Drizzt: long term market analysis is a series once or twice a month where we take a look at longer term trends in the market to get our bearings right on the general direction of where market prices is going.

How are you guys doing on the investing front? Missed out on the January run up? Got a lot of profits? Europe problem is not solved yet? What should we be doing?

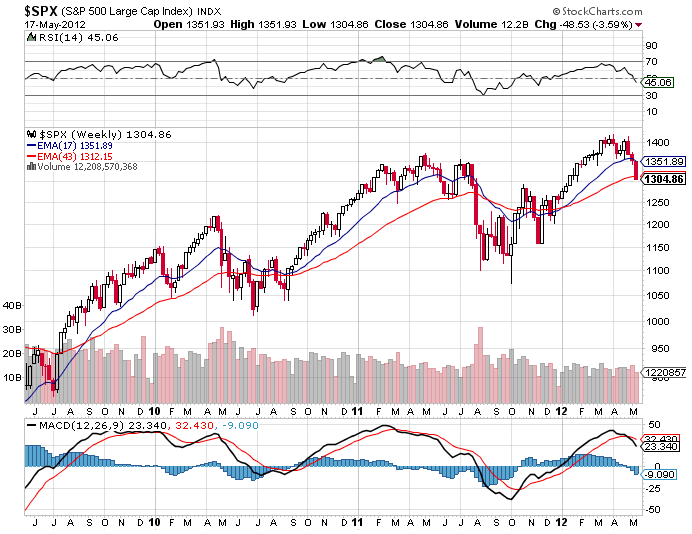

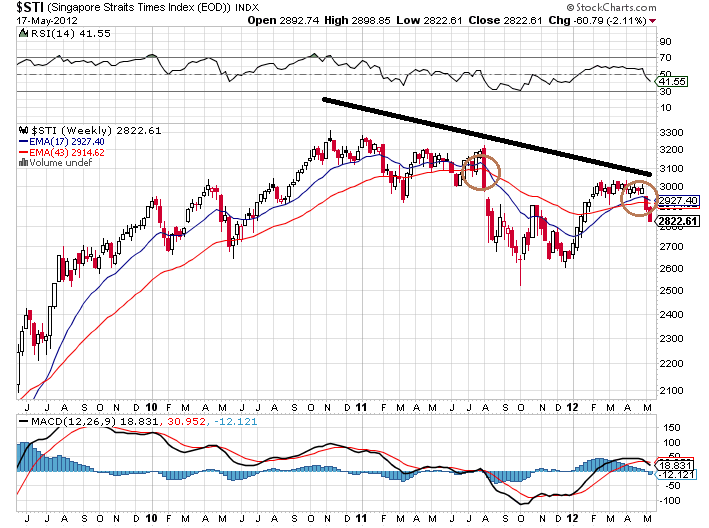

Weekly S&P500 and STI

The long term indicator we use is the cross over between the 17 week EMA and the 43 week EMA. A cut of the 17 week EMA below the 43 week EMA from above signifies an underweight and risk management position. A cut of the 17 week EMA above the 43 week EMA from below signifies an overweight position in equities.

The 17 week EMA and 43 week EMA are still not forming the death cross, but looks to be turning down. MACD is also heading down. The technical picture for the bulls do not look to be broken yet if we look from a 5 years perspective.

And up till this point, the price movement daily looks more like a correction then a full blown draw down.

The STI is more problematic. First it didn’t go above the highs in late 2010, this recent upward move taking it to only 3000. The STI looks to be following whatever is happening on Wallstreet. The 17 week EMA looks to cross the 43 week EMA much earlier than the US market and MACD looks to be going below zero if the next two weeks don’t turn out well.

What should you do?

If you are a trader trading on momentum, this is probably not an in depth analysis to help you see if the momentum are broken.

For the investor, you would have to look at your holdings into whether they are stocks you wish to keep and whether the stocks are cyclical and opportunistic buys.

Don’t ever get confuse which is which to begin with!

For the long term holdings, corrections like these are good to accumulate more. Think about the age you are. If you are 20++ to 40++, you would WANT more of these. This enables you to accumulate stocks you researched well and are good but at prices that offers little safety.

Buy in batches. You do not know how deep is this draw down. The chart gives an indication we may reach 2500, or it may just resume the uptrend.

There were so many folks waiting for a magical number like 2000 or 2200 and it never came to it.

Control your head from running wild. These are the time when investors need to do the right thing instead of losing their psychological capital.

For those cyclical plays and opportunistic buys, you may want to take more money off the table. Understand the nature of the company and historical price movement. If you can collect them lower and they don’t offer much in dividends while you wait for it, pare down.

My recent changes

I haven’t bought much this year. Just very small nibbles but looks like I will get my chance soon.

I have sold off some of the stocks that are more correlated to draw downs like Yangzijiang and Keppel Corp. I wanted to get out of Asia Enterprise Holdings but that is still under evaluation.

Will be keeping the rest. Looking forward to seeing my gains get wiped out and going negative.

For those interested in tracking my most current holdings, you can review my portfolio over here. Learn to use our Free Stock Portfolio Tracking Google Spreadsheet to track stock transactions.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Temperament

Sunday 20th of May 2012

Maybe you are right. It not easy to change a person's psyche. The problem is also it not easy to know which company will really grow bigger and bigger and which company will just survive or even disappear after few Bull/Bear cycles.

Drizzt

Sunday 20th of May 2012

i think that you will not. your brain is already psyche in that safety matters more than dividends. and there is no way dividends is going to make up for it.

i look at things that some things are gain at good valuations and they will grow with time by increasing payouts.

temperament

Sunday 20th of May 2012

The problem with me is i tend to offload all. i started with NOL, KEPPEL CORP, SEMB CORP.... Remember, i say i am a BULL/BEAR trader. Maybe i will learn to keep back some balance of "Blue Chips" that pay a steady dividends throughout the years. Hmm...

Drizzt

Saturday 19th of May 2012

actually u may not need to move around if u watch a few highly traded stocks like kepcorp, sembcorp that are fundamentally strong and they move in channels. ur game plan needs to get right, that will enable u to sit on and see when to sell. i find being sure and building up a substantial portion to be much harder.

perhaps doing stocks that are sturdy with good dividends make sense to earn when they are down yet u are able to offload some like uncle cw.

temperament

Saturday 19th of May 2012

Hmm.... What you said is very good but the problem is must react very fast or even before fundamentals change. A bit of what you said look or sound familiar or some similarity to even a BULL/BEAR cycle trader like me. After all, from time to time we must move some of our money around to better our prospect.