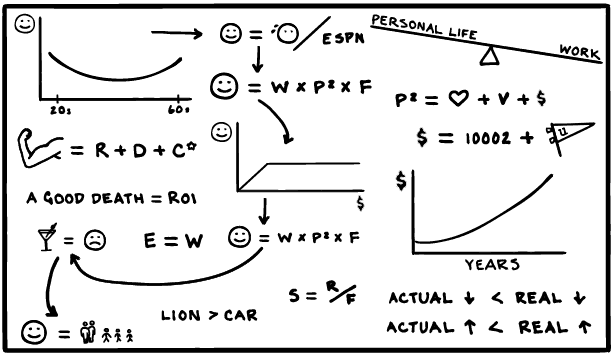

If you are a data scientist, that is what you try to do.

Make things that are touchy feely look more quantitative.

I have introduced Prof Scott Galloway in the past, where he explains about the different data points in the past, and in the future that lead to Amazon, Apple, Facebook and Google such a success. He was also one of the earliest that I heard saying the Amazons, Ali Baba needs bricks and mortar and that is what we are slowly seeing now.

In recent weeks, he put out one awesome post, that is really useful if you are an 15 year old struggling to figure out what will make your life a success. Scott will tell you he is not a thought leader in this space, but he is thick skinned enough to throw these advice nevertheless.

Its even better if you are a math and science guy.

You can watch his video explanation here.

If you feel like reading, here’s Happiness & the Gorilla.

Some of the equations resonated with me.

In the Myth of Balance, Scott talks about the paradox of viewing the success you desire and wishing to take a balance approach in life. He says that to have that success, we have to do some crazy front loading. Not many people can explain to you how front loading feels like.

However, in today’s age, too much of us think that we are “suffering” and we need to “decompress” to have enough balance.

Kyith thinks this is subjective. People with more experience also manages to live suffering better that they need less to decompress.

The poor performers didn’t master enough, and their suffering stays high and increases, thus they need to balance with a lot of decompression.

That screws up the Wealthy Formula, and why they feel incredulous about how others can channel a large amount of their disposable income to building wealth.

A lot of people get better in their finances because they are also committed in their work, their side hustles and the suffering level goes down.

In the awesome book your money or your life, the author explains that there are indirect costs to a high powered career. The cost to decompress is one.

Solution?

Be focus and get better.

Scott likely has seen too much marriages faced challenges, and that its important enough for him to think about this.

I heard before a lot of couple have arguments over money. However, money is only the conduit to facilitate the argument.

What happen most of the time is that when life’s realities come in, resentment builds up over time. It takes work.

Sometimes it is a clash of character.

Shitty money management amplifies the issue.

We can ask this question: would great sex save a couple with a ton of the above mentioned issue? Your answer would determine if good sex is 10% of a relationship or more.

In my wealthy formula, the areas where we can most effect the amount of wealth building up is to do it early and try to put more. That much should not come as a surprise.

However, the effect of compounding in other aspect of our lives is seldom talked about. For example, some folks can speed read damn well because they take the effort to practice reading fast. Some things like speed reading need to be deliberate and need practice.

Some of you who are bosses build up a lot of equity overtime with your counterparts and your underlings by treating them well, on top of being professional. That established a wide network that will compound if you lost your job, or that you need to fill a position urgently.

We do not think this is compounding, but this is a form of snowball.

Your Equity is your wealth. Your equity is also your net worth. Thus Investment Moats strongly advise you to track your net worth over time and chart it. While we are on this, you might wish to figure out your personal balance sheet and personal cash flow statement.

Scott probably have more rich friends and a lot of students who have bright careers ahead, but at this moment have student loans.

He is alluding that there are rich acquaintance who do not have a high net worth.

After writing so much money stuff, I know that there are instances where those that look rich, have net worth that is mediocre. However, I always felt that these are the minority. Majority of them got their shit together.

The lesson here is that for the poor, they are in their own world. For the middle income, they are in their own world.

For the rich, they have their own world as well. And in that world, there are “social floors” that they cannot breach. This is why even if you have a $200,000/yr gross annual income, you might not save a lot.

This one, resonate with me because for a long time, I been in the radical side of things. The demographic that is not significant enough. I am single, doesn’t have a home, don’t have kids, have an average job, doesn’t like to travel, quite the Otaku.

There are many couples that eventually get married like this, and lived in their own world. They don’t want to have kids.

My thinking is… weirdly, there is something biological or philosophical in us that will make us question that strong statement last time, when we first get married.

And perhaps that question hits hard when you have made your wealth, or when you have gotten nowhere in life, and ask yourself why am I here?

There are reasons why for some things in life, we do them over and over again.

When I read this, I dunno what to feel. When one of my parent passed away I certainly do not feel proud going through that experience.

However, I do feel that the whole episode stayed with me. If you ask me, tell me more about your life, I find that events like these feature prominently in my narrative.

Somewhat this links to compound interest.

I realize that you have to live more in the present, and be able to document that story of how you interact with others, that situation, what you did and what eventually happen.

These episodes of life gives you more color about the life that you live.

It is not that wealth building is not important. You realize that it is only one facet of your life. A significant one at this point, but you won’t live a great life if all you have is what I did well from age 1 to 38 years old.

The story of your failures, your emotional struggle, an extremely awkward situation involving yourself is the story that you need to remember.

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

RB35

Sunday 13th of May 2018

Very interesting read. Thanks for the writeup. Will check out the original post in more detail.

Kyith

Sunday 13th of May 2018

No problem RB35!