When Eagle Hospitality Trust’s (EHT) share price fell recently, I thought it is a rather good exercise to take a look at how 5 investors will experience the downside.

EHT is a real estate investment trust (REIT) who master leased their assets to their sponsors.

At various price points, it provides the investor with a dividend yield of 8% to 14%, based on their forecasted cash flow guidelines.

When the share price fell, many investors sell. There are also investors who think there is a value somewhere and are buying.

This is, after all, a business model that is not very unfamiliar to many people. It looks like it is fixable in the long term. At the same time, there is uncertainty because it feels like the current true value of the hotels are much less than what was stated in the IPO.

The Experiences of 5 Investors

Suppose we have 5 investors that tried and successfully gotten invested in EHT at different times.

All 5 investors have the same mentality:

- They think that at the price they buy, there is value. While the time period they are looking at is different, they believe that given the time frame they are looking at, the total return (dividend income received + capital appreciation) will outweigh the prices they are paying now.

- They all don’t like to lose money. The feeling of seeing their capital in the red kills them.

- If given the choice they want to protect their downside

- They all want to get in at the price where it is the lowest

So the price chart of EHT for the past 3 months plus look like this:

The price could go three ways:

- Up

- Down

- Sideways

Depend on the timeframe.

Which Investors Feel the Least Pain?

When we

- Sell and buy back at a lower price

- Wait to buy at a lower price

- Take profit and then try to buy back lower (almost similar to #1)

- Buy only after a certain plunge

Behavioral wise, we are trying to minimize the pain.

So how did this work out for our investors?

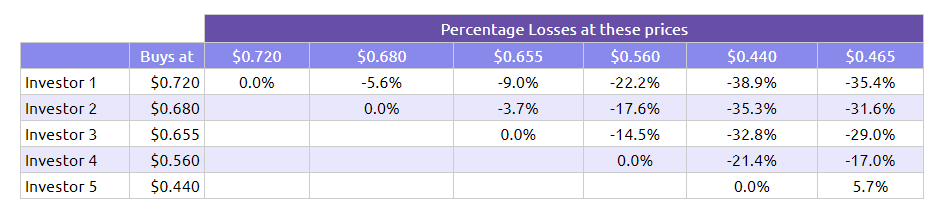

The table shows our 5 investors, who sought to buy at the closest value point, where they will be able to maximize their profits, minimize their downside:

Suppose time suspended today and we take stock of the performance.

At this point, investors 1 to 4 all have unrealized losses:

- Investor 1 lost 35.4%

- Investor 2 lost 31.6%

- Investor 3 lost 29%

- Investor 4 lost 17%

Investor 5 has the best timing and managed to get out a 5.7% return.

Who was the Smart One?

Investor 3 thought he got a good deal.

Looking at the price chart, he got in at $0.655 instead of the high of $0.68.

Investor 2 would argue she got a good deal. Instead of getting it close to IPO at $0.72 she got it at $0.68.

If we were to use some hindsight bias, and we review this way, Investor 4 got the best deal out of those that currently lost money. She got in at not $0.72, not $0.68, not $0.655 but a much, much lower $0.56.

At this point, the smartest is, of course, Investor 5 who managed to end up with a profit.

In the end, the 3 investors after the first one didn’t avoid downside. They still suffered losses.

The Impact may be Different If We Consider the Potential Absolute Losses

What spook most of us with losses is that:

- We think we are making the biggest mistake of our lives

- We think we are losing a large part of our net worth and that is irrecoverable

In terms of percentage, the impact might not be as big. But what if we present it in terms of absolute dollars?

Imagine that Investor 1 to 5 invested $100,000.

Investors 1 to 3 have potential losses of nearly $30,000 while Investor 4 has potential losses of $17,000.

To some of you losing $30,000 is a very, very, very big deal and something very distressing. For some of you, this is nothing much.

What if We Layer in Net Worth and Time Horizon?

Suppose I tell you that Investor 1’s net worth is $2 million.

Do you think if you are Investor 1, you can endure an unrealized loss of $-35,417?

I think Investor 1 had an easier time than Investor 3 if we know Investor 3’s net worth is $120,000. With a $-29,000 loss, she almost lost 24% of her net worth.

But Investor 3 will feel less pain if we know that her salary is $80,000 a year and she has 20 years more to retirement.

While this potential loss is large if she can critically think, her savings from her salary over the next 20 years will more than offset this $29,000 of potential loss.

You Need to Learn to Live with Psychological Stress of Being in the Market

We all wish to avoid feeling the pain of seeing our hard earn and previous money vanish in thin air.

But if we use price as the sole indicator in our investment decision making, you might not avoid that painful feeling of seeing your portfolio in a losing position.

In this EHT example, 4 out of the 5 investors suffered the psychological stress of seeing their portfolio in a big losing position.

There is this strategy being passed around that you should only invest in a great bear market. One where the market went down at least 30%.

It is likely they wish to

- avoid losing money

- looking like a vegetable head

- suffering losses to their psychological capital

The math of things tell me that you can’t avoid the pain of seeing large unrealized losses in your portfolio.

You cannot avoid the pain:

- For those picking the bottom, only a handful would manage to do that. And they do so by luck most of the time

- For those buying at the bottom, if you see a stock go down from $1.00 to $0.30 and you buy it, don’t feel surprise seeing it go down to $0.15. You avoid a 70% potential loss, only to get into a 50% potential loss.

What is the solution?

Based on what I understand being in the markets this 15 years, there is not much strategy that can make you avoid the pain and still earn a great return.

It means… you need to increase your willingness to take risk by learning to endure this psychological stress.

Long term, you are likely to earn good returns.

The cost is that you need to pay for this by enduring psychological stress.

This is Your Pact with the Devil.

Being a historian of the markets, being a connoisseur of understand behavioral finance can help you cope with the pain of unrealized losses better. It may enable you to retain as much psychological capital as possible.

Lastly, in financial planning, we talk about your ability to take risks. Many pay lip service to it until they take psychological damage from the markets and see their psychological capital depleting at a much faster pace than their financial capital.

I have shown you that your position sizing, relative to your net worth, to your income and how far you are from your wealth accumulation goal, affects how much psychological damage that you may take.

If you are near your goal, your income is going to stop soon, your ability to take risk is much, much lower even though your willingness to take risk is high. If you lose a large part of your capital, it will be very hard to earn them back.

However, if you have a long time horizon, even though you have lost a significant part of your net worth this time around, you learn from this possible mistake. In the next 15 years, you would replenish your capital through savings and if the stock recovers.

Here is a summary of making pain more livable:

- Understand Your Investment Strategy – It has to be both Fundamentally Sound and Implementable/Applicable to You

- Not evaluate based on price but based on understanding the business and whether you have a margin of safety in your investment

- Understand your ability to take risk. This is dependent on your time horizon – how far are you from your wealth accumulation goal

- Size each position carefully based on

- Your Net Wealth

- Your Percentage Savings Rate of your Net Salary from Work

- Be a historian of the markets, being a connoisseur of understand behavioral finance can help you cope with the pain of unrealized losses better

If you like content like this, I write more of this in my Active Investing section below:

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Win

Wednesday 20th of January 2021

Hi, enjoy reading your articles.

Retired uncle

Sunday 17th of November 2019

Well Kyith, I am aware of those ratio theory, 50/50, 60/40, 70/30, etc. Honestly, I have yet to fully figure it out as I am not smart enough. I worked from a different angle, from an annual expenses one. As long as the passive income is enough for me, I am fine. What I like about it its almost "guaranteed". There will be yearly deviation but due to the larger fixed income base, its small enough not to affect my simple "livelihood". :) The current allocation will change. I can only control what I can control, less the market and that Eagle. :)

Kyith

Saturday 23rd of November 2019

Hi Retired Uncle, it feels to me that your base is large enough such that these small fluctuations matter less.

Retired Uncle

Wednesday 13th of November 2019

Super good article. Thanks Kyith. I am in group 2 but practice both asset allocation (25% stocks) and position sizing. Risk only 1% of my net worth for this stock. Been in the market for 30 years and went through 4 crashes taught me that anything can happen. Don't be over confident, cocky or too greedy. One FA told me I am too conservative given my net worth. But I prefer not to lose sleep.

Kyith

Sunday 17th of November 2019

Hi Retired Uncle, i guess seeing real volatility shapes a person. i wonder in financial planning the better advise is to have a 50/50 portfolio, wait until more volatility, then adjust the client's portfolio. I have this idea that client's do not know their real risk tolerance until they see some volatility.