Singapore Life came up with a 3% insurance savings plan with a 3 year duration.

And judging by what the bulletin I received says, they should meet the target before the deadline of 29th Nov (tomorrow). Compared to the Temasek T-2023 bond, the duration is shorter (versus 5 years), and the yield is higher (versus 2.7%). The rating of the firm behind the bond issuer is lower though.

I think this will become a Singaporean saver’s past time, to see how many of these short term, higher yield insurance savings plan they can pick up.

Generally, Singaporeans are still very risk adverse and the safe way to invest their money is through fixed deposits and property. A plan such as the 3% endowment plan greatly appeals to them.

The first one, came up by FWD, sold like hot cakes.

Then other insurance company saw that, and started to offer it.

I wonder if we can form an insurance bond ladder with these bonds but I think there is a limitation for me. A bond ladder is a portfolio of bonds, sequence to expire every year. It allows the investor to reinvest into bonds at the prevailing interest rates.

Thus, in a rising interest rate environment, the investor would not incur a high opportunity cost of holding on to a lower yielding portfolio, while those folks that bought today have a higher interest yield. However, if the interest rate environment switches, the opposite happens.

The limitation to doing this with these endowment is that, there is a limitation how much you can invest in them.

For example, you can only invest a maximum of $6000 in this Singapore Life endowment.

Thus, I do see this savings endowment to be more of a marketing instrument for the Singapore public to get to know Singapore Life. Singapore Life is the first local independent insurance company fully licensed by MAS. They bought over Zurich Life Singapore’s business.

The Singapore Life endowment came with some unique features, so that you can withdraw your money from the plan earlier than the maturity date without penalty fees.

The free withdrawal are subjected to the following conditions are:

- Medical: If the policyholder or spouse is certified by a registered medical practitioner to be physically or mentally incapacitated from employment; have a severely impaired life expectancy, lack capacity within Section 4 of the Mental Capacity Act (MCA) and the lack of capacity is likely to be permanent, or be terminally ill.

- Life stage event: If the policy owner gets married or becomes a parent via childbirth or through legal child adoption; or purchase a new home.

- Financial distress: If the policyholder gets retrenched involuntarily.

So it is not as if you could withdraw it if XXX insurance comes up with a 5% 2 year insurance endowment next year.

I think if you did not manage to get this, its OK. Interest rates have been moving up, such that you have a few alternatives.

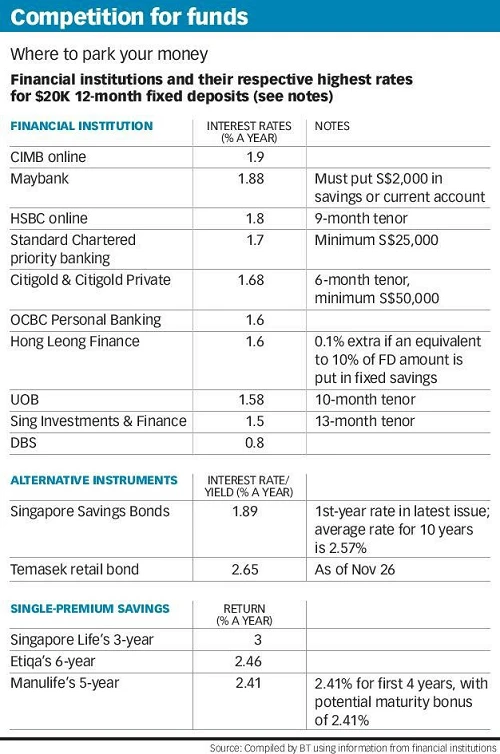

Business Times published this table above, and I thought its a good reference for you guys to check out. I thought DBS fixed deposit rates are high, then I realize some of those with larger deposits look better. Perhaps there are less reasons for us to lock into hurdle savings accounts.

However, there are downsides to these accounts as well.

For example, the Standard Chartered priority banking one requires you to be a priority banking customer, but also that the $25,000 is fresh funds.

For the Maybank one, you would need to open an account, and deposit $2000 so that you can then activate that time deposit to earn 1.88%. So your effective rate may be closer to 1.73% if you factor in that $2000 earning 0.25%. To contribute $10,000 more you need to put $1000 into that savings account. So you get the idea.

You cannot partially take out these time deposits, you will forfeit that interest earned. So you would have to firm up the role for these cash.

While we are on this topic you can check out my list of short term savings solutions.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024