S&P 500

Wow we got a great week that bargain hunters must be feeling great with their purchase last week.

The good

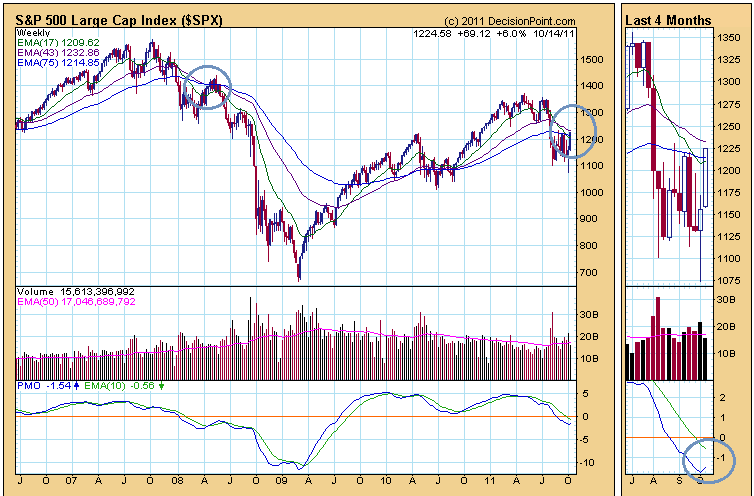

For the longer term investors, are we out of the woods yet? I find that currently, we can be in the same situation at May 2008. The Market made a strong push up from March to May before heading down what was to be the worst of the drawdown.

Based on the weekly moving averages, the 17 Week EMA looks ticking up. A strong month from now could see the 17 Week EMA cross over the 43 Week EMA. A strong push like this could see us continue the trend up higher.

A reversal of the PMO above 0 and the consolidation of the moving average could be very very bullish and lucrative

The bad

However, our lesson from May 2008 shows that this could turn down as well. With bad price sentiments next week we may have a similar situation should the crowd knows that things are not working.

It is likely that Europe and Earnings announcement could dictate the crowd’s voting.

Next Week we have the following earnings announcements:

- Monday: Citigroup

- Tuesday: Bank of America, Coca Cola, EMC, Apple

- Wednesday: Morgan Stanley, US Bancorp, American Express

- Thursday: Nucor, Philip Morris, Microsoft

- Friday: Honeywell

A good earnings profile should vindicate that the market is disconnecting from what the economy is feeling

Portfolio Update and Opinions

Currently I am, 30% invested, 4% hedged (going very bad). This week’s trades are more like “I DON’T WANT TO MISS OUT ON THIS MARKET TURN!” trade.

I really will not advise being 100% out of the market at most points because technical and market analysis can go pretty wrong.

If you missed out on the best 10 days where the market makes 20% and the rest of the month it just goes sideways, that is pretty bad for your portfolio.

What I would do is scale 20% up from here on should next 2 weeks show strength. This will bring investments to 50%, cash to 50%.

Should the market ends weak, this 0%-20% can be withdrawn with small losses and I will be back to 30%.

Currently most of the stocks owned pays a good dividend and are at a valuation that I believe are not expensive.

I would want to keep Keppel Corp, Starhub, Singtel, MIIF, CMPacific, Sembcorp Industries at my purchase price.

I would collect Keppel Corp, Sembcorp Industries, MIIF, CMPacific, CDLHT, First REIT and some other yield stocks at lower prices.

If prices do not go lower and should the market looks to stay up I would divide my cash among STI ETF and some of the yield stocks providing 6-7% yields.

For those interested in tracking my most current holdings, you can review my portfolio over here. Learn to use our Free Stock Portfolio Tracking Google Spreadsheet to track stock transactions.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

VL

Sunday 16th of October 2011

Hi, would you be sharing stock list to look out for for Singapore stocks? Sorry i don't know where to post this question, so I just post it here. Thanks. VL

Drizzt

Friday 21st of October 2011

Hi VL,

I don't have a list but the stable stocks have not come down at all. Among this is First REIT, Singtel, Starhub, Plife REIT, VICOM.

The other stocks that i would add on at lower prices are Keppel Corp, Ascendas reit, Sembcorp industries, OCBC