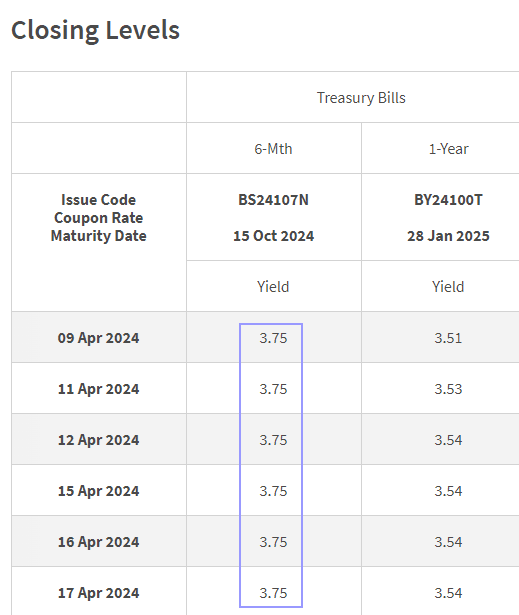

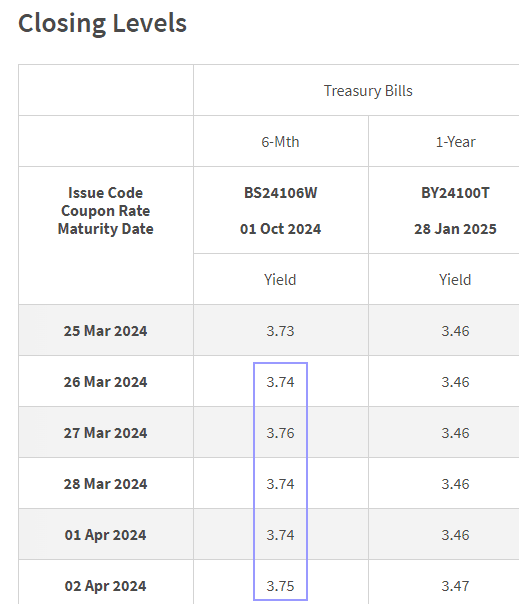

New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers)

A Singapore Treasury Bill issue (BS24108V) will be auctioned on Thursday, 25th April 2024. If you wish to subscribe successfully, get your order via Internet …