Drizzt: long term market analysis is a series once or twice a month where we take a look at longer term trends in the market to get our bearings right on the general direction of where market prices is going.

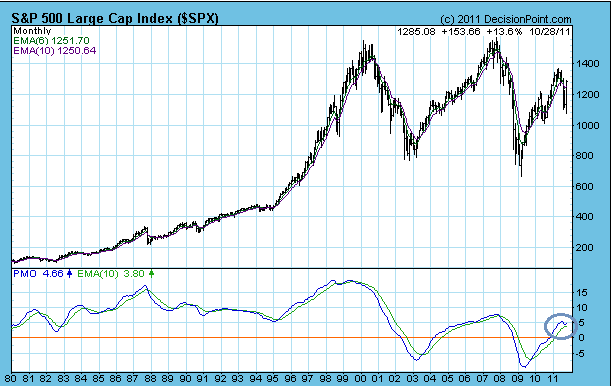

Remember my last analysis that says in the past 20 years we have not seen a point where the PMO cuts the 10 month EMA and then got slingshot upwards? Well we have a massive massive week / month where the market had the biggest monthly run up since 1974.

So where do we go from here?

Monthly S&P500, Hang Seng and STI

At Investment Moats, one of the bull and bear indicators that we use to help us determine a longer term trend is the 10 Month EMA. A cross below the 10 month EMA signifies an overweight position in equities and a cross below signifies an underweight and risk management position.

This massive month have resulted in a 13.6% monthly up move. This against a 7.2% down draft last month. We are near square one. Yet the PMO shows a possible sling shot formation.

We may resume and approach 1500 before facing that same test. It is still a delicate situation because we have not cleared 1380. The bulls will have to take one step at a time.

The problem I am still cautious is that, the place where we own the most stocks, in Asia, have not moved above the purple 10 month EMA. Technically it means we are still in a bearish trend. The PMO have a definite cut for both the Hang Seng And STI.

A caveat is that we can get a very bullish case in US market but Asia could go the other way. Do not discount that.

Weekly S&P500 and STI

The other long term indicator we use is the cross over between the 17 week EMA and the 43 week EMA. A cut of the 17 week EMA below the 43 week EMA from above signifies an underweight and risk management position. A cut of the 17 week EMA above the 43 week EMA from below signifies an overweight position in equities.

The S&P500 market is nearly resuming its bull market mode. This weeks huge move took out so many resistance.

In contrast, the STI still face an overhang at 2950. The bulls need a strong week, stronger than the US market to reverse this trend.

I am still a bit skeptical. This may be a test against the 43 week EMA and 75 week EMA before turning down. The bulls will have to have a strong 2 weeks.

Bullish Seasonality from November to April

What is helping the bulls is that we just exit the traditionally bearish period of May to October. You would probably have done well this year had you stay out during this period.

Why is November to April so bullish? I have no idea. It may only be statistical mining, but Barry Ritholtz this week highlighted this startling data trend from Yale Hirsch research on the degree of seasonality for the past 50 years.

Portfolio Movement

Some of the lessons we learn

- If you lose 50%, you need plus 100% to get you back to the same place. That is what we see in the latest down and up move. We are still back to where we were. But the technical gods will be able to take advantage of this.

- For investors like us, who do not have all the time to monitor or execute trades, at this time being in 100% cash could be suicidal. By the time you notice that the coast is clear, we are back at square one.

- If you are buying good companies that provides a good cash flow, focus on the valuation of the company and whether the business can continue to generate their cash flow. Nibble when you believe the price you pay is less than the valuation of the company. We cannot catch the absolute bottom but if time is on your side, constant purchase below valuation you should do ok.

- Do not confuse the politics of the world with how the investment world reacts. I get so many comments from friends and colleague that nothing was resolved. In 2009, the market rally 100% for one of the biggest rally in stock market history and do you believe anything was resolved? The market is a huge voting machine and mass social psychology creates overbought or undervalued market conditions. Remember that it is not whether you think this contestant is beautiful to win the beauty pageant but what you think every one will vote to win the beauty pageant.

I been nibbling dividend stocks like First REIT, SIA Engineering, Mapletree Logistic Trust, China Merchant Pacific, Ascendas REIT, Vodafone (US Market) and MIIF. These dividend stocks have not really moved up massively. I didn’t get them at a very cheap price as well.

Currently, the dividend portion of my portfolio is 36% of the overall portfolio. That is still pretty low allocation.

- If the market draws down and resumes the down trend, I may cut some of the stocks that I bought irrationally (yes it happens). The first one could be my Keppel Corp bought yesterday.

- If the market draws down minimally, and it plays out that the uptrend does resume, I will build up the dividend stocks mentioned to 50-60%.

- If the market gyrates, continue to find good dividend stocks at good prices and nibble in.

I have to confess I did some buying on Friday. It may come back to haunt me. The rational decision to do this based on the strength of the market. The way the price took out the resistance without looking back coupled with the seasonal effect next 2 months pushed my decision.

Right now, I may have regretted on buying Keppel Corp, Olam and Yangzijiang. These 3 are momentum growth stocks that are consistently watched by the big boys.

I will watch these 3 closely and should I see that I can get them at a better price I will cut them first. My decision to cut Keppel Corp in September and re-entering lower have been good. But it may come back and bite me. You guys can later see if I get burn based on this or not haha.

For those interested in tracking my most current holdings, you can review my portfolio over here. Learn to use our Free Stock Portfolio Tracking Google Spreadsheet to track stock transactions.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

J

Saturday 29th of October 2011

First of all, i like your comprehensive analysis. Personally, i felt that during the period where market is volatile, buy and selling base on big news are better than just purely using technical analysis as it reacts slower due the volatility. But once we are out of the volatility, we can use back the technical and fundamental analysis.

@gregg, I am using this method that somewhat is a bit weird. I determine how much I'm willing to lose. Then from there, i proportion it out by how many percent capital appreciation and the rest dividends. In situation where I'm prepare to lose 20% of what i invested, I make sure that the dividend collected enough to cover so that i can lose up 20%.

It gives you time to juggle the capital stocks to move it to dividends or move out of dividends. :)

Drizzt

Thursday 3rd of November 2011

hi J, thank you for giving your perspective. i don't really like to react on every big news because i really sometimes do not know which news is big enough. all of them seem big for me.

i would rather based my decisions on what the end result which is the price is telling me.

Gregg

Saturday 29th of October 2011

I love your entry price on Sembcorp Industry.....I miss out this boat....:(..

At the beginning of October, i had bought 6lots of First Reit (entry price 0.765 and 0.785) and 1 lot Starhub to enlarge my dividend portfolio which targetting passive income $1000/month by 2020. Now is $500/month, need to double up the investment.

Should I look at capital appreciation by free up cash to buy in those counter that stock price was steep discount after the big sell off in the small bear market such as Noble, Olam, Cosco, Sembcorp industry, Cerebos, Wilmar or even genting sp. But I am not able to time the bottom price, take cosco as example, it went up to >$2.00 and drop to $1.20 which i think is very cheap but end up it become cheaper at $0.80.

hm... capital appreciation or dividend play.. which one is the best!!!??.... Now i am lost direction at the junction.....maybe you can give me some thought.

*Note: by the way, do you get special discount (commission charges) from your broker since you make so many transaction within a month?

Drizzt

Thursday 3rd of November 2011

hi gregg, the saving grace is that in a bear market reits, dividend or growth they eventually go up. its just the magnitude of it. the harder they fall the likely harder their climb. another saving grace is that they almost all pay dividends. its just the magnitude of it.

my advice is not to chase the passive income target fiercely. in the end its about buying fifty cent dollar.should you see a business understand its cash flow know that it will be around for a long time and its below that price then its a better bet then first reit even though sometimes first reit is fair value according to NAV.