If you don’t have a fundamentally sound plan, what happens is that you aren’t ready for most scenarios that happen. A large drawdown is going to happen its your action plan.

Sometimes it is your appreciation of a draw down.

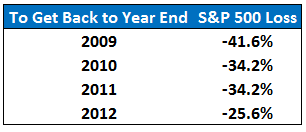

In time travelling to prior crash predication, Ben provides a rather interesting table:

Bears say the market will crash is true, but a good bear provides the RIGHT time frame. You can’t keep talking about it. The price target to get back to all these points look intimidating.

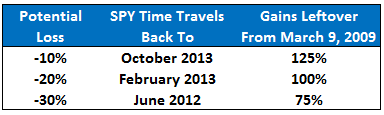

Until you realize perhaps you won’t give up all of it.

Framing your brain, you have been itching to “buy cheaper” and when the time comes, you probably think of not being a vegetable head of missing out buying much cheaper.

Well prospect with true margin of safety will try to ensure you have an iron cast business that doesn’t lose you money. The worry is that you have not learn enough, experience enough to know you have a real value proposition. You just have to improve your prospecting skill if you want to actively manage.

If you kept waiting to buy only in bear market, you might realize that, good businesses like Vicom or even mundane wants like Telechoice didn’t fall much during a 60% STI fall.

Even after the fall, their stock price may still be much higher than the peers that bought into this good business! And you miss out on the dividends!

What’s it gonna be?

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

abc

Monday 9th of June 2014

Use a simple system like the below: Reinvest your dividends every year - look for good value shares to invest or look at insider trades of good companies. Reinvest your invest-able salary savings (i.e. less your contingency cash) when there are dips in the market - invest 100% when there is a 50% dip (happens once every 10 years?), invest 50% when there is a 20% dip (happens once every 5 years?) etc.

Kyith

Monday 9th of June 2014

hi abc,

that sounds like a good rule of thumb. the 50% investment when its down 50% seems a bit hard. this means that by then you should be 75% invested. i am not sure if you mean liquidate at the top, keep 80-100% in cash in order for you to do that.

Kyith

A

Sunday 8th of June 2014

The ignorant who knows that he is ignorant will try to time the market. His returns will depend a lot of luck and his emotion.

The ignorant who does know he is ignorant will also try to time the market. He will miss most of the bull and the bear, and will probably hold more than half of his portfolio in cash most of the time. His returns will probably be worst than a regular investment plan in an index plan.

Just my view.

Kyith

Sunday 8th of June 2014

Hi A,

this does sound like me.