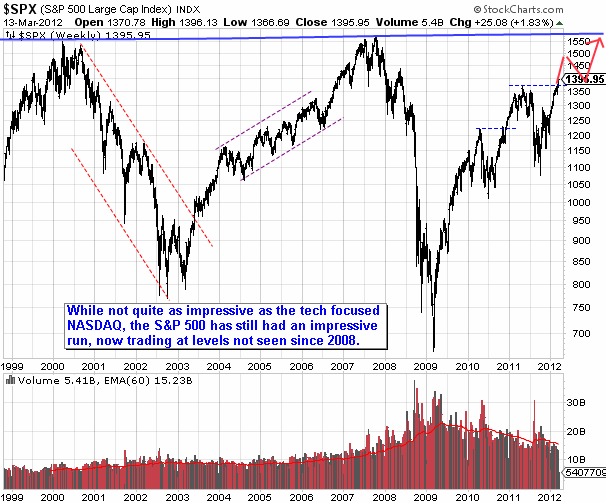

Wow, there is a trading mentality that when a stock breaches its new highs and stays up, it is very bullish because it is in uncharted territory not seen previously. Bulls have won the bears at critical long resistance

We havent seen this level since the dot come days. This is even higher than the highs preceding the GFC.

The S&P500 is not as ridiculous but the way the price moves it seems the momentum is likely to take it past to 1550.

Now I wonder what would happen if it hits 1550 breaks the trend line and heads down?

What would happen if it heads up and stays up? New Paradigm?

Have you gotten ready your investment plans for both scenario?

Latest posts by Kyith (see all)

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Drizzt

Thursday 15th of March 2012

the rally is low volume. but if you take away those light volume moves, ur return would have been -81% versus a hugely positive portfolio

James

Wednesday 14th of March 2012

The rally to 1395 last night was really amazing. Refreshed CNBC a few times after I woke up this morning to make sure I saw the numbers right, and it really was!

STI is still lagging wayyyy behind, not even at 3100... I still believe the Euro crisis (Portugal and Italy) and the Iran nuclear issue will return to haunt the markets in the near term.

Ray

Wednesday 14th of March 2012

The problem is the rally was made with scarily low volume. Lowest since Depression. Investors not convicted yet. I see the support being breached when just one US economic data go below expectation.

Fundamentals

Wednesday 14th of March 2012

Bear in mind that earnings are also higher for most US companies, probably more so that in 2007. If you look at P/E, S&P is only at 14.4x.

No one really knows where the market is headed, but in the long run, as productivity, innovation and inflation increases earnings, there is room for prices to go up.

Drizzt

Thursday 15th of March 2012

Fundamentals, that is pretty positive look on things, and Buffett seems to be more willing to spend now then a few years ago.