MAS have decided to make a push so that the financial data in your bank is more open.

When the data is more open, third party developers can easily let you access this data. This initiative is called SGFinDEx. You might have seen it in the news lately.

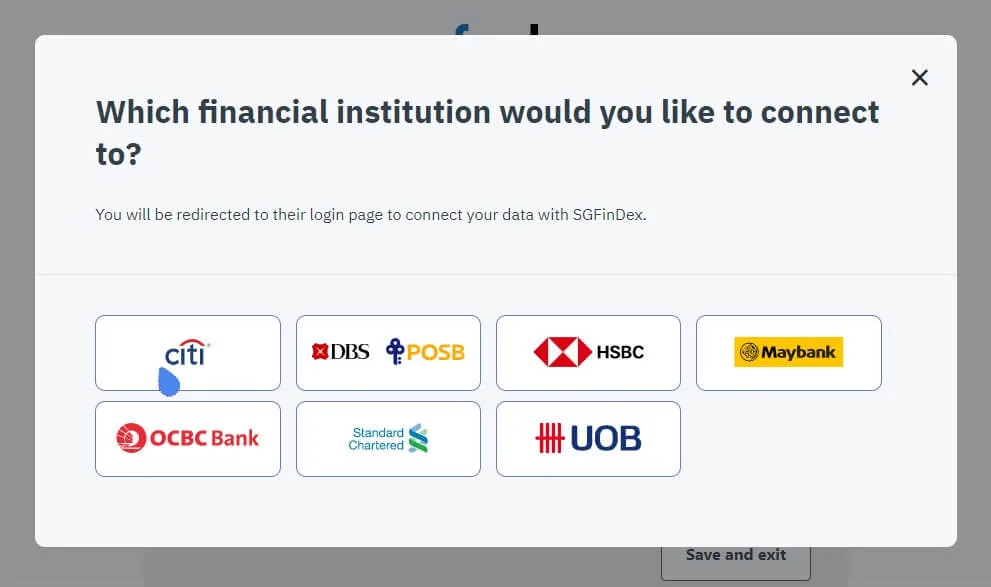

With this, I will be able to check the balances of all my bank account in one place. The supported banks are Citibank, DBS/POSB Bank, HSBC, Maybank, OCBC, Standard Chartered Bank, UOB. Basically, that is like almost all local bank you will have deposit in.

Those of my friends that are on the higher interest hurdle account in Bank of China (BOC Smartsaver) would not be able to enjoy this.

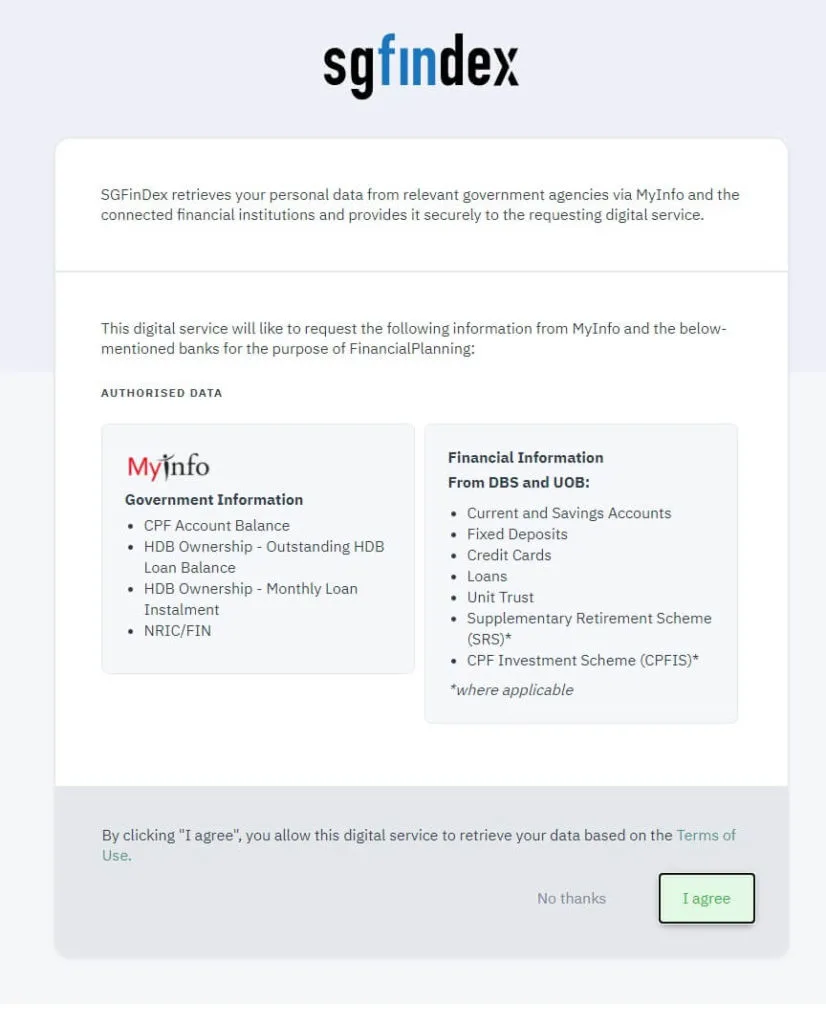

The kind of data they will be able to aggregate is also quite a lot:

- Current and savings account balances

- Fixed deposits balances

- Unit trust holdings

- SRS accounts and holdings

- CPFIS accounts and holdings

- Unsecured loan outstanding balances (credit cards, personal loans, etc)

- Secured loan outstanding balances (home loan, car loan, etc)

- CPF Account balance

- Notice of Assessment (your tax statement)

- Outstanding HDB loan balance and monthly loan installment

That is basically a large part of your financial life.

However, what you cannot currently aggregate would be your monies in your trading accounts, robo-advisers.

I think eventually, those organization would wish to be part of the financial exchange.

Navigating the Consolidation of my Financial Data

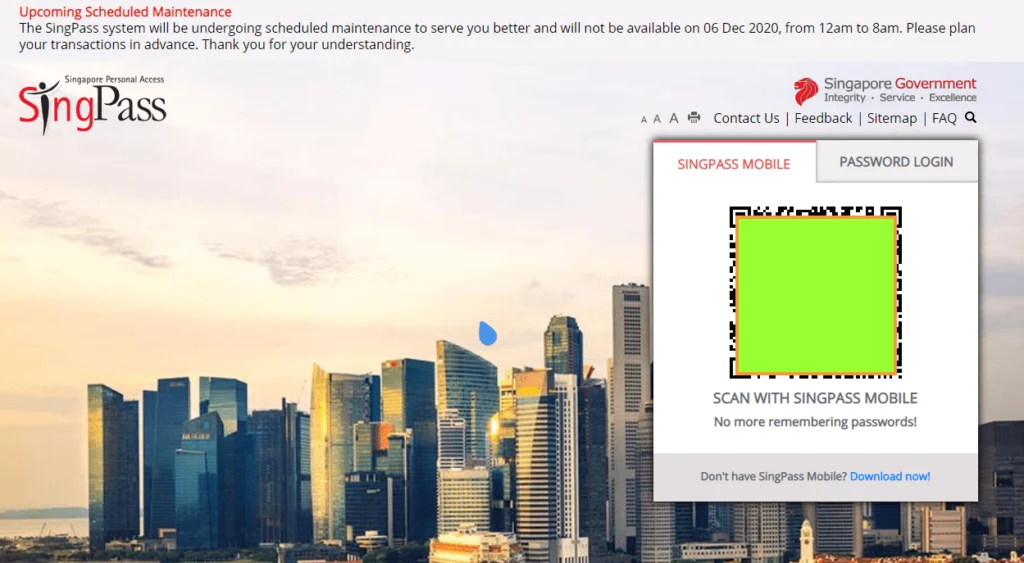

On the day the news dropped, I logged into my Standard Chartered account and was prompt that this was an option for me.

I went through the process and here is how it looks like.

(Most likely, all the member banks taking part in this initiative can let you do this! So give it a try and let me know)

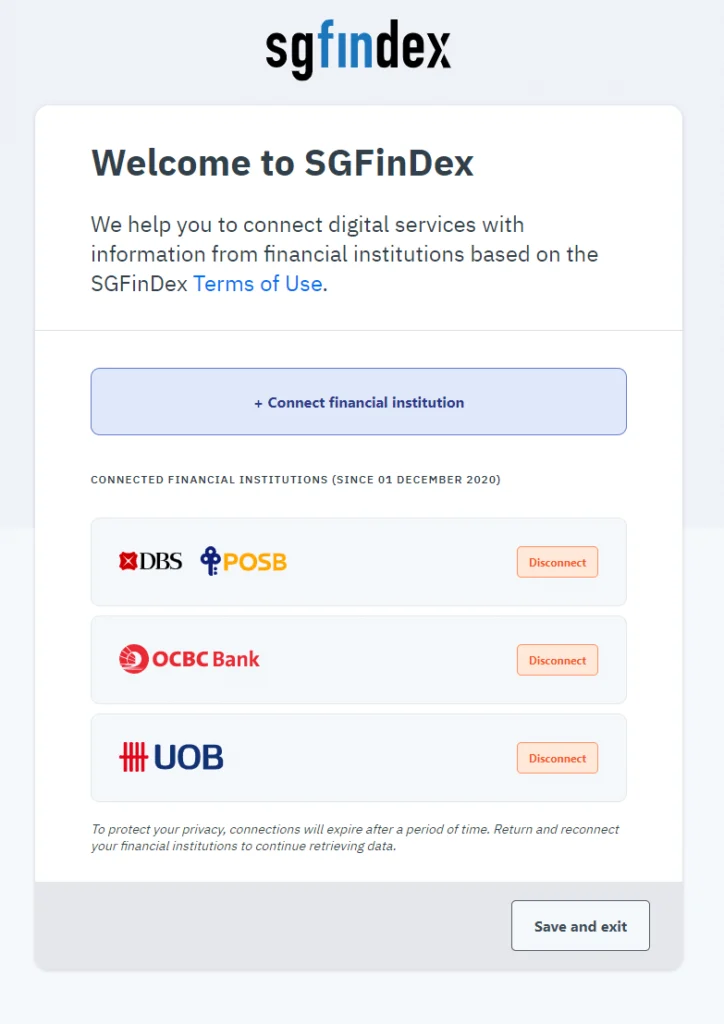

The first part of the process is to decide which financial institutions you wish to connect to .

You can see the financial institutions you wish to connect to. When you click on each button, you would need to login into each of these bank, and authorize them.

You need to authorize them to share these financial data.

In the next step, you need to authorize the financial data and the government information.

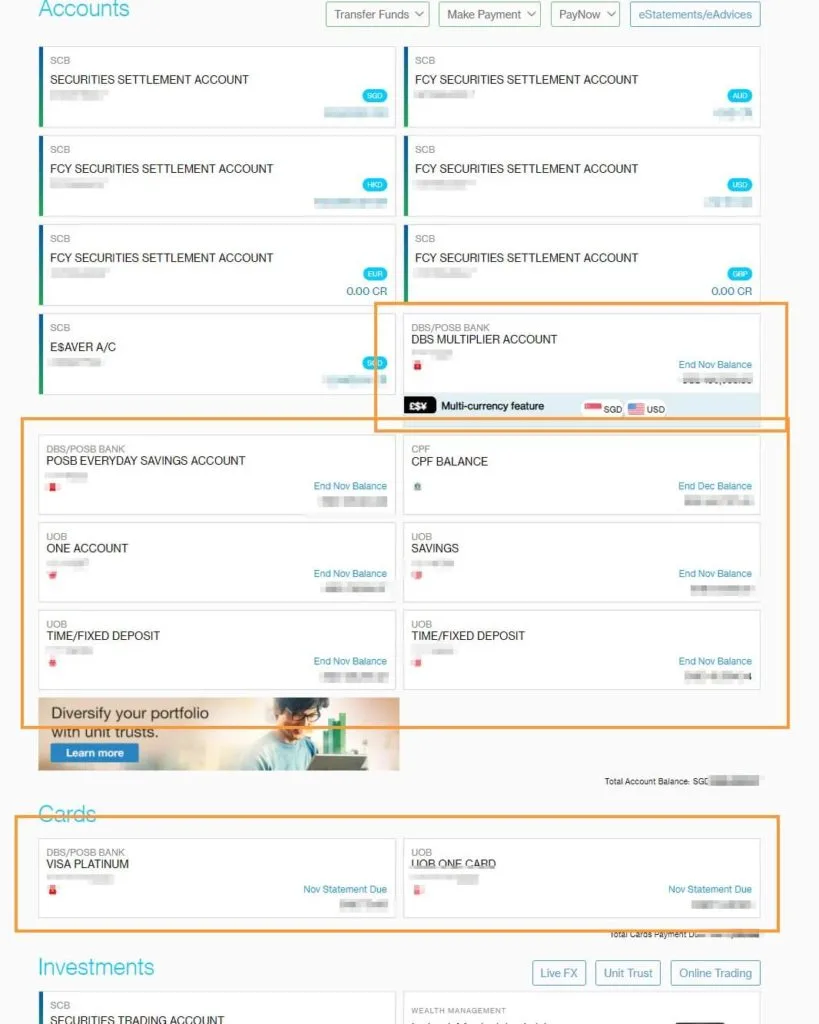

When you are done with that, you can review all the data in one place. It is very refreshing to see all your money in one place. SRS, credit cards, CPF balance, deposits are all in.

OCBC link up is bullshit. It does not work as seamless as the rest. Okay, I have managed to get OCBC to link up.

Different Banks have Different Implementation

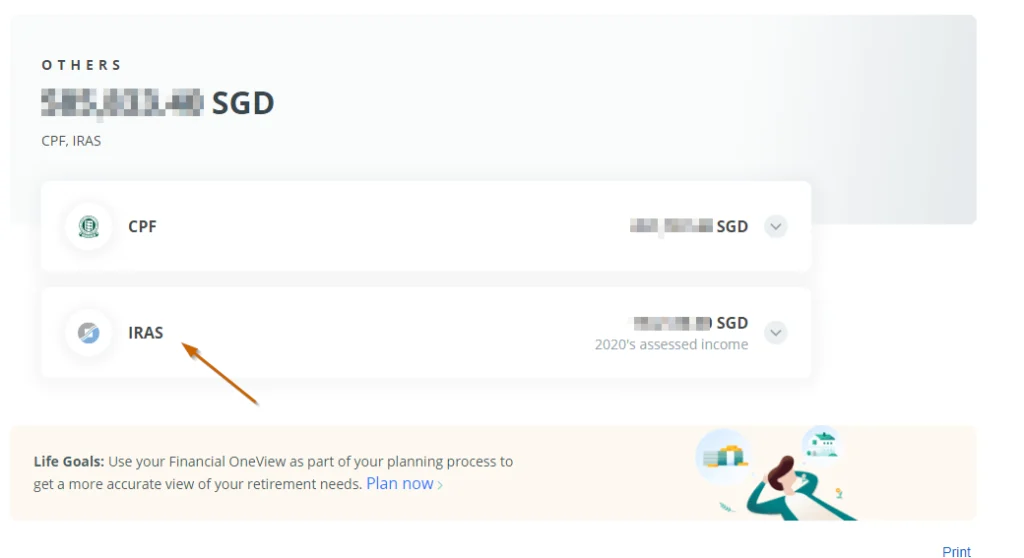

I went into my OCBC and realize different data is presented.

OCBC provides my Assessed Income from IRAS. Standard Chartered do not.

Also, Standard Chartered showed a different SRS account sum than the OCBC implementation.

So you are going to expect different experience.

What Is Amazing

Ok, so the data from the other financial institutions are not always updating. In IT-speak, we call this read-only data.

But the amazing thing is how easy it is to re-grab some of these data.

There is this Update Now button that I can click to re-grab the data.

Compared to other implementation, this is seamless in that it makes use of your SingPass to grab all the data.

So there is no need to login to all the financial institution individually to get the data.

One thing to note: I think when you refresh, SGFinDex only captures the end-of-the-month data. I tried updating it this morning and you will only have end of November data.

So for those of you who are expecting to go in daily and getting the daily data, you will be sorely disappointed.

Setting up With Another Bank is Seamless

Okay, can you actually set up this viewing in your DBS, OCBC and UOB account and view them from any of the banks?

Yes you can.

And actually, it is very seamless.

Suppose you have setup on your UOB. Then you wish to setup for your OCBC.

What i realize is that, if I have added these banks when I set up with UOB, I can immediately link to them in OCBC!

So this means that I do not have to add each of these banks one by one again!

The Negatives

I think a lot of this boils down to the implementation.

Each bank implement it differently and that is OK.

Here are some of the negatives:

- Some banks like DBS have a weird CPFIS implementation. They break down the holdings in my CPFIS as some sort of sub-accounts. Other banks did not do this. Not sure if its a good thing

- Some banks seem to have up to day data while others have only up to end of the month data. Things are not sync

- Some folks have told me they faced syncing problems for some banks. This is normal in the early stage of implementation

Why SGFinDex is Likely a Good MAS Push

To be honest, Singapore have been positioning itself as a fintech hub for sometime and it is very frustrating that this did not happen anytime sooner.

I am quite sure this is a push by MAS. MAS most likely tell the banks that those institutions who participate in this sharing, will get the data that is shared. If you do not participate, you will not get the data.

It will be damn awkward if your competitors have this very good functionality and you did not have it.

I do not believe that the banks are digital banks. A lot of things are just fluff and going through the paces thats all.

I have a friend who developed this application that tries to aggregate financial data the way SGFinDex tries to facilitate now. One of the major banks blocked-out their implementation by saying this was not “using the official API”. My friend had to comply.

But if you asked all of us, if there is an “official API”, do you think my friend would not use it? An API is supposed to smoothen the implementation for third party.

If you have one, but we cannot find it easily, what does that say about your maturity as a “digital bank”?

How SGFinDex is Useful

Okay, for someone who tracks his net wealth once a month, having all these data consolidated in one bank saves a lot of the effort.

(You can read Don’t Track Your Expenses or Budget First. Track Your Net Worth First Instead)

I can imagine syncing the data on the 30th of the month, then updating my Google Spreadsheet. It makes the process faster.

I got a feeling I would still wish to see some of the transactions. There are still some dividend data that I would have to update my stock portfolio tracker.

But for many of you, it makes it easier.

Secondly, third-companies may eventually interface with these data. Right now, I do not thing this is open to third-part application or other fintech platforms yet.

If it does, I do expect that these fintech can do a much better job creating something what consumers wanted.

There will also be applications that are more niche.

Finally, it will help a lot at work in our fact finding process.

In order to evaluate whether our client’s net wealth can still be an enabler for their goals in life, we have to constantly update their financial situation.

With this, it is remarkably helpful that a client can just update their data in one click, fill out a spreadsheet at one shot, and pass it to us so that we can review their financial data, match that to their financial goal.

Of course, this would help the robos a lot.

Those of you who does a lot of personal budgeting and tracking, do let me know how you see this.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sharon

Tuesday 8th of December 2020

I haven't try it yet but I think it will be so much easier to grab most info. in one place to update the net worth worksheet. Even updating once monthly for me it's a bit of chore at the moment, because of having to login to so many different websites - banks, insurance companies, stock brokers, CPF etc. Hope this streamlines the process. Excited to try it out soon!

Kyith

Tuesday 8th of December 2020

Haha tell me about it. But i think doing it once a month is easier if you treat it as a relaxing session.

Hans Ng

Sunday 6th of December 2020

Strangely it does not include CDP data...

Kyith

Sunday 6th of December 2020

Hi Hans, I believe they will take things a step at a time. Get it right first then all in.

lim

Saturday 5th of December 2020

Thanks for the informative writeup. Do you know whether the linkup is reversible and can we easily cancel the link?

lim

Saturday 5th of December 2020

i connected...i've linked up... there were some statements saying that you can choose to disconnect the link at any time, so that should be 'safe.