Yesterday, I wrote about my short exercise to value SPH using sum of the parts.

I realize I was not vigilant enough and missed out 3 segments:

- The Orange Valley Healthcare

- The REIT Property Management

- The Potential Future Development

#1 and #2 are tangible to compute at this point so I added into my SPH Valuation article written yesterday.

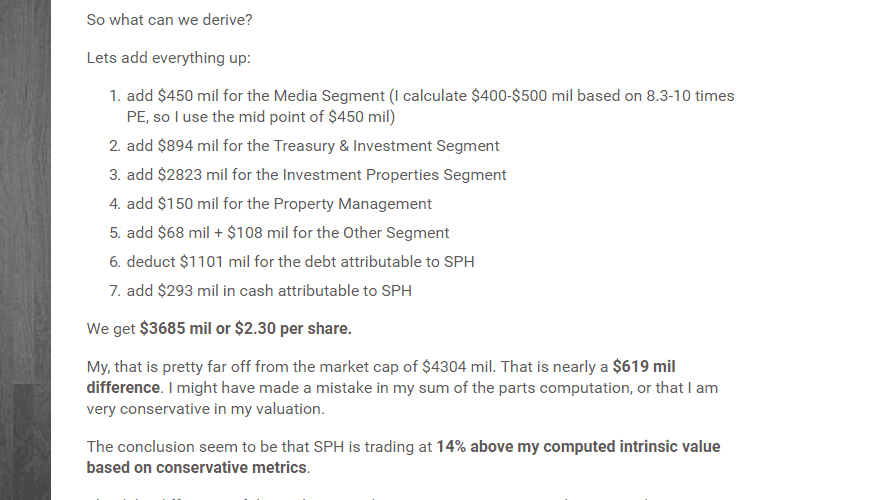

The REIT property management would probably add $150 mil to the valuation. SPH couldn’t possibly sell it off, since another asset management firm would be able to manage 3 more retail properties. However, this is to factor in the recurring cash flow that comes into the business.

We can conservatively add $108 mil for Orange Valley Healthcare. The future potential for this could be more.

With this, the revised SOTP value we derived is $3685 mil or $2.30 per share. Currently, SPH is trading at 14% above this price at $2.67.

I share my Experiences & Reflections in Active Stock Investing, Prospecting Stocks & Businesses in my Section on Active Stock Investing here. Do Read this if you are interested.

If you like materials such as these and would like to enhance your Wealth Management towards have a Wealth Machine that gives You Financial Security and Independence, Subscribe to my List Today Here >>

If you like this do check out the FREE Stock Portfolio Tracker and FREE Dividend Stock Tracker today

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Alan

Wednesday 9th of May 2018

Hi Kyith,

So based on the answers you got at the EGM . Do you still think its a good deal ?

Kyith

Wednesday 9th of May 2018

Not sure about this. A good deal is one that you can tell outright its a good deal.