In deep corrections like this, investors are more worried about protecting their capital. My portfolio cannot take a 50% draw down. Should I get out of the market?

Things like this run through your head.

Managing your head

How long does an average bear last? Can be from 6 short months to 2 years based on recent historical.

If you are young, you would want to see more draw downs.

Don’t you want to buy SingPost at 80 cents? Starhub at $2.00? KepCorp at $4.00?

It’s a dilemma when things are dear and you are afraid if you buy it, there is no margin of safety there.

So why don’t you want to pull your money out totally? If you have a knack for market timing then by all means do it. But if these are just noises and the market goes back up, you probably forced to buy back at a higher price.

Just like my previous post, know the nature of your investments, whether they are cyclical and the valuation you got them at, if you feel sad seeing profit go to waste, establish a few profit taking targets such as break in trends, a minimum %.

The WORST thing that can happen in such scenario is LOSE YOUR PSYCHOLOGICAL CAPITAL.

Now is a good time to see how risk adverse you are.

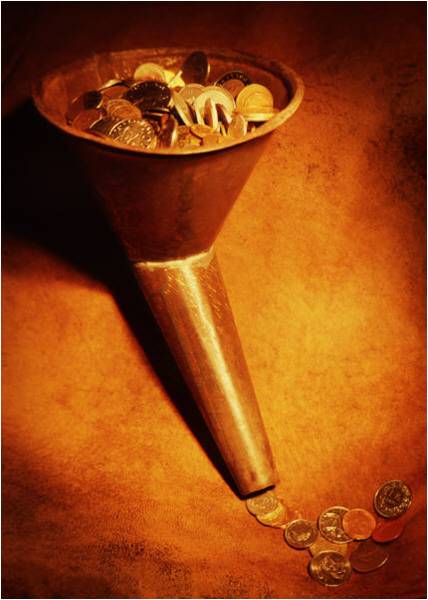

Capital Injections are important

What is important, is sound budgeting and establishing “Pay yourself first”.

Visualize where your portfolio will be in 10 years time. How much you will add to it. What kind of average portfolio yield you are looking for.

I have a useful Dividend Portfolio Projection spreadsheet that you can make a copy of to help you visualize. [Spreadsheet here]

My take is that many young folks have probably started building up their portfolio.

The size of it can range from 20k to 40k.

And if your portfolio is small, 2 years of 12k per annum contribution will add 24k to your portfolio at a LOW price.

To get started with dividend investing, start by bookmarkingmy Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

abc

Monday 21st of May 2012

Bear can last very long - see how long STI took to recover from Asian financial crisis. I suspect if Euro implodes, it might take that long for Europe (but not sure if it will also be same for Asian region).

Agree with previous comment to accumulate cash to buy when valuation is right (which likely is later and not now when Europe gets worse?) but sometimes, political leaders manage to scrape through at the last minute (usually when the impending disaster needs no explanation to their citizens and they can then do the necessary). Hence, may be good to invest from now when things are getting cheaper in case may not much go further down, but perhaps also set up stop loss to get out if things dive down quickly so as to free up cash to buy cheaper.

Drizzt

Monday 21st of May 2012

hi abc, if u count 1997, we are probably 15 years into a secular singapore bear. thats a bloody long time where prices don't resume up. in US if it starts in 2000, we are 12 years in. a typical secular bear last like 15-20 years. http://www.ritholtz.com/blog/2011/11/4-major-secular-bear-markets-1900-2011/

what ritholtz notes is that most secular bears are most vicious at the middle. question is whether we are in the middle.

i want to bring something onto the table. i have friends waiting for OCBC at $4. i asked him if it never comes what happens. he say he will continue to wait. how many investors wait for the absolute best prices or anchor to history? what would you do?

why i say be invested always is because like what abc says, the market is complex and in a secular bear the end of it can be higher throughs. should we be at the prelude of a major secular bull.....

Createwealth8888

Monday 21st of May 2012

There are bear stocks that remain low for decades and still remain low till the long-term investors left Planet Earth.

Jared Seah

Monday 21st of May 2012

Drizzt,

I like your this statement:

"If you are young, you would want to see more draw downs."

Just like if you are getting married and wants to buy a home soon, you would like to see a property crash in Singapore!

Investing has to be aligned with the life cycle we are in.

People who are planning to retire soon will have a different opinion from you and me ;)

My biggest fear is if we have a 20 years bear market like the Nikkei. Or like the Nasdaq which is still a long way from it's all time high 10 years ago...

How long a bear market lasts may depend at what prices we have bought ;)

Drizzt

Monday 21st of May 2012

hi Jared, you know thats what i have been debating hard about secular bear markets. i did simulations to see if u had a large sum and if you buy at a high and prices fall 50%, you add on to it and reinvest dividends what will happen. now simulations are estimates at best, but i like what i see.

in the end it boils down to your knowledge on valuing things, buying good stuff at good or bargain prices. you will have a better idea when the whole market are expensive. earnings do not follow.

So if we are in a 20 years bear market like nikkei, how would you propose we invest? Essentially, it is mentioned by top hedge fund manager that this european problem will muddle for 15 years using a combination of austerity, printing money to create deflation and inflation. how do we do in this scenario? stay out of the market for 15 years?

Musicwhiz

Monday 21st of May 2012

I think the amount one puts into their portfolio cannot be measured according to $XX annually. This is because as investors, we have to ensure there is sufficient margin of safety before we invest, and Mr. Market does not throw up bargains all the time.

A more realistic method (which I personally adopt) is to stash up cash and wait for a good opportunity, rather than allocate say $XX per annum.

So let's say for example I intend to save $40,000 a year, perhaps $30,000 out of this can be "reserved" for investments when valuations become attractive. The remainder serves as buffer for a long downturn, but can also be drawndown should valuations become extremely attractive.

The important thing is not to feel constrained - having cash on hand gives you flexibility on how to deploy it; even though in the interim it earns a lousy return....

Drizzt

Monday 21st of May 2012

hi Musicwhiz, i think when i say each year you have 12k or 24k addition to it, it is you have investable cash. ultimately it is finding attractively priced things to put your money to work. for the past 5 months, i haven't put much of it to work because i realise most of the yielding stocks have run up alot yet the earnings and dividends are not following them. u accumulate until times like this.

to be honest, price still looks rich versus last years

Temperament

Sunday 20th of May 2012

The best is money for investment in the stock market is for the market only . In this way you can choose when to buy or sell. So ironically you don't have to time your cash flow for investment. Talk about timing the market huh?