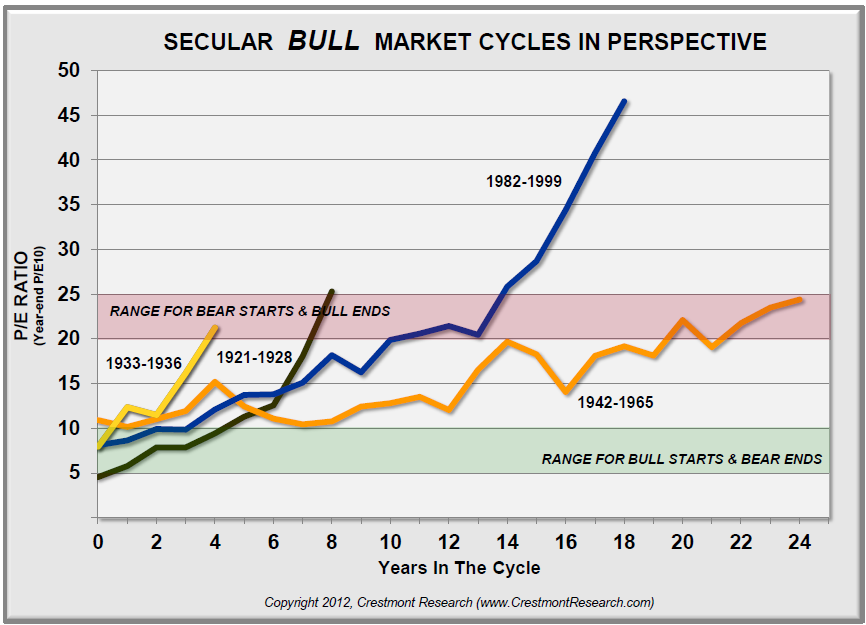

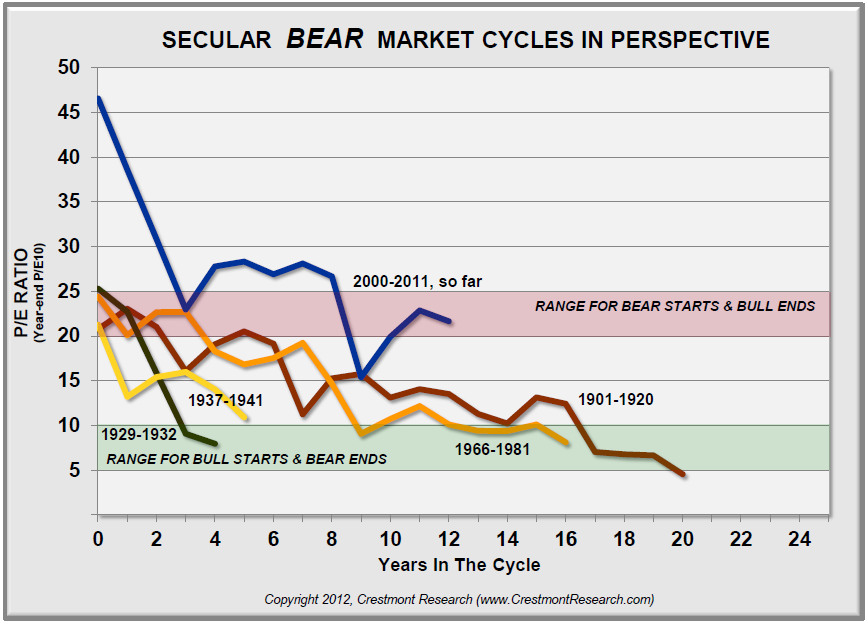

Looks like we are still far off from PE point of view. Almost all PE gets to the 10 region.

It also depends on your how you compute the PE. The PE in 2009 did get down to nearly 12 for S&P 500.

Currently, it looks very close to 1901 to 1920.

These charts are from Crestmont research, and they do have a comment to make of the PE used:

The driver of secular stock market cycles is the inflation rate–toward or away from price stability. That causes significant changes in the level of P/E, the multiplier of earnings that causes above- and below-average return periods. Some analysts do combine the secular periods from the late ‘20s to the early ‘40s, but that masks the fundamentals of underlying cycles. For the ’20s-’40s, the first cycle was a decline into deflation (bear), then the return to price stability (bull), then the upward trend of inflation (bear). Please visit the Crestmont website for more articles and charts. P.S. picksjr, the E & P/E are year-end values using the method popularized by Shiller (Year-end P/E10).

[Hattip Ritholtz]

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Invest Apprentice

Friday 3rd of August 2012

Sorry Drizzt, how do we interpret the graphs? What does it mean to be in the range for "bear starts and bulls end"? Does it suggest we will likely go further down until P/E reaches 10 range?

Invest Apprentice

Friday 3rd of August 2012

Sorry Drizzt, how do we interpret the graphs?