DBS has a pretty good report out which shows some of the “stress-test” they put the REITs listed in Singapore through.

For those serious in investing in REITs, this is a good blueprint how you can assess the defensiveness of REITs in times of stress.

This kind of assessment is very quantitative and should not be the only way you assess the REIT’s defensiveness. You have to layer the qualitative aspect as well.

Let me share some of the main takeaways.

The Metrics that DBS uses to Measure Whether Each Singapore REITs Will Survive Better

Firstly, we have to be clear what they mean when they measure the survivability of the REITs.

I do not get a clear statement from the report but after reviewing the report, a REIT survives better by coming through this testy period in a much better condition than before they enter it.

- They have enough cash flows after paying all the necessary expenses so that they do not need an additional external capital injection

- When their assets are re-valued downwards, their overall debt to the asset is still within the MAS gearing limit (now it is at 50%)

- The lower amount of debt that needs refinancing in the short term

- Able to sustain the dividends better

- Most importantly, investors have less risk that they will need to inject equity capital by way of rights issue into the REIT, to shore up capital when no one wants to loan them money they really need

These are more fundamental measures and less about the stock price. However, stock price tends to reflect over time the health of the REIT.

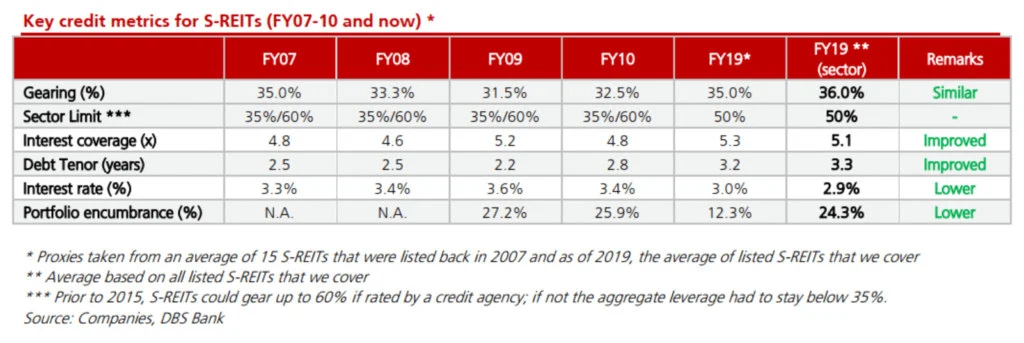

Key Metrics Show the Singapore REIT Sector is in a Better Shape Than the Previous Downturn

DBS compares current REIT sector industry metrics against the 4 years before and after the Great Financial Crisis (GFC) from 2007 to 2010.

DBS noticed that during the GFC:

- Interest coverage ratio remain stable at greater than 4.0 times

- There are more stress on the balance sheet

- Asset valuation decline by 2% to 15%

- Office sector was the most hard hit

Currently, the overall sector is in a much better position:

- The gearing level was similar to 2007

- Interest rate today is much lower

- REIT sector enter this challenging period with a lower portfolio encumbrance (this means that the amount of debt secured against their properties is lesser. That means they have more properties unsecured to collatorised during refinancing shoudl they need it. Financing companies find you less risky if the debt is secured with properties. In the event the REIT defaults, they can possess the property)

- With the recent changes to the MAS leverage limits from 45% to 50%, this provides greater flexibility for the REIT to manage their capital structure in times of financial stress

Personally, when I reviewed DBS’s data, it does not give me the idea that current situation is much different from the previous years they compared against.

If we are in a bad shape back then, the data does show that we are in a bad shape now. Vice-versa.

The only takeaway is that this may be reflective of the overall health of the larger REITs. These larger REITs will shape the table above. It seems to tell me things are not so different for the larger REITs compared to back then.

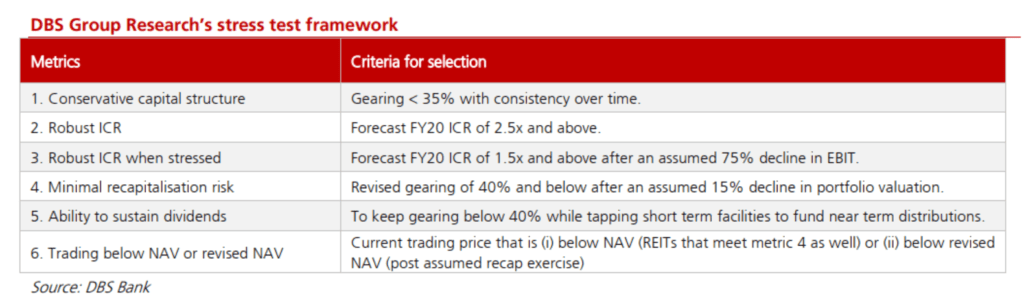

DBS’s Framework for Stress Testing the REITs

DBS decided to put our REITs through some stress tests.

These are their parameters:

DBS look at

- potential asset devaluations on gearing level

- lower cash flow on interest coverage ratios (ICR)

- whether a REIT will breach DBS’s more conservative leverage threshold of 40% after their property devalues 15%

- trading below revised NAV (assuming that the REIT needs to be re-capitalized with a rights issue)

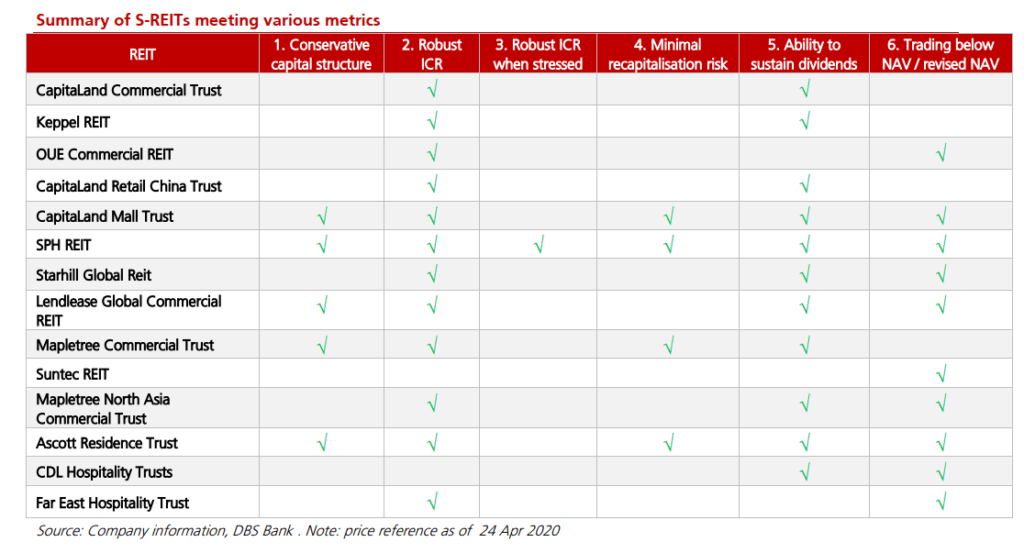

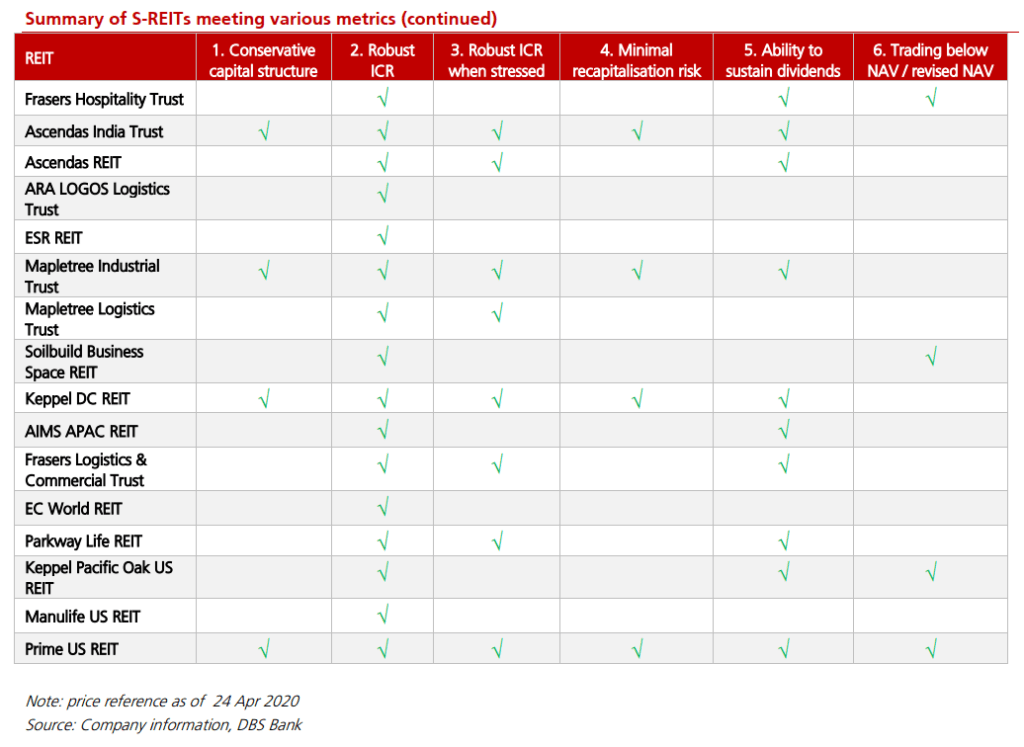

And the results is below:

So the more green ticks each REIT have, the better they will emerge oiut of this.

We can see some with 4 to 6 ticks:

- SPH REIT (6)

- Capitaland Mall Trust (5)

- Lendlease Global (4)

- Mapletree Commercial Trust (4)

- Ascott REIT (5)

- Ascendas India Trust (5)

- Mapletree Industrial (5)

- Keppel DC (5)

- Prime REIT (6)

Then there are some REITs that have 1 tick or less:

- Suntec REIT (1)

- ARA LOGOS (1)

- ESR REIT (1)

- EC World (1)

- Manulife US REIT (1)

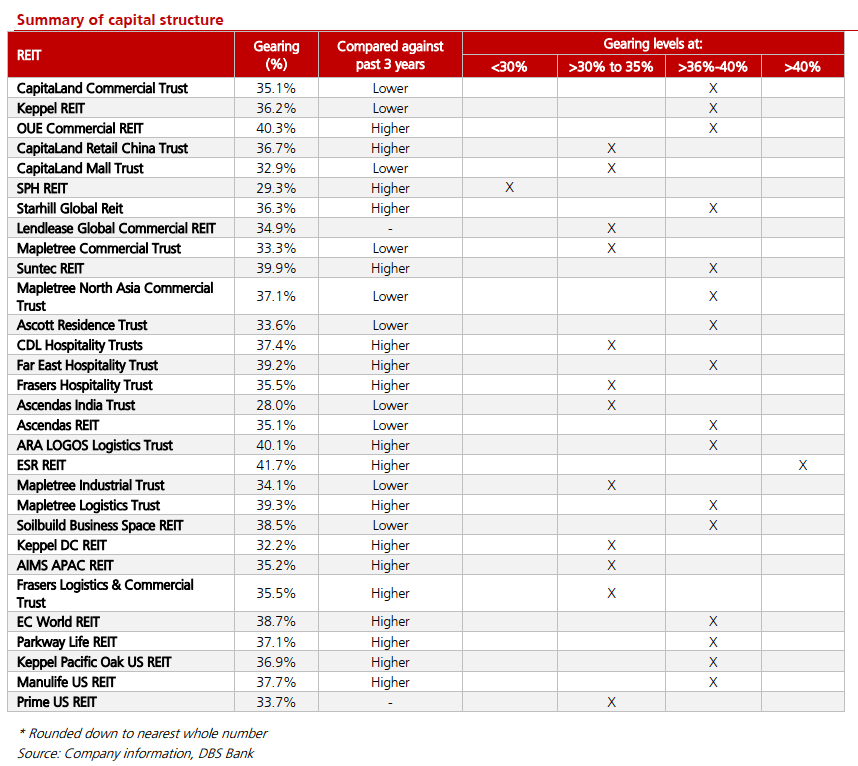

1. Which Singapore REIT have a More Conservative Capital Structure?

A lower gearing limit:

- Gives financial flexibility to tap debt capital markets if needed

- Cost of funds is cheaper

- Ability to leverage up to acquire distressed assets

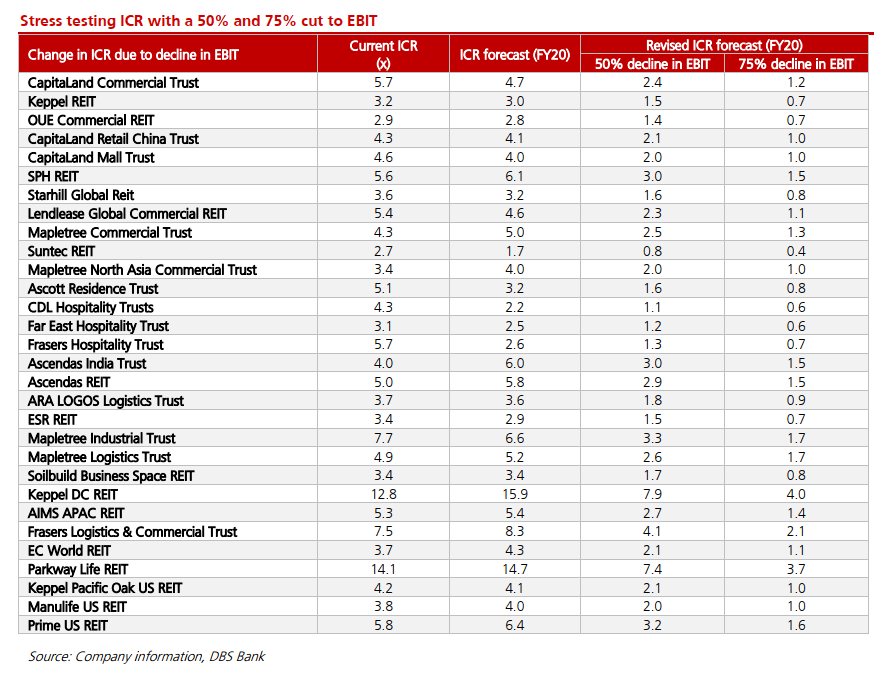

2. The Interest Coverage Ratio Test

The interest coverage ratio test is one that I appreciate less because…. I omit a situation where a REIT, with a diversified tenant base… can suddenly have no income…

DBS stress test the REITs by cutting the REIT’s EBIT by 50% and 75%. What DBS got is a “cash-backed ICR”

They assume that every quarter of delay in collections will lower the EBIT by 25% . In the even of a 6-month and 9-month delay, this will reduce the EBIT by 50% (unlikely) and 75% (highly unlikely).

In this higher stressed scenario, the ICR range is reduced to 1.1 times to 7.9 times. With a 9-month delay, some ICR can go below 1 times.

This stress test is good, but in reality it is very broad stroke. Some type of REITs such as office should be less affected such that their EBIT broadly falls by 50% and 75%.

So you do have to be a bit qualitiative about it.

Out of the troubled hospitality and retail REITs, SPH REIT and Lendlease looked particular strong despite this very stressful test.

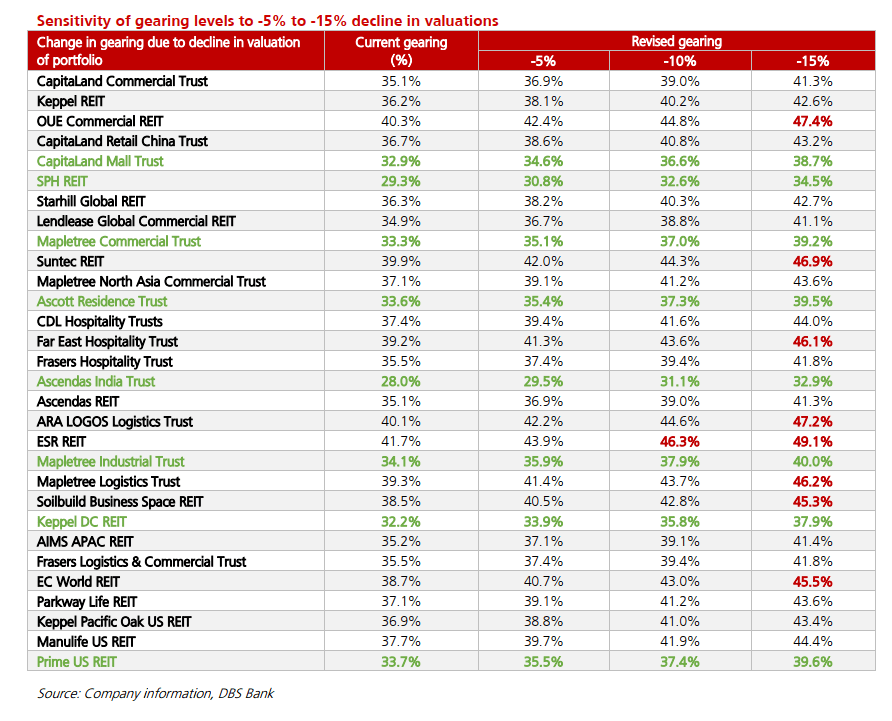

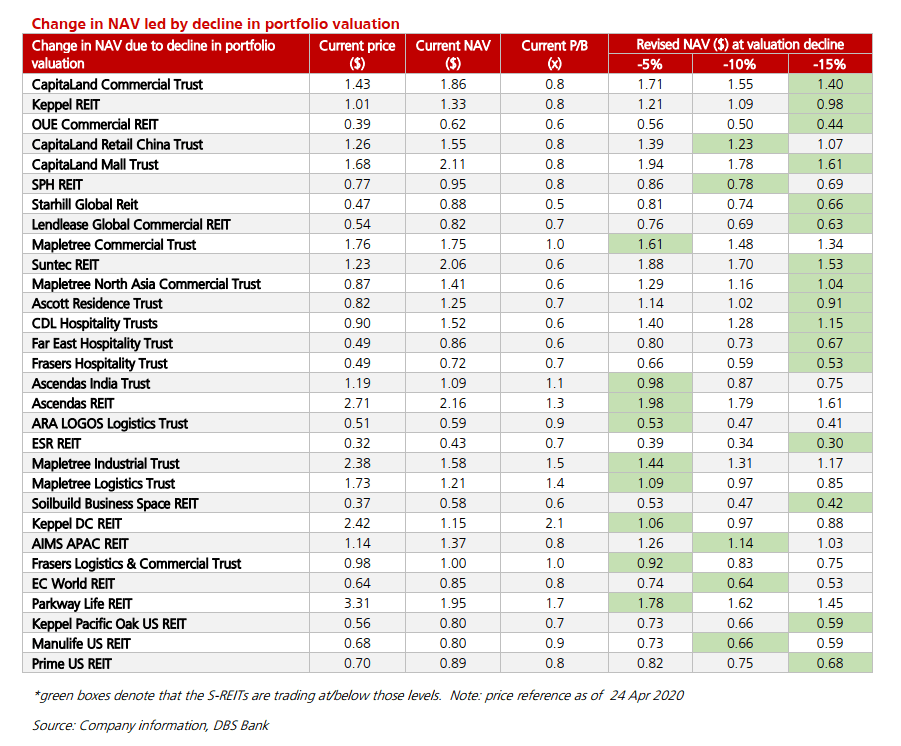

3. Which Singapore REIT is More Sensitivity to Decline in Valuations

While the REIT managers did not give clear indications, history tells us that it is likely the REITs will face a decline in valuations.

DBS tested the REITs gearing levels to a 5%, 10% and 15% drop in valuations.

All S-REITs did not breach the 50% gearing limit set by MAS. However, if we use DBS’s more conservative 45% threshold the following REIT would touch the limit first:

- OUE Commercial

- Suntec

- Far East Hospitality REIT

- ARA LOGOS

- ESR REIT

- Mapletree Logistic Trust

- Soilbuild Business

- EC World

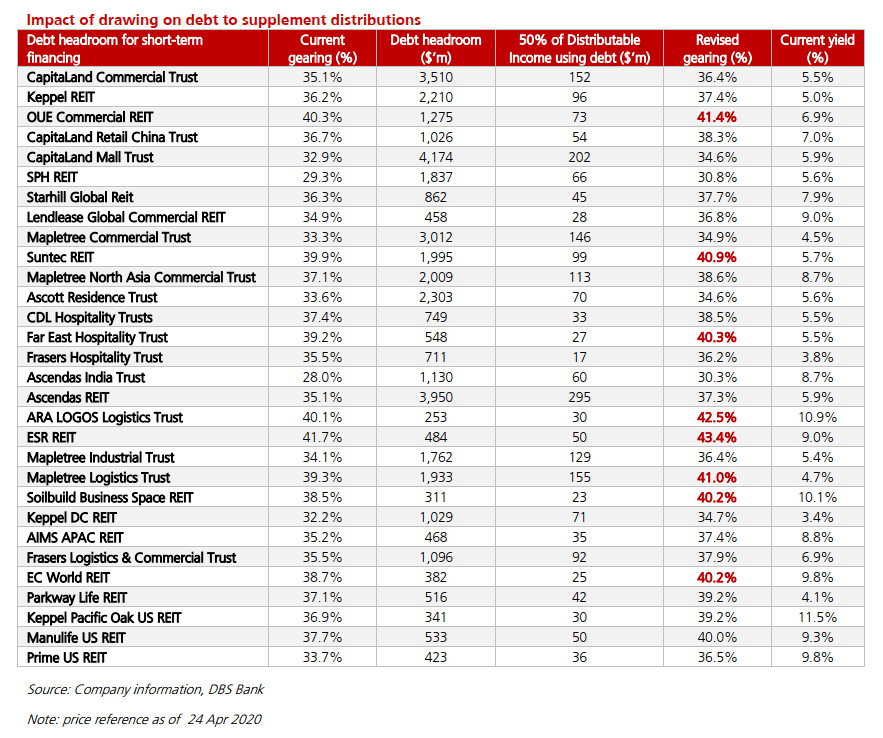

4. Which Singapore REIT can Sustain the Dividends with the Help of Short-Term Debt?

DBS stress test the REITs ability to sustain the dividends by temporary take on debt. This would corelate to the REIT’s individual debt levels and gearing limits:

The Singapore REITs could maintain the dividends, but some of the REITs will break a 40% gearing level.

5. Which Singapore REIT Trades Below NAV Even After Potential Decline in Value?

Since DBS stress-tested the Singapore REITs with lower valuation, they also presented the data in terms of attractiveness in terms of valuations.

One of the risk in investing is to use historical data and come to a conclusion that this stock is cheap. The right way to do is to do what DBS did, which is assume a discount in value that may happen and see which one still look attractive:

Those that are highlighted in green are the REITs that, after a decline in portfolio value, still has a net asset value (NAV) per unit higher than current REIT unit price. This indicates even after both price decline and NAV decline, the REIT looks attractive.

On a NAV basis, DBS believes that many REITs are trading at an implied 15% decline in portfolio valuation.

Capitaland Mall, Starhill, and Lendlease are trading at a greater than implied 15% decline in portfolio valuation.

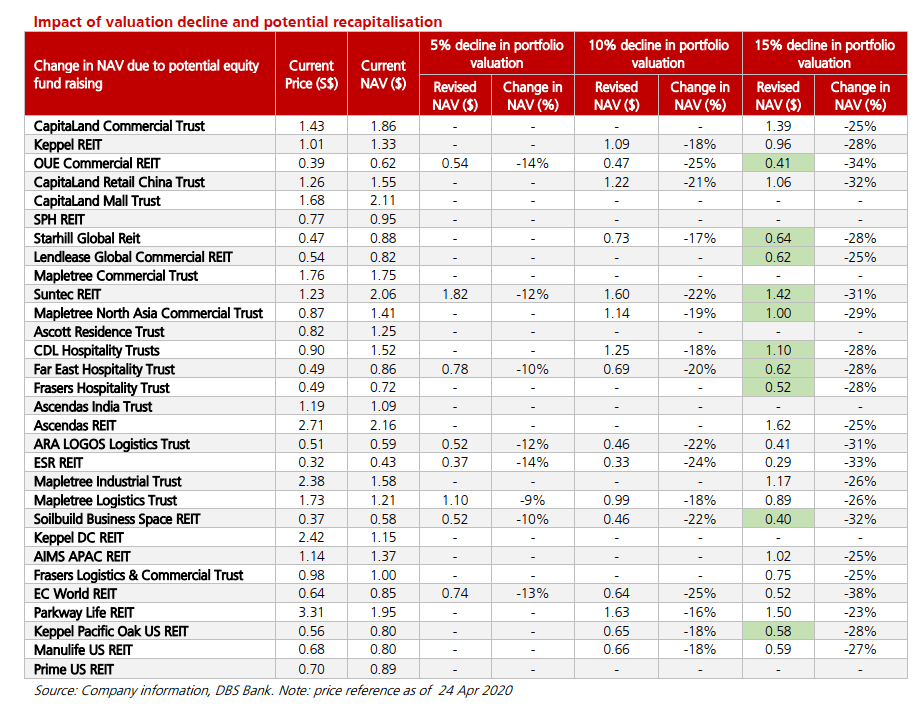

6. Singapore REIT Re-capitalization Risks When Property Value Declines

When the REIT portfolio decline in value, the gearing level increases.

Some REIT might potentially need to raise capital via rights issues, placements.

This will dilute and reduce your dividends because you are not buying properties with this capital but the number of shareholders increases to share the same pot of rental earnings.

DBS stress test this by simulating:

- the REIT does an equity fund raising if gearing goes above 40%

- the rights issue is priced at a 25% discount to current trading price

The REIT highlighted in green are the REITs that after a 15% decline in portfolio value, they did a necessary rights issue, and their NAV per unit is still higher than current share price.

Based on DBS’s assumptions, 50% of Singapore REITs in their coverage will not require any equity fund raising even if property valuations fall by 10%.

If property valuations drop by 15%, those that need to recapitalize will see their NAV per unit drop by 23% to 34%.

10 of them are trading at prices that are even below the revised NAV. They are mainly in the retail and hospitality sector.

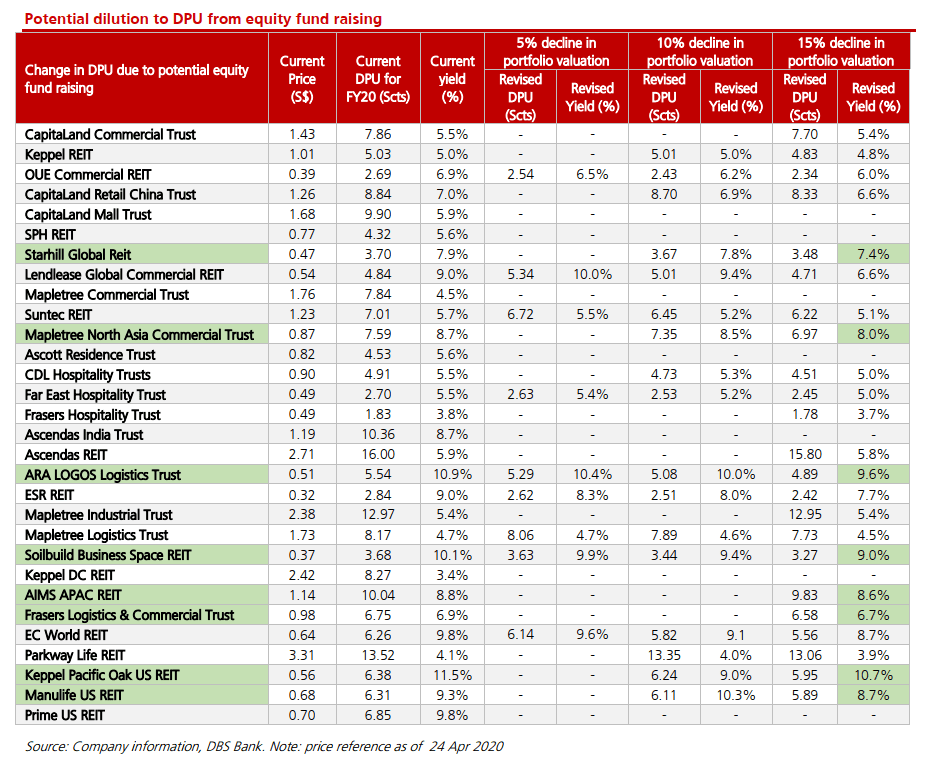

The table above shows the potential effects of the equity raising dilution on dividend yield. With the rights issue, the DPU should be diluted.

However, even after that decline scenario, some REITs are still trading with a dividend yield that is higher than their 10-year historial average yield.

Those are highlighted in green.

On average, the dilution on DPU Yield is about 1% – 2%.

The Singapore REITs that potentially will experience the largest declines in DPU Yields are:

- ARA LOGOS (1.3% decline)

- ESR REIT (1.3% decline)

- Soilbuild Business (1.1% decline)

For some, even after this decline, the REIT is still traded at attractive yield.

Last Word

I feel that DBS tried its best to provide some rational negative operation assumptions.

They did a lot of hard work there and we got to thank them for that.

In this whole exercise DBS is trying to help us assess, based on current price, what are some of the scary stuff that may have been priced in.

It is to help us see in the spectrum of very undervalued to very overvalued, where each REIT is right now.

However, I believe the markets and fundamentals are rather fluid here as well. When the property value actually goes down, the share price might react very negatively, forward pricing in a potential rights issue.

If it looks attractive today, when the event happens, it might look even more attractive.

Of course, if these valuation declines do not happen, then you missed the boat.

Some investors will look towards this for attractive mis-pricing. Others will use this as a way to assess their Singapore REIT on the risk spectrum better.

Let me know which REIT caught your eye or some realization you have after this review.

I have a FREE REIT Training Center. The link is below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

james

Tuesday 2nd of June 2020

Can you provide the link to this report? Can't seem to find it in DBS website.

Lawrence Tan

Saturday 16th of May 2020

Is there such report on Malaysia REITs?

Sharon

Friday 15th of May 2020

Any idea how they select the REITs to do this assessment? Maybe they have shares in these? Hahaha. Because some REITs like First Reit, Sasseur Reit etc. are not included.

Kyith

Saturday 16th of May 2020

I think they the ones they excluded might not affect the conclusion. the question is whether those 2 stocks are in their existing coverage and whether omitting them will make them look bad.

Sunny

Friday 15th of May 2020

Would you do an update on manulife REIT? I read the press release and Apr was not so bad. There were a little late payment and ask for rent relief but otherwise OK.

Daniel Piorecki

Thursday 14th of May 2020

Iam missing first Reit(AW9U).