Wharf Real Estate Investment Company’s (REIC) interim results was not too bad.

I first wrote about Wharf REIC here. If you are not familiar with it, you might want to get a short overview of it through that article.

Operating profit showed an improvement over last year. The profit attributable to shareholders was lower due to a reduction in fair value increase of the investment properties.

That portion should be OK. We should look upon the recurrent earnings or cash flow aspect of the business.

The majority of the revenue for Wharf REIC (1997) is from its retail and commercial office rental income. In the past, since the cash flow is so recurring, we would annualized the earnings or cash flow. We could then assume a no growth scenario and see the relative valuation of Wharf REIC versus its peers in the same industry.

If we take the operating profit ($6.7 bil) – Income Tax ($1 bil) – Non-Controlling Interests ($0.08) – Financing cost of ($0.460) we arrive at a recurring net income of $5.16 bil. Annualized we get $10.32 bil.

Wharf REIC currently has 3 bil outstanding shares, thus the recurring EPS is $3.44. Wharf REIC current trades at a price of HK$45.20.

This gives Wharf REIC an earnings yield of 7.6%. Wharf REIC have a dividend policy of paying out 65% of its earnings income. This brings its dividend yield closer to 4.9%.

How should we look at the valuation?

Wharf REIC is results is driven by 2 retail malls, Harbour City and Times Square. To give you an extend of the influence of these 2 malls, together, they account for 10% of Hong Kong’s retail sales including wet market, motor vehicles but exclude F&B. Harbour City is 4 times one of our biggest mall VivoCity.

Wharf REIC’s net debt to asset is 13%. This means the leverage factor is low.

Unlike a REIT, Wharf REIC pays taxes. Name me a few retail mall REITs of this quality that trades at a recurring earnings yield of 7.6%.

I doubt you can find many.

And how many gives a historical dividend yield of 4.9%, backed by high quality assets on 65% recurring payout?

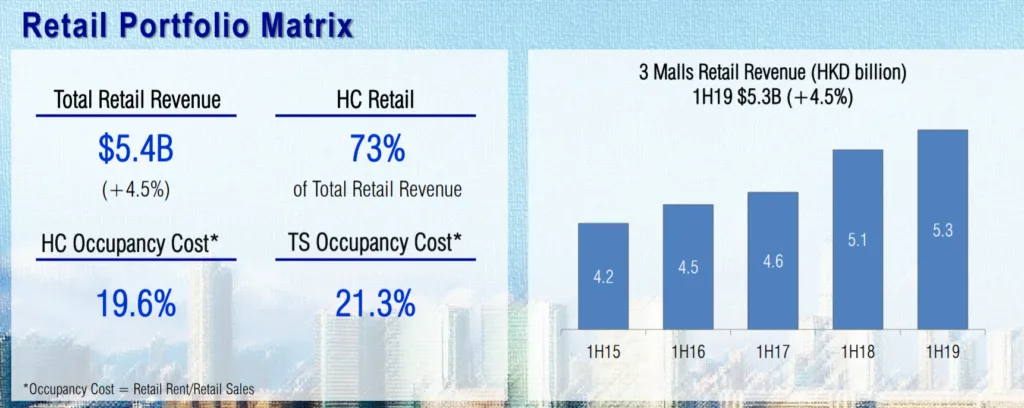

Harbour City (HC) and Times Square’s (TS) occupancy cost is rather manageable. We know it is higher versus Capitaland Mall and Frasers Centerpoint Trusts.

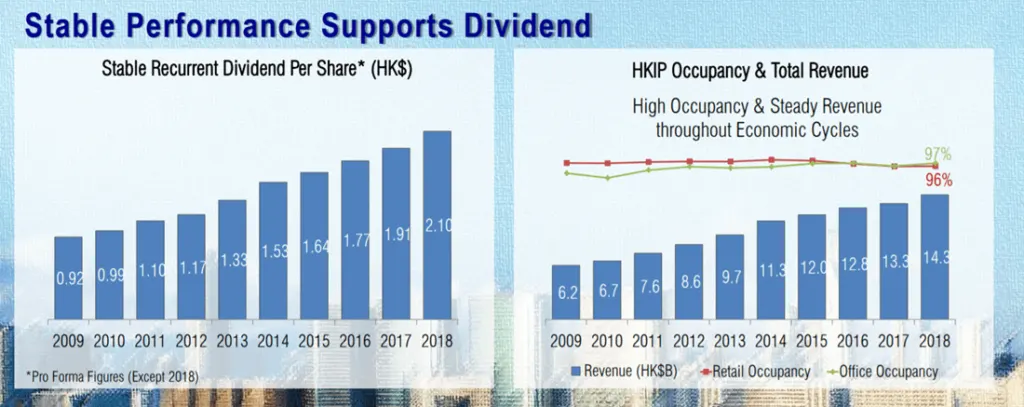

Wharf REIC’s dividend per share have observed to be consistently growing. It’s occupancy since 2009 have been consistently high. The revenue trend have also been consistent.

When a company do not pay out all their free cash flow as dividends, and they have a good recurring business model, they can show a rising dividend per share trend.

Certain tenants of Capitaland Mall, a Retail REIT in Singapore is on a percentage of turnover rental revenue model. This means that part of the rent is determined by how well the sales is. It gives the mall operator an incentive to do their best to make sure they also deliver in bringing greater footfalls to the tenant.

Upscale malls like Harbour City and Times Square should take a certain part of their rental revenue from percentage of sales. That would explain the good revenue trend.

Here are the average passing rent per square foot per month:

- Harbour City: $508

- Times Square: $290

- Plaza Hollywood: $102

The disparity is huge.

Here are the respective retail sales for the past 6 months:

- Harbour City: $18.5 bil

- Times Square: $4.4 bil

- Plaza Hollywood: $1.2 bil

We are investors who are seeking to make money. Whatever happen in the future is what we are concerned about. To find out whether the cash flow is growing and recurring, we look at the past to find results.

And since the intrinsic value of a stock is based upon the aggregate of future cash flow discounted to present value, what if all these riots and protests fundamentally alters Hong Kong?

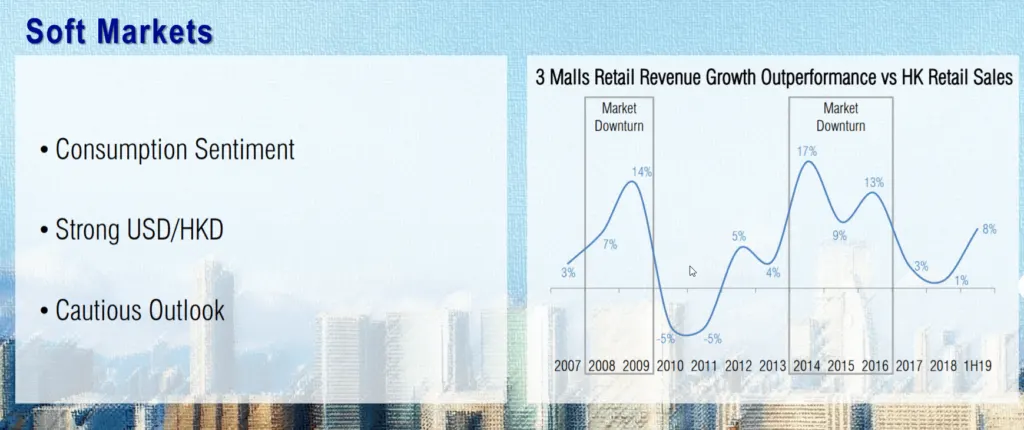

Wharf REIC highlighted how the 3 mall revenue changes during the recent 2 downturn. In 2008, we observe a -19% shift in rental revenue.

The webcast or the webcast transcripts were not out yet, but in an article on the South China Morning Post (SCMP), Stephen Ng, the chairman & managing director of Wharf REIC and Doreen Lee, vice-chariman and executive director of Wharf REIC have these to say:

- “This time, it is like a perfect storm. External factors and internal factors are all erupting at the same time,”

- “In July and August, Hong Kong’s overall retail sales are not [expected to be] very optimistic. We will be affected,”

- “Overall, tenants’ businesses [have become] more difficult.”

- “We all know Hong Kong’s retail and catering industries are [facing difficulties], particularly in shopping areas [such as] Tsim Sha Tsui and Causeway Bay,”

- “The second quarter was worse than the first quarter. But it is not a significant plunge. It is worsening gradually. The hotels [sector] is not optimistic, nor is retail.

- “Will it be worse than [the 2008 financial crisis]? It is possible but … I do not have a crystal ball. I hope there will not be such a big wave.”

- “Demand is weakening. In the short term, we think the outlook is not very optimistic,”

- “Currency is a very important factor … As the Hong Kong dollar strengthens, it has a very big impact on Hong Kong’s overall consumption and demand,” “Yesterday, the yuan broke the 7 [yuan to a US dollar] threshold. This is an even bigger warning.”

- “In these few months, all tenants suffered from a certain degree of impact,”

- “We have to pray for the best, and hope the situation improves,”

- “How long will it take? It is difficult to determine.” A drop in office rents in the second half, if any, will be in single digits,

When you put out information to the media and shareholders, you will wish to control the narrative. Some of my peers will say there is no value in attending AGMs or results brief.

I will say attending these briefs gives me some insights on the narrative of things the management cannot provide in data. You have to view these subjective data in the context of what they have been saying in all these briefs. If a certain management have always been positive, positive, positive and suddenly become…. withdrawn in their outlook, it may be significant enough to take note.

Management usually tries to give a balanced narrative. Some companies with less substance will talk up their company. So these tend to paint a rather positive picture.

But man, Doreen and Stephen were asked some tough questions and they are not hiding much. From what they say, in the short term, you will expect the second half results to be not as good. Just to what extend it is not good.

Recall that we annualized the earnings and say the earnings yield is 7.6%. Going forward, at least in the short term, the earnings yield might not be as high as 7.6%. As a longer term investor, what we are more concern of is not these short term earnings yield BUT the longer term ones.

This might be murky because… has Hong Kong permanently been altered? Would the international retail scene changed in a permanent manner? How fast is this change? How secular is this change?

The above questions are the more pertinent ones than all the pictures of the riots and mayhem.

Some short term changes remained short term. Those are noises. Some… become secular. Those are the ones that may make a gem like Wharf REIC become a value trap.

The history shows us evidence of quality or absence of quality. True quality is a moat. Short term it gets disturbed. The stock price may be mispriced. However, when the quality really disintegrates, then it becomes a real value trap.

If you run a concentrated portfolio, you make educated bets. If quality retains, your portfolio will flourish as a result. However if quality disintegrates, your portfolio will take a big hit.

This is what makes individual investing tough. There is value in good critical thinking. But that is not enough, you also need to go at least deeper into understanding something more than crowd. You also need more info about the business more than the crowd.

There will be those that say this is a secular shift bet on it. There will be those that say this is not a secular shift and bet on it.

I write more about my thoughts on active investing below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Kevin

Tuesday 13th of August 2019

Hi Kyith, Nice article. Since this is listed in HK. Does this counter dividend or future earn profit(After sold out) have to report income tax if we purchase at Spore here.

Kyith

Tuesday 13th of August 2019

No you do not have to.