This week have been a busy week at work and perhaps over the weekend, I would like to digest some thoughts about Manulife.

So for my coverage, I should be writing some really short articles to compensate for the inactivity.

The volatility have picked up this week, and there would be 2 thoughts running through your head:

- Is this a correction

- Is this the long overdue plunge to oblivion

In both cases, it leads to some thoughts on cash allocation.

Ben Carlson wrote a good piece about a common question we get a lot.

Cash can be an addiction if you are a active stock investor:

- When the market is up, you will tell yourself to hold cash and wait for the correction to invest

- When the market is down, you will tell yourself not to be a vegetable head, wait for the price to go down more before buying

This is why even though there are deep corrections, not many benefit from it.

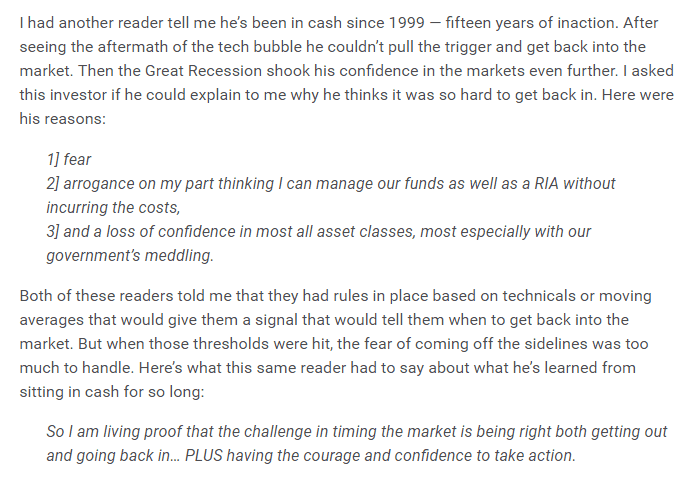

He cites one account from his reader who struggle with this. He exited the market in 1999 and stayed out.

#3 is interesting in that it clouds a lot of novice investors. They believe they can read the macro factors well, the political maneuvers and how this will affect their wealth building. Often there is not enough close correlation.

#2 is something I suffered from and I do admit that as an active investor, I do have some arrogance (maybe more!) on my part.

This cause us to pay some few percentages in behavioral costs versus the benchmark rate of return.

One important job of a sound adviser, which I highlighted in my financial adviser article this week, is to coach you to work through these behavioral issues. And the difference can be 1.5% in your long term investment returns.

As you grow older, I realize I tend to be cognizant of these weaknesses and not be so stuck up and tell people you shouldn’t pay for these fees.

Those fees would have exchange someone who pushes you to make some valuable decisions when otherwise you wouldn’t.

Cash is an addiction. And what Tadas, and Ben said in the article are some of the internal conversation happening in my head. Are they also happening in your head?

I think there are 2 risk around in investing:

- Taking a large permanent loss to your capital, that you cannot come back from easily

- Missing out on a large market run. This is an opportunity cost lost. Had you been invested you could have 100% or even more money

You would realize #1 and #2 are often conflict.

The solution I find is to have options. Options means that you view things in a spectrum. That there are not just one outcome but more than one outcome.

Some of these outcome are acceptable, or there are easier mitigation, ways to transfer the risk through other investing tactics. I talked about looking at an investment as a series of different outcomes in this article.

When it comes to portfolio management, it means that being 100% in cash is dangerous if:

- do not have a process that factors in your negative behavioral tendencies

- a poor process of identifying when you get in well and get out well

If you have a good process that factors in this, you should do OK. The guy who wrote in said it very well that to do well you need the whole package, including the psychological part.

Having said that, I always emphasize: Know the essence of the war you are fighting. Put it another way, respect the objective. If the phase is in late stage wealth accumulation, having bonds/cash reduces the volatility of the portfolio, and prevents a market draw down from affecting your goal.

If you only have $10,000 capital and you are going to inject $200,000 in the next 15 years, then stay invested but think about whether at this point you want to keep what you hold.

These 2 articles might help:

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – The Deeper stuff on REIT investing

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Temperament

Sunday 14th of October 2018

The temperatures of 2008, 2009 stock market were too hot for me that affected me of even nimbling during 2015, 2016 market's dips.

It was not normal for me to be incapacitated by fear this way.

By other ways maybe.

Temperament

Sunday 14th of October 2018

That's why I call myself "Temperament" and not "Temperature".

LOL!

Even then I can't take the temperature sometimes!

Kyith

Sunday 14th of October 2018

you mean the raining temperature now?

Sinkie

Saturday 13th of October 2018

Lots of people have processes or systems, but the real difference is whether they have the discipline & the conviction to carry them out?

Too often we become impatient when our pre-determined signals or conditions don't appear for a long time, or become too fearful / fomo during melt downs & melt ups.

The yearly Dalbar & Spiva studies show that although the average active funds underperform their indexes over the long run ... but the kicker is that retail investors tend to even underperform the underperforming active funds!

That speaks to poor active investing / trading decisions, over-trading, poor market timing.

Kyith

Saturday 13th of October 2018

Hi Sinkie we often give in to our behavioral tendencies.