Recently, a friend asked me for wealth management advice. She has done well in her career and has accumulated a comfortable sum of money. In addition, she had received a sizeable inheritance last year. With this newfound wealth, she’s wondering if she could strategise her finances better to grow this pot of gold for her retirement and eventually leave it for her children.

Not too long ago, DBS contacted me to see if I am interested to take a look at what they offer for their DBS Treasures clients. I thought it will be good to take a deeper look at their wealth management solution so that I can refer my friend to them where suitable.

So, this post is sponsored but the views are my own.

The New Affluent and High Net Worth

The new affluent are increasingly younger. They might have amassed their wealth by rising up quickly in their career, leveraging a lucrative business opportunity or simply through inheritance. Or most probably, a combination of the above factors, just like my friend.

Despite getting into a comfortable financial position, Singaporeans are not resting on their laurels. A survey from Quilter International in 2020 shows that 55% of Singapore’s higher net worth investors are more concerned about wealth creation rather than wealth preservation.

With a longer time horizon for investing, the new affluent can take on more risks for greater returns.

Therefore, instead of being conservative and relying on traditional wealth preservation vehicles like real estate, deposits and insurance endowments, they have the appetite for managed investments, such as equities and bonds, to play a larger role in their wealth building.

The younger high net worth investors are likely to be digital natives who prefer to have a platform that allows them to centralise their investment needs without a gatekeeper. At the same time, a human advisor will complement the self-directed platform by providing guidance for more sophisticated structured products.

Let’s see how DBS Treasures is able to fulfil these requirements of the newly affluent.

Access to a wide range of financial products

Clients of DBS Treasures will have access to financial products that one might otherwise not have access to. I have to say, the range of what DBS offers is rather robust.

The basic layer of DBS’s banking service covers our essential banking needs:

- Access to investment solutions for investors with different risk appetites and different levels of involvement

- Insurance protection

- ETF-based and Fund-based digiPortfolio

- DBS Multiplier provides us with opportunities for higher interest if we choose to do more with DBS, such as investments, insurance and more.

DBS Treasures is a wealth management solutions/provider that is accessible to accredited investors with minimum investible assets of S$350,000.

You qualify as an accredited investor as an individual if:

- You have net personal assets that exceed S$2 million but net equity of primary residence capped at S$1 million of the S$2 million thresholds or

- You have net financial assets that exceed S$1 million or

- Your preceding 12 months’ income crossed more than S$300,000 or

- You are a person who holds a joint account with an accredited investor.

As an Accredited Investor banking with DBS Treasures, you will be given a Wealth Management Account which is a dedicated account for your investments, on top of your traditional DBS Savings Account, all managed within your digibank app.

I would like to highlight some of them.

Competitive Portfolio Financing with Multi-Currency Revolving Term Loan (MRTL)

If my friend wishes to explore a leveraged exposure with fewer constraints so that she has greater resources to make her money work harder, she is able to do so with DBS Treasures Investment Financing, which is a Multi-currency Revolving Term Loan (MRTL) facility.

With this facility, she can use her existing investment portfolio as collateral for a loan drawdown to settle further investment purchases, or to meet short-term liquidity needs. This allows one to leverage their existing portfolio and invest even further.

DBS identifies two use cases with their clients:

An important point is to ensure that there is always adequate collateral. Like all finance facilities, there is a stipulated period to restore your collateral value or reduce the loan amount if there is a collateral shortfall.

Access to CIO Model Portfolio Suggestions

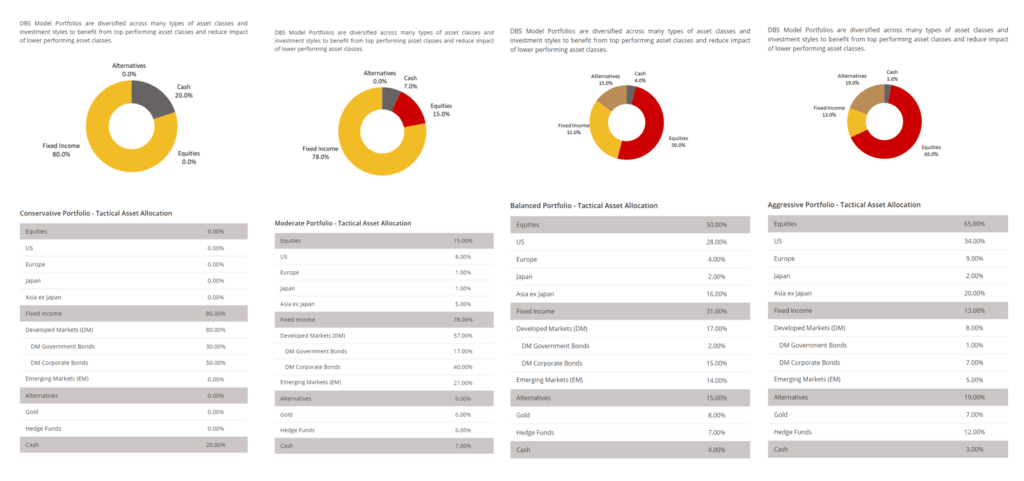

Clients of DBS Treasures also have access to portfolio allocation strategies from the Chief Investment Office (CIO) through the CIO Model Portfolios.

The model portfolios are based on the CIO’s investment philosophy expressed as a combination of strategic asset allocation and tactical asset allocation.

Investors are able to find an ideal portfolio matching their risk appetite, expressing overweight and underweight in various asset classes and geographies according to the Chief Investment Office’s view.

Access to Funds-based digiPortfolio

DBS’s robo-advisory platform digiPortfolio has been popular among investors since its launch.

If you’re a retail client, you can only get access to ETFs-based digiPortfolios.

If you’re with DBS Treasures, you’ll have access to the funds-based digiPortfolios on top of the ETF-based portfolios.

Access to Structured Investments

For the sophisticated accredited investors, they will have access to structured investments offered under DBS Treasures.

Structured investments are investment products whose performance or value is linked to an underlying asset, product or index.

These may include market indices, individual or baskets of stocks, bonds, commodities, currencies, interest rates or a mix of those.

At DBS, some of their structured investments are developed based on the CIO’s in-house strategy (for example, the DBS barbell strategy). Depending on your circumstances, these structured products may complement your portfolio.

A note: Accredited investors are assumed to be savvy individuals and are subjected to less stringent requirements. You have access to more products but do be aware that structured products have a range of outcomes that requires adequate sophistication to understand and ensure they will work for your specific needs.

Smart Wealth Management for a New Wealth Generation

While variety and choices are good, what is more, important is the delivery of these solutions in this post-Covid world.

There is an increasing trend of transiting to a digital-first culture, including the affluent and high net-worth. They prefer to be able to check information and make transactions all from an intuitive, native smartphone application.

In this regard, DBS is at the forefront of understanding its digital needs, especially being the World’s Best Digital Bank.

Trusted Phygital Advisory

DBS firmly believes that delivering cutting edge advice for the high net worth requires a combination of great human and digital experience.

By signing up as a DBS Treasures client, you will get access to a team of experts be it for investments, insurance etc.

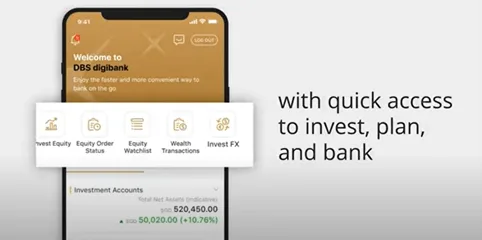

However, as a digital native, you are fully empowered to express your own wealth management decisions through their digibank app.

One App, One Login, One Life

DBS has put a lot of thought into their user experience. It is this constant improvement that has allowed DBS to bring home the World’s Best Mobile App for Wealth Management award in 2020 by Cutters.

With one application in your hands, you have access to the majority of your financial life, such as:

- SRS investments and cash

- Unit trust investments

- Stock investments

- FX investments

- Insurance plans

- Credit cards

- Banking Accounts

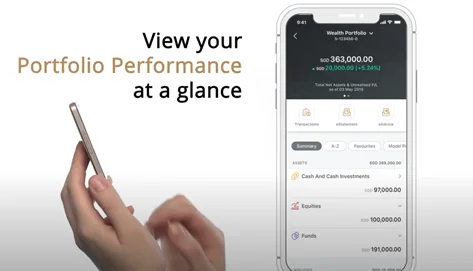

As a DBS Treasures client, you can open a Wealth Management Account. The Wealth Management account allows you to separate the money identified for investment purposes from other needs.

It allows you to have a consolidated view of all your holdings, which would include your unit trusts, different currency deposits, structured investments and individual stocks. This is rather useful as you do not need to manually tally each investment transaction to compute your own gain and loss performance.

Be Notified and Never Miss Another Opportunity

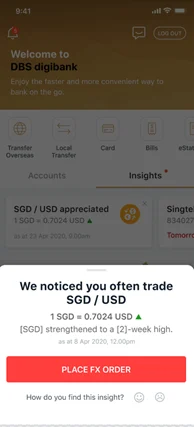

As a sophisticated investor, you may uncover great investing opportunities listed all over the world.

To improve the cost basis of your investment, it would be good if you can convert between different currencies at the optimum time.

DBS’s Forex Online Trading allows you to trade in nine currencies so that you lock in the currencies that you need at the rates you prefer.

Foreign currencies held through Forex Online Trading and held in your portfolios will be treated as part of your assets under management with DBS Bank.

Additionally, the DBS digibank app provides you with notifications on significant foreign exchange movements and more. This allows you to quickly evaluate, place an FX order and lock in the rate that you want.

This prompt alert is well-received that they have recently rolled it out for equity as well. You’ll get alerts to strong market movements and price changes in your holdings on your digibank app.

If the prices in your investments experience significant changes, you will be notified and hence, you don’t miss out on opportunities to buy in or get out of the stock in time.

My Conclusion

In a bid to improve its product & service offerings, DBS continues to digitally transform their business by enhancing both its range of products and its digital wealth platform.

Today’s high net worth individuals demand not just good financial products, but also a trustable wealth management partner that is quick to adapt to their ever-changing needs. The digibank app that a DBS Treasures client enjoys allows one to get customized market insights and analysis received so that he/she can stay ahead of the market trend.

If I wish to commit to a wealth management partner, I will want a platform that scores high points on product breadth and digital depth.

DBS Treasures score high points in both areas.

DBS Treasures is not the endpoint in your wealth journey with DBS. As your wealth continues to grow, you will progress towards DBS Treasures Private Client and eventually DBS Private Banking experience. Isn’t that an upgrade we all look forward to?

Learn more and join DBS Treasures today.

This article is for information only and should not be relied upon as financial advice. Any views, opinions or recommendations expressed in this article does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability. This article is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024