Property Soul has come up with a rather nice article that lets you determine whether you can afford a dwelling and whether you are paying right for it.

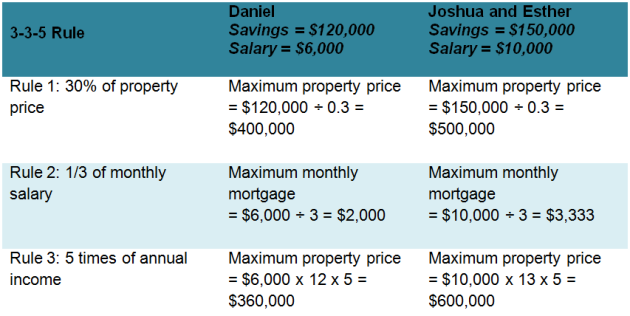

He cites the 3-3-5 Rule which de-construct to:

1. Your initial capital should be 30% of your property price

This is rather prudent, in that you are paying down a good chunk of the dwelling to avoid being overleverage by a large mortgage. For a single, if you have 250k, this section you can afford a 250/0.30 > 833k dwelling. Sweet.

2. Monthly Mortgage Payment Less than 1/3 of your Salary

The total debt servicing ratio (TDSR) means that the total debt of a couple or single wanting to purchase a dwelling cannot be more than 60%. This rule goes even further, by stating that you should not use more than 30% of your gross salary (pre tax) to service your mortgage. If my salary is 3.5k per month, i can only afford $1,166 monthly mortgage payment. This means at most i can take out roughly $250k in HDB mortgage or $230k in Bank Mortgage. I would need to use more cash.

3. Purchase a dwelling that is no more than 5 times your annual income

This filter ensures that you do not pay for an overly expensive place. The problem i find is that if you are a single, you have lower income, this might not be a good gauge that you are buying with good value. Perhaps a median couple combine income would be a better judge.

So if a couple combine income is $10k, this translates to $130k approximately. They should pay less than $650k for their dwelling.

Well, looks like no one should buy a condo at all, perhaps if your combine salary is $260k then.

The article makes a good read. Do check it out.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

WY

Sunday 22nd of June 2014

think the math for annual income seem abit off. seem to be based on monthly income rather than the said annual income

Kyith

Sunday 22nd of June 2014

The should be based on annually income more accurate isn't it. If it's monthly then the figures will be a bit inflated

Tf

Tuesday 17th of June 2014

A very good reminder on the fundamentals.... and a good point you raised that this may not be so applicable for a single person. That said, it is certainly applicable for couples who are eligible to buy a hdb flat.

Kyith

Tuesday 17th of June 2014

this whole thing sounds more like for a 35 year old middle manager earning 15-20k a month.

Jade

Tuesday 17th of June 2014

If this is the case, then a single with $10,000 per month income can only afford a $650,000 property. However, a single below 35 cannot buy a HDB, so he/she can only buys a shoebox apartment.

Kyith

Tuesday 17th of June 2014

that means that he can only buy a shoe box apartment based on affordability. but you see the flaw here of the third rule. does value change due to your income level? it doesnt. the third rule seems the most flawed.

Richard (Invest Openly)

Tuesday 17th of June 2014

Very useful and simple to apply rules. Thanks for sharing...

Kyith

Tuesday 17th of June 2014

Credit goes to property soul. I am just highlighting to readers