Three years ago, Financial Samurai wrote a great post to help us make sense of our exposure to risky assets versus how much pain we can endure.

I thought it is always good to reshare it here and update my thoughts about it (this post was first published in Jan 2019).

Those who have chatted with me would know how I feel about some of his posts, which sometimes border on too dramatic but often he comes from a more conservative angle.

This article gives a good way to frame the problem of managing your equity exposure, and how to balance up your risk tolerance.

Why We Fear Market Drawdowns

A drawdown happens when something that you bought fall in value from a certain point.

Usually, suppose a stock reaches an all-time high of $100 and now it is at $70, we say the stock experienced a 30% drawdown.

Psychologically, most of us do not take large drawdown of our wealth very well.

We call people like this more risk-averse individuals.

The opposite to risk-averse are those who feel very OK to see their net worth go down by 75% and carry on with their lives. These are the more risk-seeking folks.

Risk-averse folks are less risk-tolerant. Risk seeking is more risk-tolerant.

So how do we factor how tolerant we are towards risk into the management of our wealth?

For the more risk-averse folks, they tend to favour financial assets that are less volatile.

These are financial assets such as individual bonds, fixed deposits, government bonds, insurance savings plans, investment property. These are less volatile in the eyes of wealth builders (which might or might not be true in reality)

Then there are the more volatile financial assets such as individual stocks, commodities futures, options, non-money market/bond unit trusts.

Financial Samurai feels that we often overestimate our risk tolerance.

What this means is that we think we can endure many downsides to our net worth but in reality, we struggle with some residual mental issues when we implement our portfolios based on this assumed high-risk tolerance.

And thus he introduced his Financial SEER, which is short for financial samurai equity exposure rule.

Sizing your Equity Exposure according to the Number of Months of Income You Earn

Financial Samurai say that when your portfolio is down, usually the main way to “rescue” your portfolio is via capital injection.

And a lot of the capital injection comes from your income.

For example, suppose your portfolio is $10,000.

The average decline in this region is about 50% for example. So you could see your portfolio get cut to $5000.

If your income is $5,000 a month, that decline is almost like 1 month of your income.

You can view it as an opportune time to buy into volatile assets with a prospect of higher return at a good price.

If you frame your brain that way, you should sleep pretty well at night.

However, if your portfolio is $300,000, the same 50% decline will cut your portfolio to $150,000.

That $150,000 reduction in value is almost 30 months of your income or 2.5 years. Generally, it is also a good time to purchase more, at good valuations, but psychologically, it is hard to endure such a great net worth reduction, and the income cannot readily “rescue” your portfolio.

If your portfolio is a mixture of 50% stocks, 50% bonds, then the reduction in portfolio value is probably half, or around there. So it will take your portfolio 15 months instead of 30 months to come back.

Generally, I do think if your capital injection to your portfolio, can make up for the unrealized losses in 12 months that is pretty good.

So according to Financial Samurai, the portfolio size, the allocation to volatile equity and your working income is related.

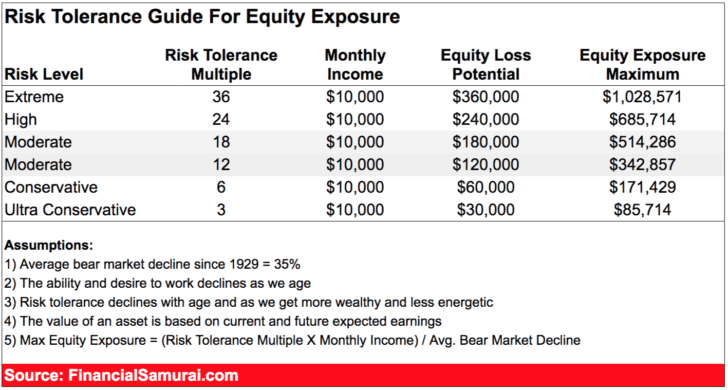

With that he came up with this rule:

Your Risk Tolerance = (Public Equity Exposure X 35%) / Monthly Gross Income.

Suppose your portfolio is $500,000 and you are 70% in equity, and your monthly gross income is $7000/mth.

The expected equity drawdown is 40%.

Your risk tolerance = (500,000 x 0.70 x 0.40)/7000 = 20 months.

If your risk tolerance is higher, you could take it that your monthly income makes up for the decline in net worth. If it is lower, generally you can take less.

My metrics are a little different from Financial Samurai in that, I generally only consider the recurring capital injection from gross income into the portfolio and not the entire paycheck. If we use the same metrics, the multiple will be higher.

As financial samurai says, 12 to 18 months is a good gauge.

How to Calculate your Maximum Equity Exposure Your Portfolio Should Have

Given that we know this relationship between income, equity drawdown, portfolio size and equity allocation, we can re-arrange them and compute your maximum equity exposure.

Suppose you are rather moderate and can frame your mind to inject 1.5 years of your income to make up for the decline in portfolio value.

The higher percentile decline you are afraid of for your entire portfolio is 40%.

Your portfolio value currently is $500,000. Your monthly salary is $7,000.

Maximum Equity Exposure = (Your Monthly Salary X Risk Tolerance Multiple) / Expected Percentage Decline

Your maximum equity exposure is = (7000 x 18)/0.40 = $315,000.

$315,000 would be a 63% equity exposure.

Now, that is probably your psychological point if you would like to preserve your mental capacity to make investment decisions soundly. It coincides with what I always say that you can be an entrepreneur by concentrating when your portfolio value is lower, but over time it might make more sense to increase the returns per unit stress by being a little more diversified.

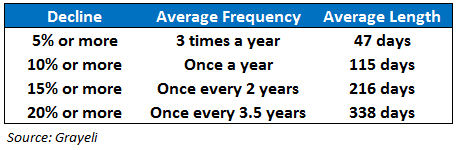

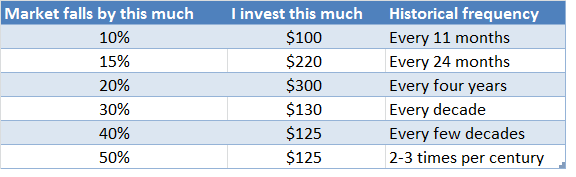

We could layer this with what Morgan Housel illustrated in my previous article on how much you would invest, in different market falls. The data is based on developed markets. And if you are afraid of a more than 20% fall, it happens once every 3.5 years and typically lasts 10 months.

So if this is the average, to cushion this, your maximum equity exposure is (7000 x 18)/0.20 = $630,000. This is more than your current portfolio, so it also means you can be rather fully vested, to cushion greater than 20% fall.

The main reason you can have more equities is that

- the drawdown is lower

- your risk tolerance is 18 months which is less conservative but not to the point of being very aggressive

I do think that this ratio is very useful but it could possibly make a person under-invested in equities at the wrong time.

Let us go through some thoughts.

How to Factor in Different Market Regimes into Your Maximum Equity Exposure

I think it pays to layer this with how long has been the duration of a secular bull market.

The average duration of a bull run in developed markets is 4 years plus. In emerging markets probably shorter.

And thus if we just emerged from one big market drawdown, or in the midst of one, your maximum exposure might make you under-invested.

The general equity market is in a process of dropping and you might have already suffered some losses. It will be challenging to implement something like this in the middle of it as your portfolio has already taken a hit, and then you found yourself overexposed.

This maximum exposure can still work, but perhaps you need to tweak the parameters a bit. Since the value is already down a fair bit, the potential drawdown should be adjusted downwards, and not used as 40-50% of your portfolio. If you use that, you will probably be so overweight in cash or bonds at the wrong time.

If we are in the midst of some initial recovery (if you can spot this, which can be difficult), limiting your exposure to equity this way… just feel really weird and not right.

At the end of the day, we have to recognize that this way of portfolio allocation is to manage your downside based on risk tolerance and that, the downside will shift.

There are some markets, such as the emerging markets, where the volatility is so much that perhaps fluid shifting of equity exposure is just difficult.

If you cannot take this volatility, then most likely it is better for you to form the majority of your portfolio with bonds.

If you currently do not earn an income, you will need another way to reframe market drawdowns.

One of the components of determining risk tolerance and maximum equity exposure is income.

But if you have stopped earning income, or going to soon stop earning income, Financial Samurai’s way of framing is not too relevant to you.

Financial Samurai and I are showing you some different ways to trick your brain to accept that the downside is temporary and not making a grave mistake by selling your portfolio at a low.

Without income, the stock and bond allocation in your portfolio is greatly determined by:

- How much wealth you have accumulated

- How long do you need your money to last

- How much income do you need to spend

- Do you need your income to have inflation-adjustment

Due to these constraints, it means that you may not have a choice but your asset allocation needs a fair amount of equities.

If you are really risk-averse, you can only allocate a small amount to equities and you may need to adjust your expectations to

- Taking lesser income

- Living with the probability that your wealth may not last for the duration you need

- Take less inflation-adjustment

We can use the popular safe withdrawal rate as a way to illustrate this.

If your spending is $30,000 a year and you have $3 million, your initial withdrawal rate is 1%.

This means that relative to your wealth, your spending is very small. You can have a smaller equity allocation such as 30-40% and a higher bond allocation and you can achieve your goal of having an inflation-adjusted income that lasts for 40-50 years.

If the market tanks 50%, your bonds do well and your entire portfolio may only tank 15%.

Very livable.

Contrast this to if your spending is $30,000 a year and you only have $750,000.

Your initial withdrawal rate is 4%.

Based on the historical studies, there are sequences where you would run out of money even within 30 years if you do not have adequate equities in your portfolio.

To ensure your income lasts, you need to have a certain amount of equities in your portfolio. Your hands are tied.

And that would mean that you may not have a choice but to endure a larger drawdown in your portfolio, which you may struggle to deal with.

In general:

- More resources you have => high-risk capacity => possibly lower equity allocation

- Fewer resources you have => low-risk capacity => possibly higher equity allocation

This is why the more affluent people have less of this problem dealing with drawdown because they can structure their portfolios in a certain way.

Summary

I think Financial Samurai conceptualize something good here.

This rule shows you the relationship between your current income and equity exposure, which is seldom mentioned.

Do go and read his article, or subscribe to his blog. It is pretty good for those who are high-income earners, or high net worth.

As mentioned, this is not the first time I talk about this related subject. You might want to check out these relevant posts:

- How Traditional Portfolio Allocation Strategies Can Alleviate Large Market Plunge Fears

- You Not Only Have Downside Risks. You have Upside Risks as Well

- Taming Portfolio Size Risk

Let me know if this way of determining things work for you too.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

lim

Sunday 26th of December 2021

What a coincidence, I just posted in HWZ my IBKR portfolio made 20% this year (technically 19.7% -waiting for year end window dressing to push it up to 20%), but the max drawdown of my IBKR portfolio was 36% in 2020. I saw that as an opportunity to buy more. 2020 was the sale I have been waiting 10 years for. [there was a mini sale in 2016 in between, but 2016 was not the sale I was looking for].

Revhappy

Thursday 30th of December 2021

Hi @lim, Congrats Nice to say hello to you here as well :)

Hi @kyith, I noticed you reduced your cash big time in the last couple of week you went from 50% cash to now almost 2% cash! Would love to know your motivation behind sudden increase in your allocation to equities. I have been trying to do that but it has taken me more than a year now and yet I am half way through in getting to my desired allocation. How did you manage to get yourself to invest everything in one go?

lim

Sunday 26th of December 2021

oh yeah, HWZ is keeping track of your portfolio. I guess we should say congrats on hitting the $1m stock portfolio mark sometime this year. Many other bloggers will have big big self-congratulatory posts on their blog for hitting $1m, but I guess it cooler to be more 'low key' about such things :)

Divy123

Sunday 13th of January 2019

Hi Kyith you have probably heard about/ read about no fee value funds like Aggregate asset management which advocates a 100% equity portfolio ( invested into a huge basket of cheap stocks like their fund does) which they have back tested over decades and which they say will not likely run out of money with a withdrawal of 5% per year.. If this works as they say, fluctuation in value of the portfolio should not matter in the long run( except it would still be mentally challenging ). They are advocating this as a strategy for funding retirement needs and capital preservation for bequest to survivors. I dont recall you doing an article on this form of retirement investment. Would appreciate your thoughts.

Kyith

Tuesday 15th of January 2019

you can refer to this article > https://investmentmoats.com/uncategorized/eric-kongs-5-rule-to-retirement-planning-strengths-and-challenges/

I have reviewed his full commentary (available to clients only). after reading up on the subject, i think a lot of people underestimate sequence of return, and think it can be beaten by high returns.

Sinkie

Sunday 13th of January 2019

People often overestimate their risk tolerance becoz they do it during good times, booming economy, good job, high salary & increment etc.

However large stock market declines don't occur in a vacuum --- they occur in a confluence of negative factors i.e. perfect storm:

1) Bad economy / recession 2) Increased job loss risk 3) Recurring debt servicing that takes up large % of monthly income 4) Reduced ability to get another job if retrenched 5) Lower salary even if get replacement job 6) Prolonged time period before recovery

So to me, the bigger factor in how much equity exposure depends a lot on how well above bases are covered. E.g. 6-12 months emergency fund, whether debt servicing is below 30% of current income, stability of profession, cyclicality of industry, how many dependents, monetisable crossover skillsets etc.

I know, I know .... no neat mathematical formula to provide the answer.

But risk tolerance & ability to stick to the long term plan goes beyond just investing, into the realm of personal finance. And personal finance is messy. :)

Createwealth8888

Sunday 13th of January 2019

Depending on which stage of your life journey in the stock and job market; bad economy, crashing market and likelihood of losing job is much higher.

When we have no incurring income from job employment; automatically over time we will adjust our risk tolerance and appetite. It will come naturally!

Blade Knight

Sunday 13th of January 2019

Many thanks for sharing this Kyith! Appreciate as this helps a lot!