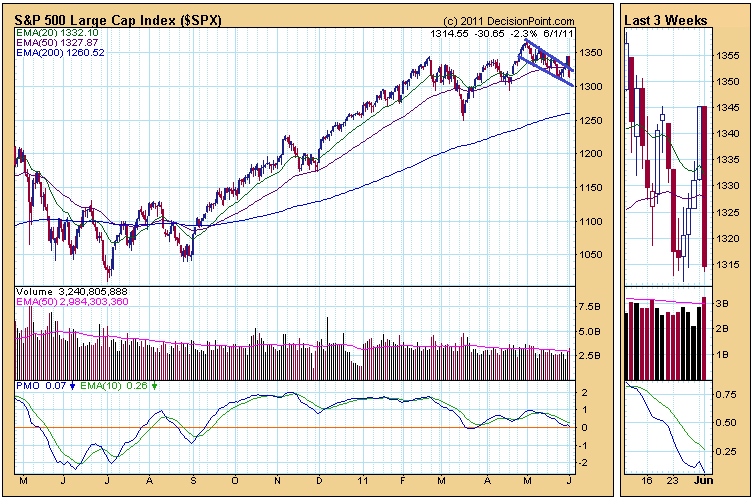

This morning there was a 2.3% drawdown on the S&P 500. For the past month, prices have been drifting lower in a consolidation pattern. The breakout last few days looks bullish. But this was followed by today’s drawdown.

It seems the price action is telling us that perhaps the crowd is not feeling the bullish vibe. I do see that if a breakout fails with such a strong signal, it may likely go strong in the opposite direction. Volume though low was still higher than last few trading days.

Further price action down will see the 20 day EMA cutting the 50 day EMA. Lets see if we will move below 1300.

Latest posts by Kyith (see all)

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024