China healthcare have grown a lot. However, expenditures remain at 6.4% of GDP, which is far below the OECD average of 9%.

The chart above measures the health expenditure per person. China ranks in the 92nd place worldwide.

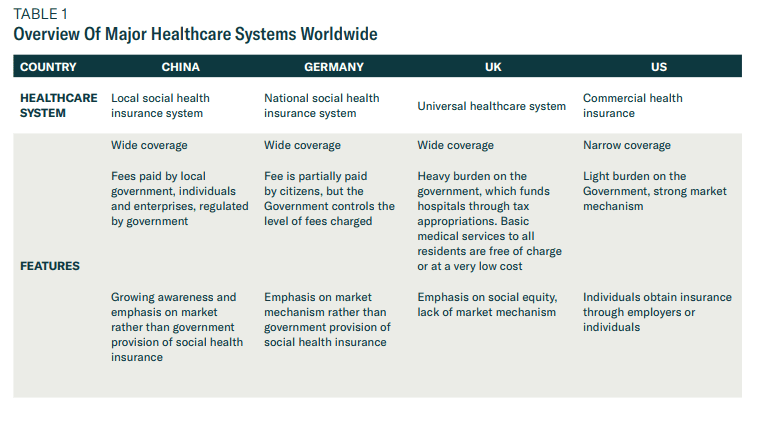

In the BCA report, global healthcare systems can be classified in the three categories, either Germany, UK or US. China’s system is closer to that of Germany.

Here is something interesting:

In 2000, just over 20% of Chinese citizens had healthcare coverage. The SARS outbreak in 2003 was a wake-up call for Chinese leaders. Thanks to heavy government subsidies and political commitments, China achieve universal healthcare coverage in 2011. Nearly 95% of its citizens have healthcare coverage.

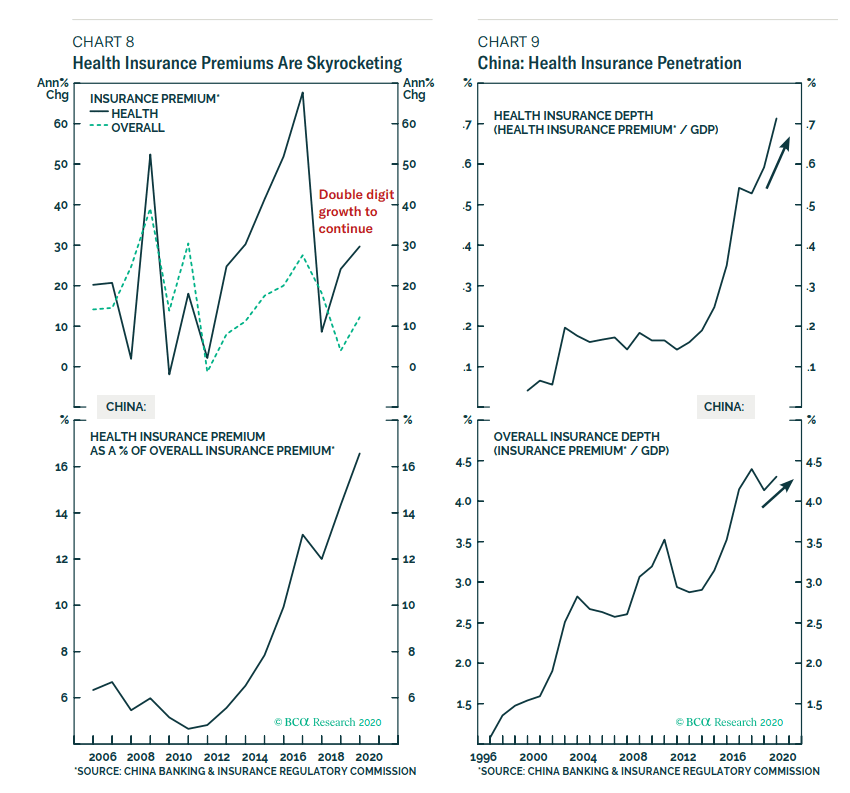

Public health insurance may not be enough. And key signs is the increase in penetration of private health insurance.

In chart 8, we see that the CAGR for insurance premiums are growing at double digits. There may be signs of steady asset expansion.

A high and steady growth in premiums, during a period of low discount rate, may warrant a higher PE.

Faced with financial strains and growing demand for healthcare services, the government is supporting private healthcare providers by relaxing regulatory restrictions and offering tax incentives to Chinese consumers when they buy health insurance.

Early in July, the regulators also raised the equity investment cap for all insurers form 30% to 45% of total assets. In May, they also allowed insurers to invest in the secondary capital bonds issued by banks as well as perpetual bonds. This will expand the investment opportunity for insurers to diversify their investment portfolios and improve the asset/liability management.

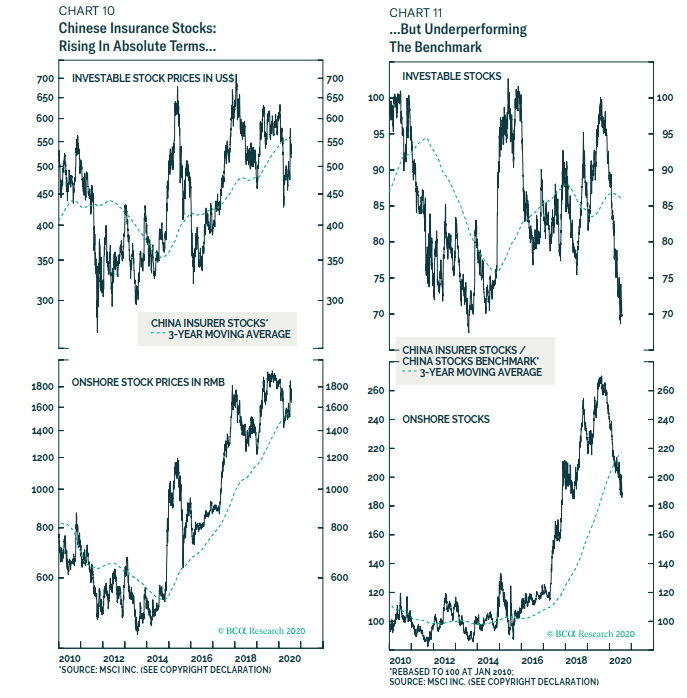

In terms of performance, the investable insurer stocks in China have not done as well as the overall China stocks. The insurance stocks have rallied off the March lows but still lag the benchmark.

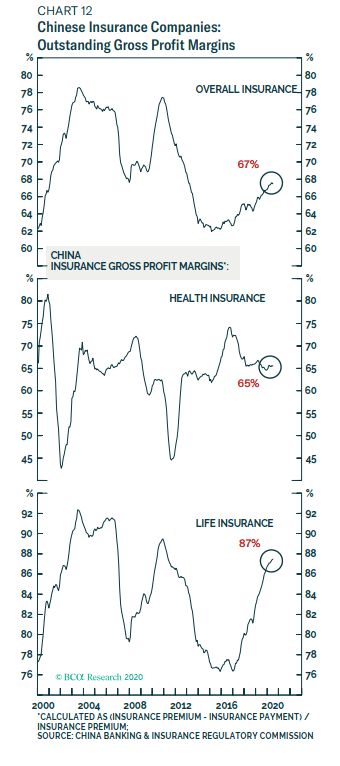

These charts show the profit margin of health and life insurance. This is calculated as (insurance premiums – insurance payments)/insurance premiums.

It looks like not a lot of insurance payouts!

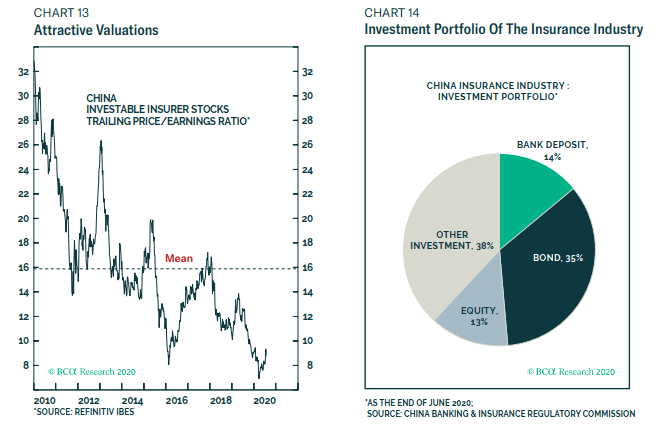

Chart 13 shows that the equity valuation in terms of Price earnings are rather low compared to other sectors.

Chart 14 showed some hidden risks that we should be aware about. If we look at the investment portfolio, 38% is in other investments which can be made up of project-based debt schemes, trust plans and long-term equity investments.

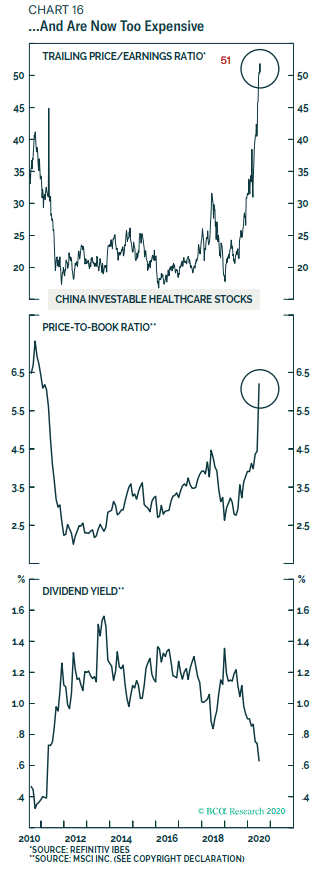

Lastly, the other way to invest in this sector, is to invest in healthcare stocks. The above charts shows the relative valuations of the healthcare stocks.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Emma Vinson

Thursday 6th of August 2020

Thank Kyith for your article. I was wondering about the impact of Corona on the China insurance sector. You mentioned about the SARS outbreak in 2003 that had a great impact on the insurance sector leading to wider universal healthcare coverage. Nowadays, however, you wrote that the “public health insurance may not be enough” and that there are “key signs is the increase in penetration of private health insurance”. Do you, thus, think that, with Corona and contrary to SARS, we are going to see a boom in the private health insurance sector in China?

Kyith

Sunday 9th of August 2020

Hi Emma, the trend is that demographically the level of insurance is less than other developed nations. This provides a possible tailwind for the sector to grow. There are many cross-current though because China is also trying to reform their sector encouraging more investments.

Raymond Chiam

Monday 3rd of August 2020

Bro, be careful about dabbling in investment in China related Co. Recent economics is signalling big trouble in China finance industry. For more info u can Google kyle bass and hear what he said abt China finance. This guy successfully shorted the USA sub prime mortgage crisis so his words are worth listening to. Basically China is running out of cash and has been defaulting like crazy locally. Beware.

Rex

Tuesday 4th of August 2020

Kyle Bass has been trying to short China/HK for years, and his fund has only lost investors money. He is a hedge fund manager with a pessimistic view of China, and he may be right based on his analysis (advocates and detractors from the so-called Chinese property bubble, the tenuous peg of the HK$ to the US$, and the economic miracle of HK post-1997). However, if the market does not listen and he is fighting the State, his investors would be in for a painful experience.

Options play with NYSE:LFC may be a more flexible method to get in and out of the stock.

Kyith

Monday 3rd of August 2020

Hi Raymond, thanks for the heads up.

Rick Fok

Monday 3rd of August 2020

It does sound like a good potential for insurance in China.

I am just curious, can Singapore's insurance agents venture into China to sell some international insurance products.

Or Can China nationals buy Singapore's insurance products??

I am exploring idea of how both countries can benefit from this potential

Kyith

Monday 3rd of August 2020

Hi Rick, I think that is possible. There are local folks buying endowment plans in Hong Kong. Whether they can claim the coverage or not is another thing. So I think it may be possible.