One of the things I participated in at work was working on different aspects of client communication. Some stuff is easier for us to explain because, through our understanding of history, we can clear up for clients why they are looking at things the wrong way or a different way to look at it.

There is some communication that we should tamper with more and one of them is “how we can help you avoid duds in your portfolio as you invest with us.”

Unless you are living under a rock, it should not escape you that the majority of the financial world was melting down and in a bear market even before the “official” bear market signal (which is a 20% fall in the S&P 500). This is a bit ridiculous because every place except commodities is facing some sort of a drawdown.

This is a price chart of Netflix. You would have seen many charts such as this. The price gets cut by 52% and if you have gotten invested, the price gets cut another 41%.

What is the difference? You just bare with the pain over different time periods that’s all.

I learn over time that to have great returns, it sometimes depends on luck not to bear the pain of volatility but most often, it is like you making a pact with the money god that in order to earn that great return, you have to bear shocks like this.

The shock to some investors for the first time is that they didn’t know “blue chip” FAANG components can do this.

Blue chips or large-cap stocks are supposed to be stable.

Meta Platforms used to be another FAANG and due to poor earnings guidance, it is now down 48%, while the index is not even in the bear market territory.

One of the things that I would try to explain to others is how the sentiments can quickly shift from “this is a good buying opportunity” to “this has so much risk that we should take note about, and I am not sure if they can return to the glory days.”

Individual stocks are going to be volatile. There is no such thing as blue-chip or defensive and it should not fall by 40%.

The market tries to consistently and efficiently reprice these companies based on new information and these companies get cut because the expected future cash flows look to be much lower. As an individual investor, you can try to disagree with that with your investment thesis. You are disagreeing with the timeframe the aggregate market participants are looking at, that they are being too jumpy about it.

This is what is happening to some well known large-cap stocks. What is underneath the surface is worse than this.

This is a price chart of Asana (ASAN). As a to-do list nerd, I love their product.

As a side note, if you are an individual and looking for a very robust to-do list that syncs between the web, and your phone and wish to use it for free, you can give Asana a try. For an individual, it is free because their target is the enterprises that find value in collaborative task management.

They are happy for you to try it as a small group or individual.

Asana IPO in Oct 2020 and I have no idea why they went up from $26+- to an absurd $144. Is task management going to be the next big thing??? Like everything else, it crashed down to $22.

A very dangerous narrative would be that we own fewer tech companies like Asana have no earnings, no fundamentals and we put you in more rock-solid companies.

Rock-solid companies like Meta Platforms crashed by 48%.

Companies like Asana have the same economic drivers as the blue-chip in that they are valued based on the aggregate of their future cash flows discounted back to today. It is just that the long term growth rate was too lofty, for too long, and too far away.

Once the market realizes that their future cash flow projects were too crazy, the stock massively corrected.

The same thing happens to a well-regarded stock like Meta Platforms as well.

That narrative is dangerous because… there are two possibilities right now:

- Earnings of the well-regarded stocks that we put our clients in starting to disappoint, and all of them go on this 25-50% fall in value.

- If you put clients in companies on the cheaper value spectrum, they are essentially fewer quality businesses (unless you get them to solely invest in value + high profitability/quality firms). So you are buying some seemingly faulty shit in the first place.

If you keep drumming that you help your clients avert disasters like these kinds of stocks, sooner or later, be careful it would come to bite back at you when the economy becomes challenging, people spend less and the well-regarded firms also put in poor guidance.

We are starting to see traditionally value + profitable stocks with good momentum do this like what Target did.

Expensive things get cheap and cheap things to get expensive

The right narrative is that stocks get overvalued and overvalued stocks fall until they are fair to undervalue.

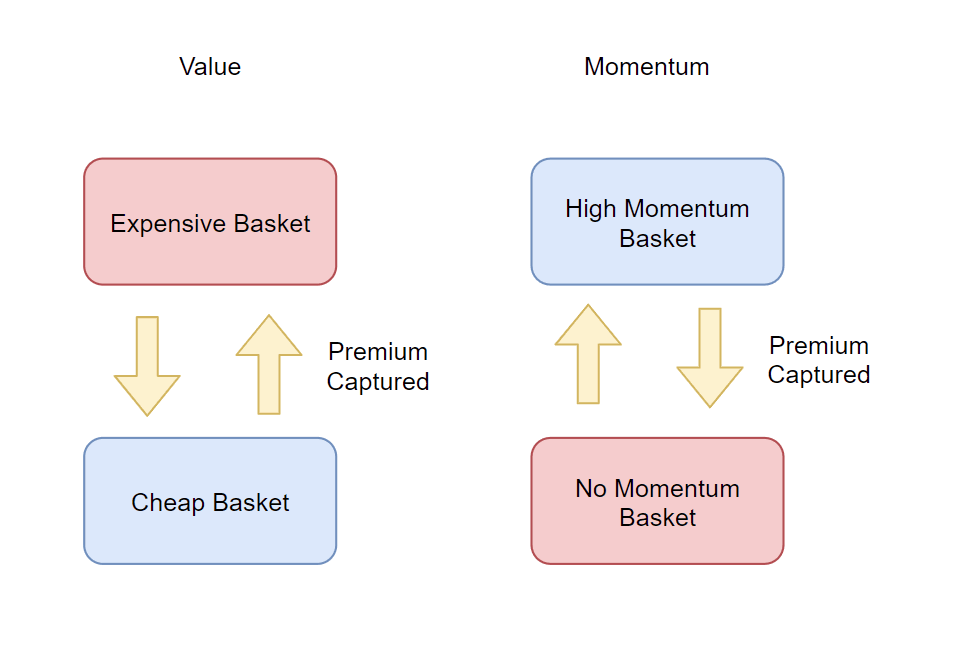

What you want to do is have a systematic way to harvest those premiums. Premiums are the rewards for taking on the risks of buying neglected companies, that others think might be going to have worse and worse cash flows in the future.

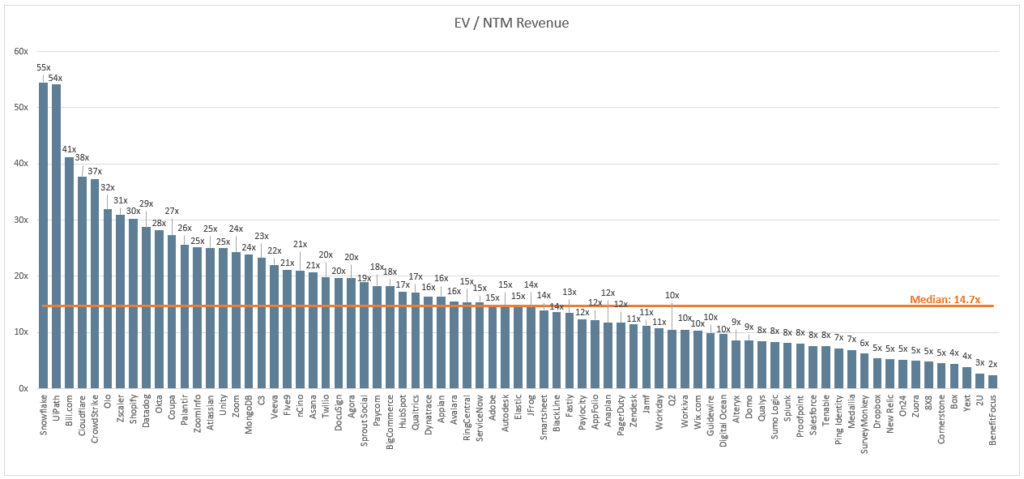

I pulled the Enterprise value divided by the next twelve months’ revenue (NTM) of cloud companies from Clouded Judgement a year ago in 28 May 2021:

EV/NTM is something similar to price-to-sales which is a valuation metric. Not always the best but better for companies with no official earnings. EV factors in the debt of the firm minus the cash.

These cloud computing companies tend to have less debt and a lot of cash, so EV/NTM would be lower than Market Cap to NTM.

The median cloud companies trade at 14.7 times enterprise value a year ago.

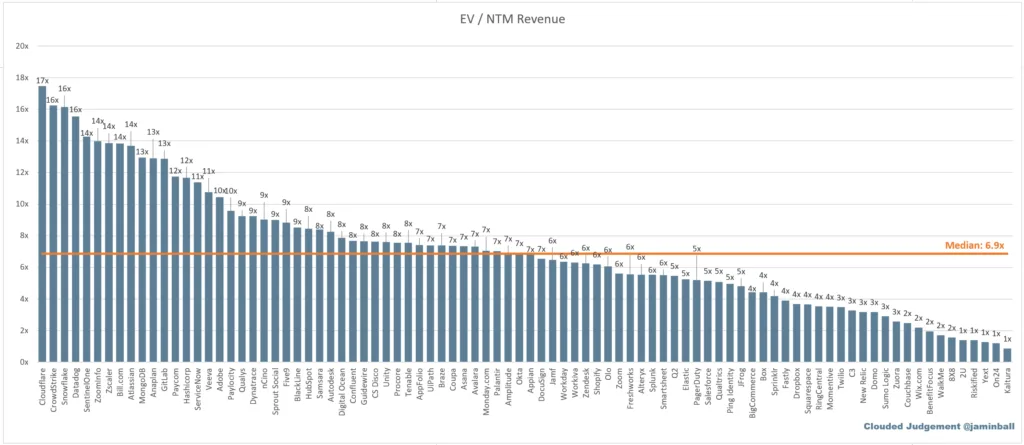

This is what they look like today:

The EV/NTM has been cut to 6.9 times.

Their price has corrected relative to the future revenue projections. But have they gotten cheap enough? That is a good guess.

Eventually, they might have gotten too cheap that there should be some mean reversion.

The problem with these companies is not that they have no earnings but that their earnings will come far into the future and when the opportunity cost (read interest rate) is too high, they get whacked.

You can’t be telling clients that these stocks have no fundamental drivers when a lot of your clients are using their software-as-a-service in their business even when times are challenging such as Hubspot, Salesforce, Cloudflare, and Tenable.

The focus on harvesting value and momentum premiums

The uncomfortable truth is that things become very attractive and people overpay for them and things become too ugly that people don’t want them.

In both situations, there are scams and ponzis and you don’t want to have a large part of your portfolio in ponzis.

The first thing is to make sure that as a cohort you are not buying ponzis and scams and this is where you need to make sure that there are sound economic drivers to what you are investing in.

Holding a basket is to be diversified enough such that the odd ponzis and scams do not impair your capital.

Basket of stocks transit from being expensive to cheap to expensive to cheap. Stocks also lose momentum, then gains momentum then loses momentum.

These are the major forces at play.

As I look at things more, I gain a deeper appreciation that fundamentally, the right way to invest is to buy things at more reasonable prices.

What you are buying or not is another matter altogether.

As individual investors, we try to capture the premiums from the migration of stocks from the cheap basket to the more expensive basket in our own way haphazardly.

When we invest in factor funds tilted towards value such as Dimensional, Avantis or BlackRock funds, this is what we are trying to do but in a more systematic and passive manner.

Advisers should be asking the clients if they share this philosophy of not buying expensive things and a preference for buying sensible and cheap things. And if they do, what they are invested in is a way to do that systematically implement and execute such a strategy.

Communication should also be a systematic way to achieve more margin of safety.

Certain fund managers today would allow you to be diversified (avoid duds killing your entire portfolio, get exposure to winners) and also systematically buy cheap and strong in a passive manner.

That should be the underlying message and not no-earnings shit are Ponzi schemes.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Sunday 29th of May 2022

When sentiment is bad, correlations all go to 1, whether bad shit or good shit.

That's when Peter Lynch will say "In investing, stomach more important than brains."

Right now is probably a good time to put a good chunk of warchest into various tech, cloud, and semiconductor ETFs, and DCA over the next 6-9 months.

Revhappy

Wednesday 1st of June 2022

@Sinkie,

I agree with you. I feel too many people are calling this a bear market rally and dont fight the FED and blah blah blah as if they know it all. From my past experience people are always wrong, nobody can call the market correctly, yet they always think they can somehow call it, lol.