So I was debating with my friend on Optus which was purchased by Singtel in 2001. Its been 10 years since then so we could probably assess how well it has done for Singtel.

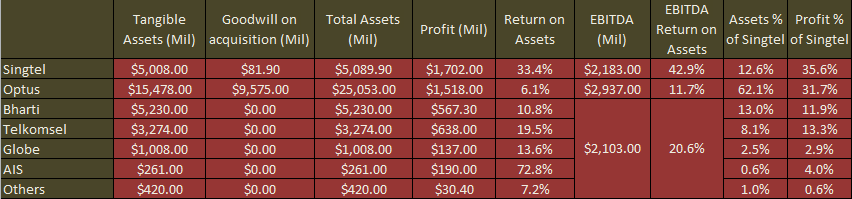

Here is a look at the investments on each subsidiary and the profit generated based on Singtel’s 2011 Annual Report:

The first conclusion is that Optus is important to Singtel. It contributes 31% to Singtel’s bottom-line which is the second highest behind Singapore’s contribution.

But that is only part of the picture. Optus ranks the lowest in terms of return on assets. (Return on assets shows for $1 dollar of assets how many cents of profit is generated)

The level of assets invested in Optus is astounding.

If Optus ROA is that of Bharti, they would have generated 1 billion of extra profit. That is a 2% boost to your free cash flow or dividends.

Using Bharti is a good comparison since Bharti had their own fair share of problems. Had we use Telkomsel ROA, Optus would have generated 3.2 billion of extra profit. That’s almost a 6% boost to your dividends.

Pressure to write down OPTUS’s value

Indeed there are so many instances in the past 10 years that Singtel was pressured to write down the value of OPTUS. Although they bought it for this much, its assets is only worth half of the current value:

Singapore Telecommunications is expected to make a substantial write-down on the value of its investment in Australian carrier Optus when it releases both sets of first-half results on 8 November.SingTel paid A$14 billion (US$7 billion) for Optus, a full service telco that had been growing at a double digit rate but which recently announced an imminent slowdown and the layoff of hundreds of staff.But some analysts say this was way over the odds, and with the events of 11 September driving the share price even further some put the real value of Optus at only A$8 billion ($4 billion).While nobody seriously imagines a A$6 billion write down is on the cards, a fairly hefty figure is expected by analysts in both Singapore and Australia.However, once the write down is out of the way, and SingTel has streamlined Optus’ operations, it is expected to perform better than its major rivals in Australia and to add considerable value to SingTel’s regional presence.

This happened again in 2006:

Optus is worth S$18.2 billion in SingTel’s books. "In our view, this valuation may not be supported unless the earnings performance of Optus materially improves" by 2009, Merrill Lynch said.

SingTel has Optus’ assets in its books for S$18.2bn. In our view this valuation may not be supported unless the earnings performance of Optus materially improves.

Indeed, this report shows that Optus’ ROIC (on BV) at a mere 6% is declining, and is well below its WACC of 11%. This is being driven by lower returns on wireless and the sustained weak, negative returns from fixed line.Rather than selling the business or trying to drastically restructure it to improve returns, SingTel is trying to lift margins/ROIC by increasing fixed capex (now running at A$400-500m pa).

This is in order to leverage ULLs to enlarge the network footprint and increase capacity for the corporate market.

However, we think there are considerable risks that these gains are delayed and potentially confiscated by ULL migration delays from Telstra, very aggressive market pricing and higher customer service costs.

Even if successful in turning around its Aust. fixed line operations it only adds 10 cent/sh to our SingTel valuation of 2.42/sh, and Optus’ ROIC still remains well below WACC at 6%.In fact, we think there is a growing risk that SingTel could be facing a massive writedown on its Optus investment (circa S$5-8bn), unless returns materially improve by FY08/FY09.

We also feel there are other risks that are still not priced into SingTel’s stock, including new Government sponsored broadband networks in Singapore, MNP, slower growth from associates, CEO change and ongoing Temasek selling.

However, Morgan Stanley kept its ‘Buy’ call on the share, noting that it is one of the "best-value" telecommunications companies in the region despite the competition.

According to the paper, SingTel paid S$13 billion for Optus in October 2001 and most of the acquisition was goodwill worth S$11.4 billion.

SingTel has already reduced a total of S$1.78 billion in Optus goodwill in recent years, he added. It’s external auditors had signed-off that a write-down of Optus’ carrying goodwill was not required.

Comparing against Vodafone and Telefonica

I believe in business you make good moves and sometimes you made bad moves. How well you perform should be benchmarked against your peers.

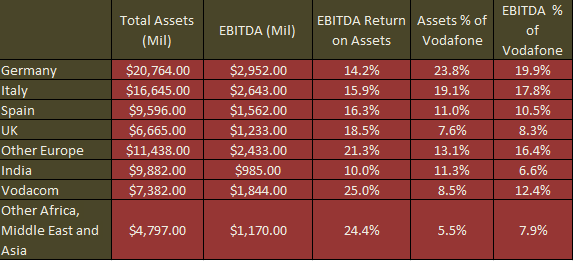

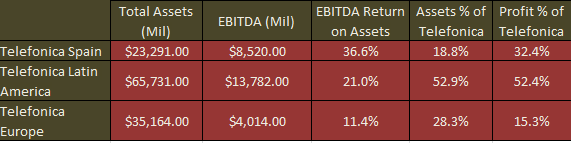

The following 2 tables shows the Assets vs EBITDA Return on Assets for 2 of the Top 3 telecom companies in the world, Vodafone and Telefonica.

These 2 telcos have established their footprint throughout the world and its good to see if how well Singtel’s acquistion fare against them. Unfortunately, I could not get the figures as net profit so we can only compare the return on assets based on EBITDA.

Vodafone:

Telefonica:

The comparison shows that Optus ranks amongst the lowest in terms of EBITDA return on assets. It also shows how well the Singapore and Emerging Market investments are for Singtel when compare against the subsidiaries of other telcos.

Conclusion

We do believe that Singtel was forced to make an impulsive acquisition as part of their strategy to expand. And as such due to their failure to purchase prospective telecoms in Hong Kong, was forced to pay over the odd premiums for Optus.

In recent times, developed markets are prone to more intense competition compared to developing market telcos, limiting their room to grow.

While Singtel would keep telling us that Optus will eventually come good, we do believe that not making that investment would have generated much higher returns on shareholders’ money.

Disclosure: Author is vested in Singtel

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024