I wonder if any of you guys were caught buying on a high in crude oil and silver or gold. The scale of the correction took me by surprise and that says a lot consider we have seen big corrections in the past for gold and silver.

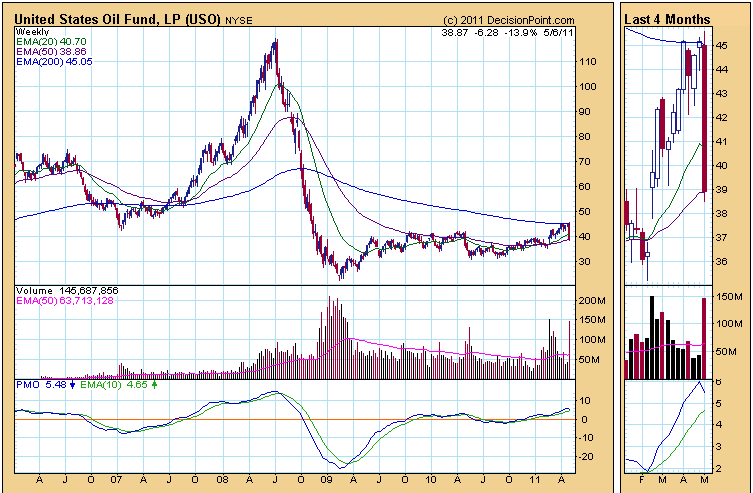

On the weekly chart, USO did not successfully clear $46 or the 200 day EMA resistance on high volume. USO is currently very oversold and could be due for a bounce. however, I do wonder if it will go all the way down to $32 – 33.

The price trend looks to be inching up for a golden cross where the 20 day EMA will cut the 200 day EMA from below. Until then, if you would like to trade, we do suggest to take some profits off at resistance.

Latest posts by Kyith (see all)

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Musicwhiz

Wednesday 11th of May 2011

I was shocked by the scale of the sell-down, especially in Silver.

But knowing the pundits and experts, they will start issuing buy calls again as US$30++ is so much cheaper than the US$50+ heights that silver touched a while back. I guess anchoring is always part of the psychology amongst those who would earn their commissions from the speculation.

And so the band played on.....and the music has yet to stop.

Drizzt

Wednesday 11th of May 2011

hi Musicwhiz, but thinking about it, 30 bucks is cheaper than 100 bucks! if you look at it fundamentally then it is very possible.

the pull back is necessary technicallly.