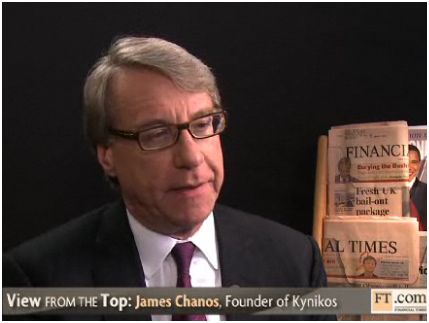

Jim Chanos is bearish and skeptical on a lot of things. Recently, he discusses with Value Walk what he considers as value plays and what are value traps.

Value stocks should contain the following characteristics:

- Predictable, consistent cash flow

- Defensive and/or defensible business

- Not dependent on superior management

- Low/reasonable valuation

- Margin of safety using many metrics

- Reliable, transparent financial statements

And these are the following traits of value traps:

- Cyclical and/or overly dependent on one product

- Hindsight drives expectations

- Marquis management and/or famous investor(s)

- Appears cheap using management?s metric

- Accounting issues

In the following Scribd article, he explains them further:

98208144 VALUExVail 2012 James Chanos

[Hat Tip Value Walk]

Latest posts by Kyith (see all)

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024