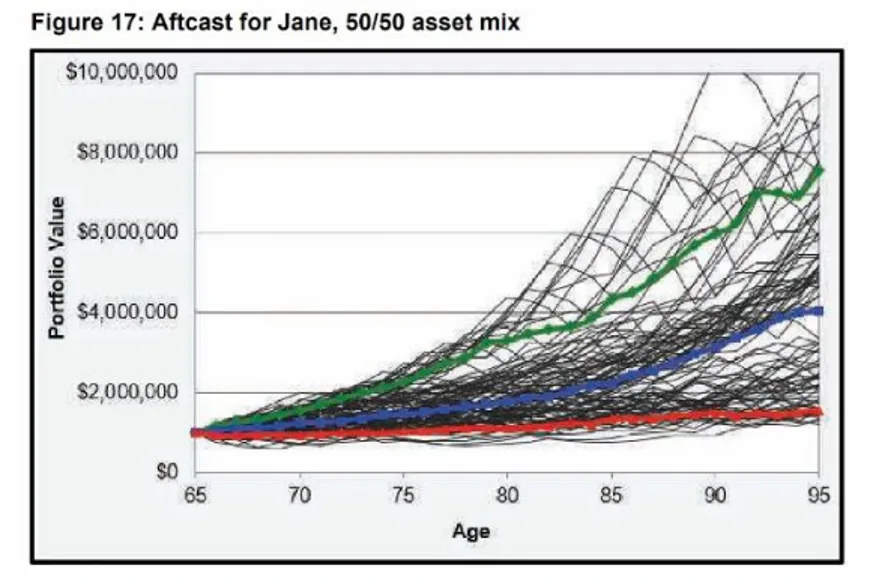

Jane goes through the same retirement income strategy but chooses to start with a much more conservative withdrawal rate:

Jane might live through the same sequences as Marilyn, but observe that even in rather unlucky situations, she would not run out of money.

So the million-dollar question is how low is conservative enough?

There are various research but if I were to collate there tends not to be one clear answer, due to the different permutations but your starting income extracted from your portfolio should be kept below 2.8% of the portfolio starting value.

This means if you have a $1 million portfolio, you can only start with $28,000 in income.

For those with a longer time horizon, or who wish to keep the money in the family through different wars and famine, the rate is closer to 2-2.3%.

The lower the rate, the more capital you will need. This means that not all your spending can be planned out this way. You would also take note that, you might live a lot of money on the table not spent if you turned out to be far luckier.

Thus, not 100% of your spending on financial independence can depend on very conservative risk-managed spending parameters like this. It has to be your very carefully constrained essential expenses.

Let us take a look at other strategies that may augment being conservative.

De-risking your portfolio briefly

Keeping your portfolio less volatile matters in ensuring the money doesn’t run out. To have sustainable income is not a high-return thing. The higher your return expectations, the higher the volatility.

You can mitigate large drawdowns in the earlier years of retirement, where no income comes in by deliberately reducing the equity allocation in your portfolio for the first X years of your retirement.

You can then after X years systematically scale up the equity portion to ensure your assets grow to keep up with inflation.

The reason you need to scale up again in retirement is that if your retirement is longer as you start younger than 65, you may need more returns to ensure the portfolio last longer.

My concern here is how long the drawdown will last. A secular bear will have numerous ups and downs. Adverting the first 5 years might mean you adverted a bull run in a secular bear only to be ready to scale into the bear leg of a secular bear.

De-risking your portfolio with Safety First Strategies

This solution is to shift to products or allocations that have lower volatility.

By reducing the risk profile, it is a more safety-first approach. You are ensuring that you have a high degree of how much $ you can get and how long it lasts.

Assets that fell into this category are:

- Bond ladders

- Annuities

- Bond ETFs or Funds

The downside of de-risking is that given how low rates are, this solution will need a larger capital. Quite similar to the first conservative starting spending strategy.

Not everyone can do that.

Thus, it is better to combine with other strategies. This strategy is meant more for your essential expenses and you need another spending strategy for your less essential expenses.

Income-based asset approach

Another popular approach to prevent the principal to be withdrawn that creates the sequence of return risk problems is to focus on income-producing assets. These would include

- Property Rentals

- Dividend Growth Stocks (an example are dividend stocks on this dividend stock tracker)

By spending only the income distributed, the principal has the potential to grow after the initial loss of value.

The weak point of this approach is that your annual withdrawal spending depends very much on the yield afforded by the property rental, and dividend stocks.

The assumption for wealth distribution is that there is a particular spending goal that you need to meet. And when you don’t meet it, it is considered a failure.

A property might not be rented out or rented at a reduced lease and when the markets are not doing so well, dividend distribution can get cut.

Your spending will be volatile unless you decide to stabilize your spending by selling some of your capital.

The income-based approach is more suitable for your less essential expenses where you are more flexible with your spending.

Cash Flow Reserve Ladder / Bucket Approach

The idea behind this plan is to create steps based on how far out you need the money. Specifically, to combat the sequence of return risk, a 1 to 2-year liquid non-volatile cash reserve is built up which caters for the first 2 years’ spending needs.

This ensures that the volatile stocks portion do not get withdrawn and they have the potential to swing back up when the stock market becomes better.

In this illustration, the cash flow distributions such as dividends and interest income are channelled to the cash flow reserves which will then be in waiting to be spent in the next 1-2 years. Suppose your stocks do not have high dividends, a rule can be set such that:

- Periodic rebalancing between fixed income bonds and equity stocks investments. It is a systematic buy low sell high

- If equity stocks investments are positive and doing well, sell part of equity stocks investments needed for annual withdrawal cash flow and move it to cash flow reserve.

- If equity stocks investments are negative, move the bonds portion

The result is to minimize the drawdown when equity markets are not doing so well.

In some cases, the buckets or assets match close to the spending horizon, and they are executed more stringent. the worry here is that rebalancing between asset classes cannot take place and the person misses out on the performance and systematic prudence afforded by rebalancing.

This approach looks very much to be a combination of the few approaches before and you can see the elegance in this solution.

Variable Spending Strategies

The assumption here in this article is that the person has a fixed spending goal and if you do not meet this then it’s a failure. In reality, people may not spend like that. They tighten up when things get challenging and tend to spend more when the situation is good.

The idea here is to come up with a fixed set of ‘scripts’ to control a person’s withdrawal depending on the economic situation, the initial withdrawal amount, and the withdrawal percentages.

The original idea of this strategy is to boost the hard 4% withdrawal rate identified by William Bengen in Oct 1994 of a safe withdrawal rate based on historical USA figures that will last a person over a long time, such that they will not outlive their asset.

In recent years, this rule has been challenged due to the change in the economic climate and the corresponding investment returns.

These variable spending strategies serve to boost a greater than 4% withdrawal rate to improve spending, but it helps sequence of return risk because many of what was simulated would include negative sequences.

David Zolt has a good article here on retirement planning by targeting safe withdrawal rates.

Some rules:

- If stock markets return is good, annual spending withdrawal goes up with inflation (CPI). If the stock markets return is bad, no increase in annual spending withdrawal

- If the current annual spending withdrawal is less than 1st year’s annual spending withdrawal, the no increase in withdrawal rule does not apply (if not you get to spend less than what your original plan out)

- Capital preservation rule: If current annual spending withdrawal RATE is greater than 120% of 1st-year annual spending withdrawal RATE, reduce current annual spending withdrawal by 10% ( your portfolio is shrinking)

- Prosperity rule: If current annual spending withdrawal RATE is less than 80% of 1st-year annual spending withdrawal RATE, increase current annual spending withdrawal by 10% (your portfolio is growing)

- Portfolio Management rule: Make priority withdrawal from asset classes which experienced the greatest growth

The idea here is to create fundamentally sound wealth management decision rules to ensure that spending does not increase when markets are bad, with the occasional recalibration back to the original spending withdrawal amount.

The risk here is that the plan needs to be well thought out, failure could leave the person in a worse-off position.

By accepting this, you may be subjected to losses in purchasing power, while boosting your annual withdrawal RATE.

This fits a person who is very well aware of how he wants to spend his money and spends the time to understand how his plan works and points of failure. He must also be someone willing to execute such intermediate wealth management rules.

Most importantly, it fits for the early retirement or financial independent folks (a bit ironic here) who is planning with little buffer and working with tight wealth fund parameters (e.g 6% withdrawal on a $400,000 all stock wealth fund)

Multiple streams

The last solution is alternatives, where a person not just has his wealth fund to depend upon but also government social security support, children support or strong enough to still work on a part-time basis.

An understanding of the sequence of return risk will enable the person to be stringent about spending less than the spending goal and makeup via these other sources.

Summary

The sequence of return risk can be called the evil stepbrother of dollar-cost averaging or reverse dollar-cost averaging and could pose some complications to your retirement goals.

If you digest this whole article, you will realize that a common theme is that even the solutions have many negative aspects that you would need to find more solutions to.

This is why having a competent planner really can bridge the knowledge gap and hopefully guide you well so that you do not outlive your assets.

There isn’t a foolproof solution. Well, there is, that is build up to $5 million and spend only $50k annually. This gives you much more buffer or margin of safety to work with.

To figure out how much you need to be financially independent or retire, you have to work to figure out some basic parameters such as your ideal must-have and good-to-have expenses as well as how you can still competently build wealth when you get that. If you have not figured it out do find the resources that can help you figure it out.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

TFI

Friday 17th of June 2022

thanks again for your great sharing. one question that I always have about such simulation is the assumption of expenses continues to be the same (inflation adjusted) as one person ages. But as we age, our expenses should reduce. Children are independent, insurance are mature, no more private car, a lot less travelling, eating less...

I am just wondering if you have data to show which is more likely? people continues to spend as much as they age or their spending decrease as they age.

Kyith

Monday 20th of June 2022

Hi TFI, it depends on how you go about your planning. For example, I would determine my desired retirement lifestyle based on line item first. Then i would assign the cost to it. This will work out in today's dollars, how much it cost. In this way, i will take out the cost that goes away after children is older and when i am not working.

Given this, we work out the retirement expense. So for a lot of us, we have factor that in.

thinknotleft

Saturday 11th of June 2022

We can also choose portfolio like Harry Browne's Permanent Portfolio or Ray Dalio's All Weather Portfolio that have lower drawdowns and work acceptably during all economic conditions.

Such portfolios will mitigate sequence of returns risk better due to their lower drawdowns, compared to the 60 equities/40 bond portfolio.

Brendan Yong

Tuesday 18th of November 2014

A very detailed explanation Kyith. Especially liked the concept of cashflow reserve, laddering. It's also a sobering thought about market volatility and its effect on our hard earned savings.

With a portfolio 100% exposed to stocks, the risk of an early string of losses are serious. If you were hit by both the 2001 internet bubble, plus SARs in 2003, then the Financial Crisis in 2008, you could really be "OUT" of money soon.

However, had the investor took a more balanced approach with bonds in the portfolio, the volatility would not have been that bad. (http://www.ritholtz.com/blog/2013/08/asset-class-returns-2). Trading off some returns but still a respectable 6-8% pa. Hence your concept of De-Risking.

Laddering of bonds maturing every year that meets expense requirements are a great idea. However, with yields so low, you can hardly find anything AAA/AA that's less than 5 years giving you more than 3% pa.

Multiple streams of "low correlated" income would offer some comfort. Despite attractiveness of property rentals, they carry some risks: tenants, interest rate, rental market. So, I'd combine rental with some annuity/bond income for certainty of maybe 50-60% of my expected expenses. in Singapore, we can factor in CPF Life (MSS Scheme) as part of that retirement funding. The rest I'd leave it to my stock dividends, rental income, and other investments.

Kyith

Tuesday 18th of November 2014

Hi brendan,

Thanks, i think this is an example a competent planner would help to point out this issue.

I have not gotten to reply on your paper yet sorry about it.

Guest

Tuesday 18th of November 2014

Hi Kyith

Regis Tabaries

Sunday 16th of November 2014

Hi Kyith,

Thanks for this very pragmatic, well thought about and documented article, as always.

Just to share my thoughts, in your article the main focus is on market risk and people behavior. These are clearly the main drivers for building your wealth. But in my opinion, they should become marginal once you retired and you should be focusing on other type of risks by then: unknown unknowns. This is what can hurt, especially if your assets are concentrated in a location/sector/nature/class.

What-if governments decide that dividends should be taxed at 75%. What if your base currency becomes so weak that even a bag of rice becomes unaffordable. What if a SARS-like virus strikes again? What if your tenant refuses to pay? Is your plan hedged against these risks?

I think you cannot just rely on bonds/equities/dividends/real estate if your plan is to create a stream of sustainable cash flows which will allow you to live Decently for a very, very long period. And very long means for at least the next 40 years given our age. I think you also have to integrate the concentration, fiscal, FX and systemic risks for this tenor. At the same time you need to be flexible and agile to change your plan and adapt to new rules.

My ideal retirement plan includes: 1. Renting out a small property in Europe (London is my preference) and one in Dollar (Singapore is my preference) 2. A basic retirement pension insensitive to the market movements (CPF and life insurance annuities both in USD and SGD) 3. A mix of high yield equities and blue chips for growth 4. A reserve fund in liquid cash (and physical gold?) for rainy days 5. Some very long term bonds paying stable coupons 6. Retiring in a location where daily expenses/taxes will not be outrageous

The intention being that if (ever) one or two of the above streams vanish, I can still live decently. If this was to (ever) happen or if I need to do an arbitrage from one asset class to another, I will not need to liquidate some of my assets at their worst price.

I am still far away from my objective since I cannot even figure out how much each bucket should contain, but the good news is that there is still plenty of time and opportunities to come :)

Regis

Kyith

Monday 17th of November 2014

Morning Regis,

As usual, excellent thought provoking comments. You have to understand the context of the discussion is on the sequence of return risk mitigation and thus i didn't delve into the unknown unknown. If i may add a word, if you have thought about it, its actually known unknowns haha!

I like your plan actually, pertaining to mitigating the sequence of return risk. its very diversified really and there isn't a benchmark to beat at that time its more of meeting the wealth distribution goal.

Heavy active management though!