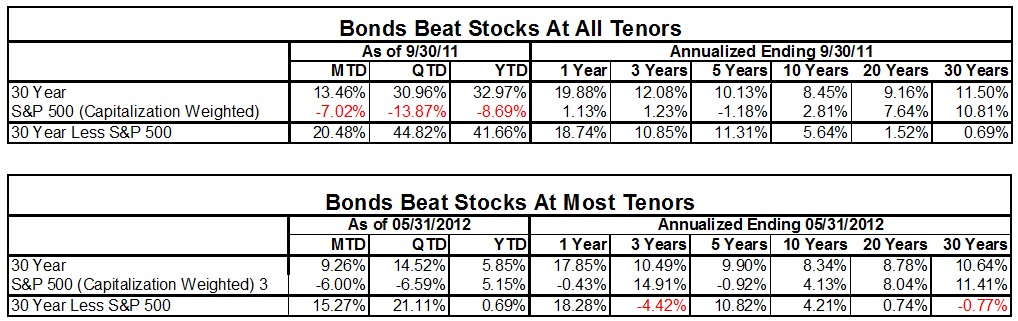

Jeremey Siegel wrote stocks in the long run that stocks outperformed bonds. Looks like we are abit wrong.

[Revisiting stocks for the long run >]

Latest posts by Kyith (see all)

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Anthony Wu

Wednesday 22nd of August 2012

'Preference shares' from OCBC or UOB are actually bonds in different names. They give you 4-5% annually, but you have to pay a 5-7% premium, when buying. 'Bond funds' in the market are mostly rubbish, as far as I can see. Anything else better in the category of 'bonds'?

Drizzt

Friday 24th of August 2012

hi Anthony, i think i wouldn't call bond funds rubbish. to bring you to a time in 2001 and 2002 before the bull run in 2003, bond funds had great returns due to higher yields. the problem is that you cede the decision making to the manager.

then again we lament the problem of not having smaller denomination of debts. i was hoping for a good bond ETF. i think there is only one listed here

Anthony Wu

Tuesday 21st of August 2012

That may be true when you buy bonds in big amounts, such as US$100,000. But as a retail invester, the most accessible is a bond fund, which has always been disappointing in performance. Anybody knows how to handle that?

Drizzt

Tuesday 21st of August 2012

Good point. the fact is that corporate bonds you will get 4-5% yields which is decent and less volatile. But retail investors are usually left with the scrubs like Genting perpetuals