In 2018, I spotted a telecom operator that has in excess of a 10% free cash flow yield. So I took a look at it.

Till today, I could not increase my conviction in this stock due to the limited information that I could uncover about the business.

It is not a very sexy business and I think in recent years, not many folks would touch it due to the challenges in the industry.

My posture has always been to let the company’s result tell me if I was wrong, or that I was cautiously right. The world is different today, but the share price is not too far off from where I first pick it up

A Brief Introduction to Citic Telecom

Citic Telecom (stock code: 1883) was established in 1997 and listed on the Hong Kong Stock Exchange in 2007.

The company provides a whole assortment of telecommunications service mainly to the people in Macau and coming into Macau.

Citic Telecom owns 99% of Companhia de Telecomunicacoes de Macau, S.A.R.L. (“CTM”). Before 2013, Citic Telecom owns only 20% of CTM. In 2013, Citic Telecom purchase the other 79% of CTM that it does not own from a wholly owned subsidiary of Cable & Wireless Communications and Portugal Telecom.

The purchase consideration was US$1.16 billion or equivalent of HK$9 billion then.

Macau Post, an entity controlled by the Macau Government, owns the remaining 1% equity in CTM.

- CTM held a 41% market share in the Macau mobile market. This was down from 43% in 2018.

- CTM held a 42% market share in the Macau 4G market. This was down from 46% in 2018.

- CTM held a 97% market share in Macau’s broadband services with a broadband penetration rate greater than 91% at end 2019

A substantial shareholder of Citic Telecom is Citic Group. Citic Group, a large state-owned enterprise in China owns 58% of Citic Telecom.

The Macau Telecom Market

Macau boasts a sophisticated, independently regulated communications market. Liberalization has now fully opened the telecoms market.

Demand for telecom services is significantly driven by the millions of visitors that visit Macau every year. 87% of visitors classified as residents of mainland China or Hong Kong.

Macau’s mobile market is very competitive. There are four mobile network operators (CTM, Hutchison 3, SmarTone, and China Telecom Macau) and a mobile virtual network operator (MVNO) offering services.

Mobile penetration is in excess of 200% due to multiple SIM card ownership as well as sales of SIM cards to visitors.

Macau have a population of 650,000.

Citic Telecom’s Business

Like most telecom operators, Citic Telecom’s revenue is derived mainly from

- Mobile sales and services. Sale of handsets and providing 4G and in the future 5G mobile services. This is their main bread and butter.

- Internet services. This would be broadband services.

- International telecommunications services. Voice services, SMS, and their “DataMall” services.

- Enterprise solutions. Citic Telecom through its subsidiaries provides info-communications and technology services (ICT). Customers are mainly global MNC. This business spans more than Macau but includes Europe, Russia, China (those countries along the One Belt one road), South East Asia. Services include Cloud computing, VPN services, Datacenter services, systems integration.

- Fixed-line services. This is the declining phone line business. While they own a monopoly on this, it has been declining and will decline over time.

The unfortunate thing with Citic Telecom is that they would only provide breakdown of their revenues by segment. In this way we have no idea how well each segment is doing.

The Challenges for Telecom to Diversify Away from Traditional Profit Sources

We do know that overwhelmingly the mobile services and internet services enjoy the best EBITDA margins of around 20-30%. The enterprise solutions segment should command around 10 to 15% margins.

The one thing I realize as I read a few annual reports of telecom companies is that they will describe the great potential of their various segments.

However, at the end of the day, majority of what drove profits is the mobile and broadband business.

The rest of the enterprise, advertising, internet content, data center segments often are either still losing money or a small portion relative to the mobile and broadband business.

This is also where telecoms struggle with as they have become more like commoditized utilities. We subscribe to one provider but we are so fickle that when another provider lowers their price, we switch over.

With greater number of players, this will reduce a very high EBITDA margins down. Since the mobile and broadband EBITDA margins are so much higher than the rest of the new segments a telecom operator is trying to develop, telecom operators’ results live and die by the mobile and broadband segment.

However, despite what I mention, the telecom operators have no choice but to explore these new segments.

The main reason is that; they already have the infrastructure. By developing new users around the technology infrastructure, they encourage greater use, and may be able to charge enterprise clients, SME at better rates.

5G brings a lot of promise (and also lots of CAPEX) but at this point, it is just potential.

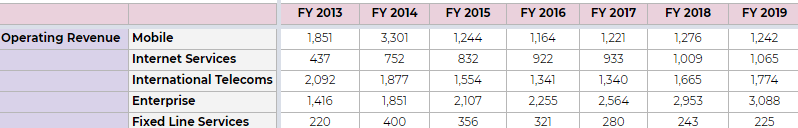

Citic Telecom’s Segmental Revenue

While Citic Telecom is adding mobile subscribers, revenue did not seem to move much. Fixed line services is on a declined.

The surprise was the boost in international telecommunication service in the past 2 years due to SMS and voice. I wonder whether that will continue.

Mobile Subscriber Growth

While there can be more mobile penetration over time, it does not mean it translate to revenue. This is because ARPU tends to go down over time as well.

Here are some of the latest Citic Telecom subscriber numbers we have:

- 2019 Postpaid Subscribers: 350,000

- 2019 Prepaid Subscribers: 796,000

- 2019 Broadband Subscribers: 193,000

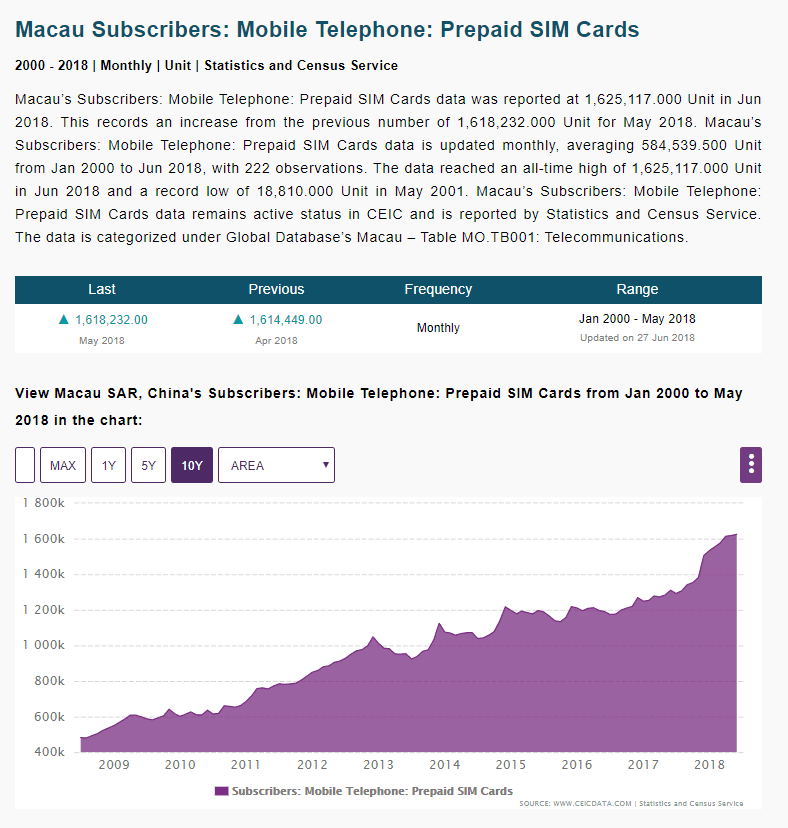

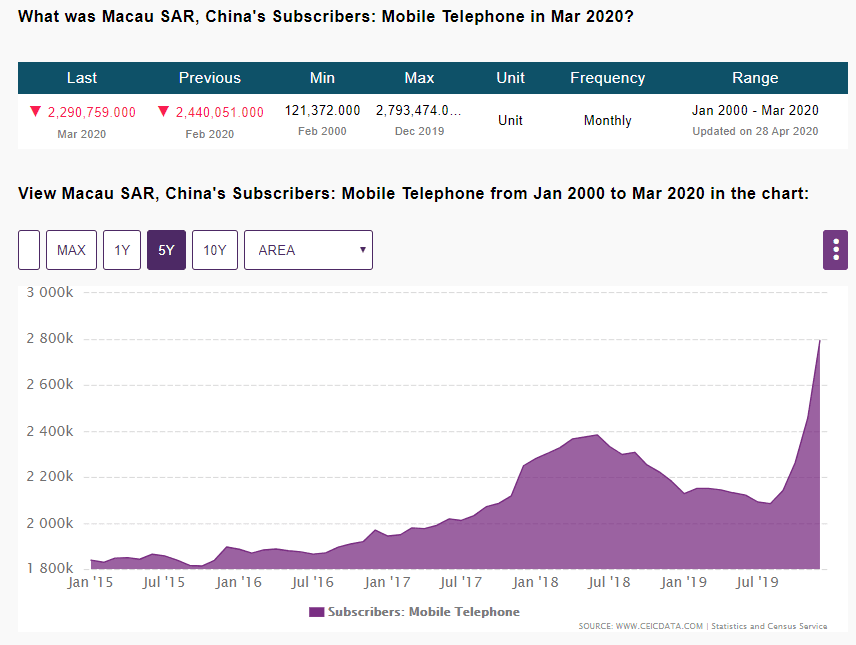

Here is the growth of Macau prepaid sim cards over the past 10 years:

Probably not the most up to date but better than nothing. Citic telecom probably have slightly less than 50% share of this.

The compounded growth is 12% a year.

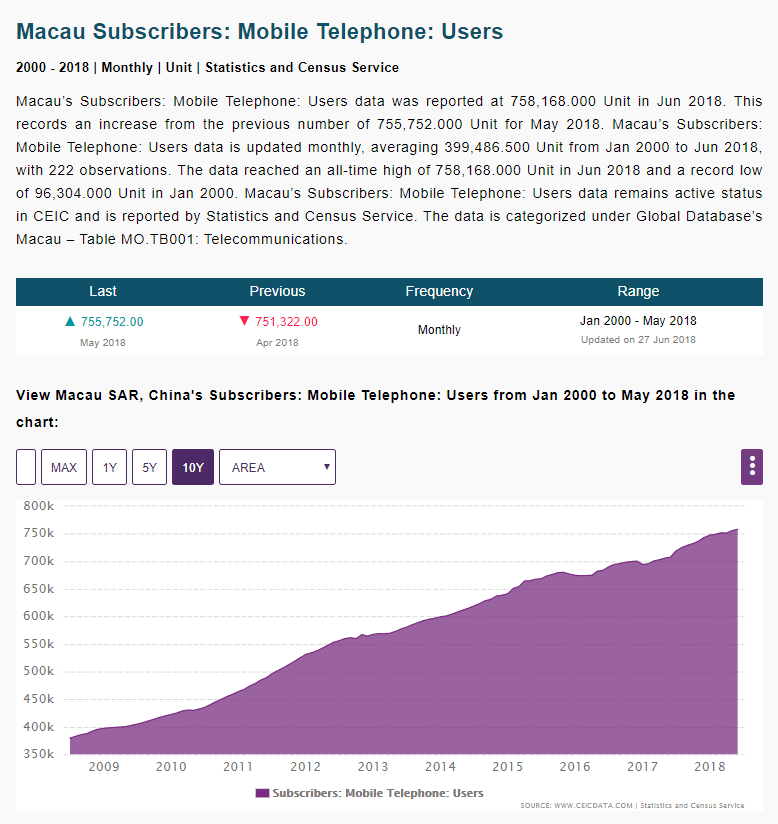

Here is the growth of Macau mobile subscribers over the past 10 years:

I think I would trust Citic Telecom when they tell me that by 2019 their market share would be 41%.

The compounded growth was 7% a year for the past 10 years.

Given this kind of consistent subscriber growth, and that Citic was able to capture enough market share, it cannot be revenue stay stagnant for so long. The only explanation is that in terms of the operating dynamics, it is unfavourably deflationary.

A2P SMS

What have been driving this have been A2P SMS Business. A2P stands for app to person.

There seem to be an increase in the pace of global expansion of major PRC internet companies and with that a growing demand for authentication SMS from financial institutions.

- In 2018, SMS revenue grew 38% or 146 mil.

- In 2019, SMS revenue grew 74% or 287 mil.

International Telecoms have been declining and suddenly this turned around.

Amazing.

If you bank with Bank of China in Singapore, you will know how crazy their 2FA SMS can be. Almost every action generates an SMS.

According to a survey done by Ovum and Tata Communications, SMS is the primary mobile specific service that companies use to communicate with customers.

A2P have been gaining momentum for a few reasons:

- Consumers prefer their communication to be short and personalized and on their terms

- SMS open rates are higher and faster than email open rates. 98% of SMS messages are read versus 20% in email

- Increase two factor authentication

Ovum forecasted that by 2022, revenues from app to person SMS will exceed revenues from person to person SMS. This is despite the traffic from A2P to be half that of P2P SMS.

“Unfortunately for most telcos, P2P SMS has become essentially value-less, since they have had to bundle unlimited SMS into mobile tariffs to remain relevant to their customers, an increasing number of whom use chat apps such as WhatsApp, WeChat and Facebook Messenger.

However, telcos can still charge a per-message termination rate for A2P SMS, which means it remains a more valuable source of revenues, since enterprises still value SMS for its global reach, affordability and mature ecosystem. However, chat apps, which Ovum forecasts will have 3.2bn unique monthly active users (MAUs) by 2020, are also connecting enterprises with consumers via their platforms. Telcos and the wider ecosystem are therefore under pressure to protect their A2P revenues, driving them to upgrade from SMS to Rich Communication Services (RCS),” – Ovum

Enterprise Growth

The growth area is definitely in internet services and enterprise. Part of the boost in Enterprise have been acquisitions:

- In Oct 2016, they acquired Acclivis Technologies and Solutions Pte Ltd. You might be familiar with it because it used to be a subsidiary of DeClout Limited. It provides comprehensive cloud facilities and owns Pacific Internet in Singapore and Thailand

- In Feb 2017, they finalized the acquisition of Amsterdam-based Linx Telecommunications. This includes Linx’s 470 KM submarine fiber network in the Baltic Sea, its network operation centers (NOC) in Moscow and Talinn, Estonia. It also includes a data center in Estonia serving Estonia’s largest internet exchange.

- In 2016, Citic Telecom acquired Citic Telecom Tower (CTT) in the data centre cluster in Kwai Chung, Hong Kong. Their intention was to turn this into a high grade data centre with more than 4000 racks. They completed this in late 2018. In 2019, they sold out all the racks and proceed to expand with 500 more racks. This should be completed this year or next year.

For the past 4 years, the enterprise segment has grown 15% a year. If we assume that the conservative operating margin of 10% a year, this will add 4.5% a year to Citic Telecom’s profit.

However, if I look at Citic Telecom’s profit growth in the past, I am probably either too optimistic in the segment growth or operating margin, or there were administrative overheads.

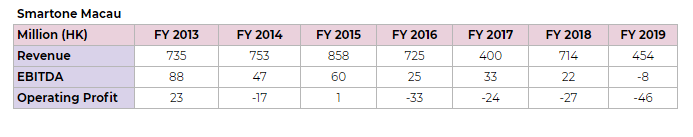

Review of Competitors

For some reason Macau has got to be the most opaque telecom market to do research.

Out of the 3 competitors, Hutchison 3, Chine Telecom Macau and Smartone, I can only find the results of Smartone.

For such a small city of 650,000 people, they have 4 telecom operators and one MVNO.

This is one of the reason I was pretty cautious on this investment.

Intense competition has sort of kept Citic telecom on their toes. During the time where I remain invested, telecom operators around the world have been struggling due to competition. For some reason, Citic telecom has remained a bright spot among the telecom operators.

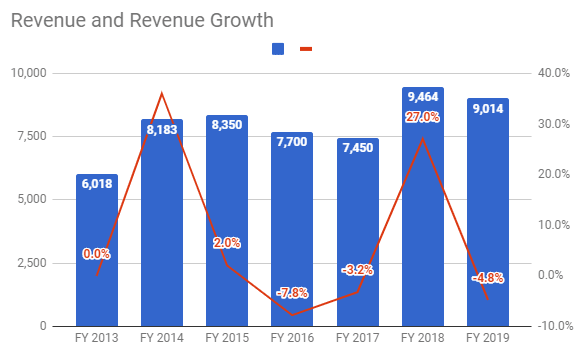

Citic Telecom’s Revenue Growth

Citic Telecom’s revenue have not been great for the past few years since they acquired almost all of CTM’s stake. The most meaningful boost to revenue was from 2017 to 2018.

$1 billion of that came from handset sales, and another large contributor was from… SMS-based services. SMS revenue in that year was up 386 million, which is a 37% increase.

Just when we thought SMS is dead, we did not realize that the demand for greater security have also increase the need for 2FA authentication. One common way is through SMS.

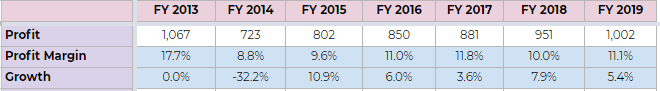

Citic Telecom’s Profit and Cash Flow Trend

Given the revenue profile, it is a little surprising that Citic Telecom’s profit growth has been pretty decent.

For the past 6 years the profit growth averages 5.5% a year. Citic Telecom profit margins have held up pretty OK.

We are not sure what the future may bring, but it is likely the growth will not exceed this range unless 5G surprises me on the upside.

Given how intense competition has been in the telecom space, I would not be surprised if the compounded average growth slows down to 2-3%.

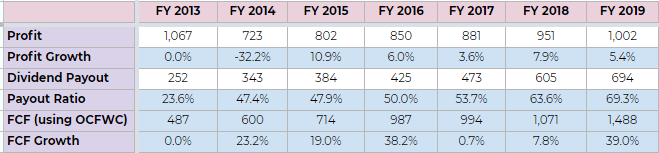

While Citic Telecom’s profit growth looked decent, their free cash flow growth looks much better, especially in 2019.

2019 was boosted by higher depreciation and slightly higher net profit. Free cash flow growth over the past 6 years have been 16% a year.

I should warn readers that my free cash flow is computed by using operating cash flow before working capital. This will give a more consistent free cash flow. However, I am not glossing over working capital.

For the most part, Citic Telecom’s net working capital is quite in control, and I did not detect any signs that it will manifest into a greater issue. (If you would like to learn to differentiate each of the cash flows used in investing, you can read my comprehensive cash flow article here)

I have also listed the dividend paid out each year, relative to net profit. The dividend payout ratio starts off low at 24% and progress upwards closer to 70%.

If you look at the dividend paid out relative to profit or free cash flow, the payout has been rather conservative.

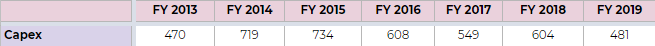

The issue with telecom operators is that they have to sink in greater amount of funds for capital expenditure but they could not earn incremental value from it.

Citic Telecom’s capital expenditure over the years have gone down quite a fair bit. However, Citic Telecom have indicated that once they have the 5G approval they will roll out the deployment of their 5G network in the first half of 2020 (it remains to be seen if Covid-19 will affect this plan).

Macau will be one of the first few cities in the world to have full 5G network technology coverage.

With the roll out in mind, it is likely that the capital expenditure in 2020 could be higher than the average Capex trend of the last few years.

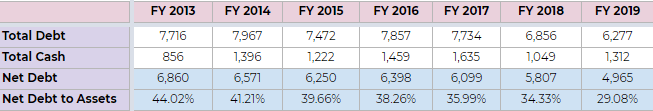

Whatever cash flow that is left over from capital expenditure is mainly channelled to reducing their debts over time. Citic Telecom’s debt to asset have reduced from a less than comfortable 44% to a more comfortable 29%.

The Impact of Hong Kong Protest on Citic Telecom Results

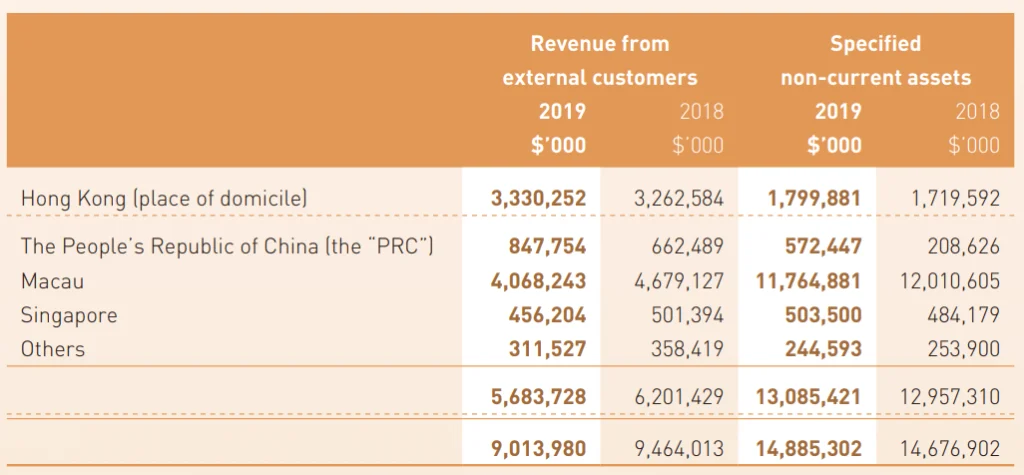

I was also interested to review the full year 2019 results because from the segmental reporting, a large portion of revenue comes from Hong Kong.

The issue is that I am not sure if this was derived by customers in Hong Kong or that it is due to a subsidiary domiciled in Hong Kong.

I have a feeling it is the latter.

In any case, the unrest in the second half of 2019 did not affect Citic Telecom much. This was quite fortunate.

The Potential Impact of Covid-19 on Citic Telecom

Covid-19 is a different challenge altogether. I think I was quite lucky that out of all the stocks I own, I have a fair bit of telecom holdings in 2 of the stocks.

An industry that most investors do not like turn out to be in a better position than a lot of the industries that most investors like.

Telecommunications became very essential now.

However, certain segments of Citic Telecom would be affected by this:

- A portion of revenue comes from people visiting Macau. With lock-down restrictions, and very, very low tourism numbers, part of mobile revenue will be affected.

- A part of ICT revenues should come from on-going projects. This may be adversely affect when some projects are put on hold.

- International telecommunication revenue likely going to be affected as well

Macau depends on tourism. It is likely some of Citic’s main ICT customers are the casino and resort operators.

For this reason, I am not optimistic about their upcoming results.

Some numbers:

- 2017 Postpaid (exclude Internet of Things and SIMN) ARPU: HK$206

- 2017 Postpaid (Internet of Things and SIMN) ARPU: HK$30

- 2017 Prepaid ARPU: HK$11

- 2019 Postpaid Subscribers: 350,000

- 2019 Prepaid Subscribers: 796,000

- 2019 Broadband Subscribers: 193,000

Most likely, the Postpaid revenue is 7 to 8 times that of Prepaid. I think the impact of this is quite controlled. However, I cannot be certain of the aggregate impact.

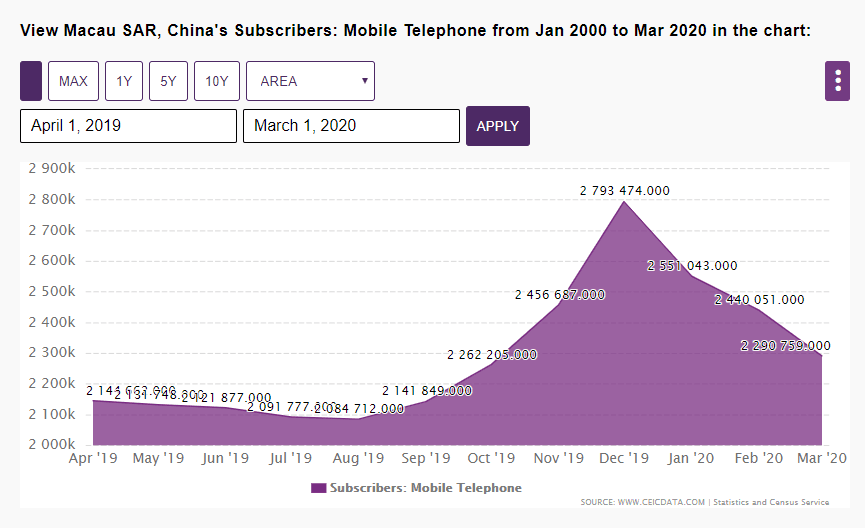

The graph above shows the 5 year Macau mobile telephone subscriber growth. There was some craze spike from Sep 2019 to Dec 2019 where the number of subscribers went from 2.1 mil to 2.8 mil.

Note that a large amount of these are likely to be pre-paid subscribers.

I suspect that this was due to the unrest in Hong Kong diverting the amount of people there.

In any case, Covid-19 has totally collapse this:

- 2020 Feb: 2.44 mil

- 2020 Mar: 2.29 mil

I suspect this drove the spike in A2P revenue. For the next 6 months’ result, Citic Telecom probably will reverse that A2P revenue.

Valuation

For a business with recurring cash flow, earnings yield and free cash flow yield seem to be the better way to evaluate whether Citic Telecom is attractive or not.

EV/EBITDA is another one.

Citic Telecom have 3.65 billion shares outstanding. At a share price of $2.89, this puts Citic Telecom’s market capitalization at $10.5 billion.

With a net debt of $4.9 billion, this puts Citic Telecom’s Enterprise value to be at $15.4 billion. Citic Telecom’s 2019 EBITDA is $2.49 billion.

This gives Citic Telecom an enterprise value of 6.2 times. This is pretty attractive.

With a net profit of $1 billion and a free cash flow of $1.5 billion, this gives Citic Telecom earnings yield of 9.5% and free cash flow yield of 14.3%.

Currently, Citic Telecom have not gone ex-div yet. The share price bakes in a $0.15 dividend. If we backed that out, the market capitalization you are buying Citic Telecom at is $10 billion. Likely the valuation will not differ much.

In any case, the risk to this valuation is that things do not return to normal with social spacing. It will affect the number of people visiting Macau. Of course, Citic Telecom have the potential to offset this by the increase demand in their ICT business.

Based on the latest dividend per share of $0.20, this gives Citic Telecom a dividend yield of 7.3% (if we use the ex-div price of $2.74).

Investing in this climate is tough because there are a lot of uncertainty. If you look at Citic Telecom, the valuation does not look expensive, but they are operating in an area where prolong shut downs will definitely affect the business.

We will have to see how this unfolds.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sunny

Tuesday 12th of May 2020

Good review of this company. Their enterprise solution is probably running out of HK. This should be s the growth area if large corp continue to stay in HK... Macau gov doesn't encourage a lot of competition. That explains their APRU there is so much higher than HK. They want things to be stable, until they really want to do something due to various political agenda.. That's back in 2018 I believe when APRU really came down.

Kyith

Tuesday 12th of May 2020

Hi Sunny, they might try to poke the telecom again.