Readers would note that although a lot of the research and commentaries on this site is fundamental based, there is an element of behavioral commentaries as well.

I believe behavioral and technical analysis or information is required as well because, at the end of the day the market is made up of people, groups carrying out demand and supply.

What determines price of certain companies is not just valuation but the herd’s valuation.

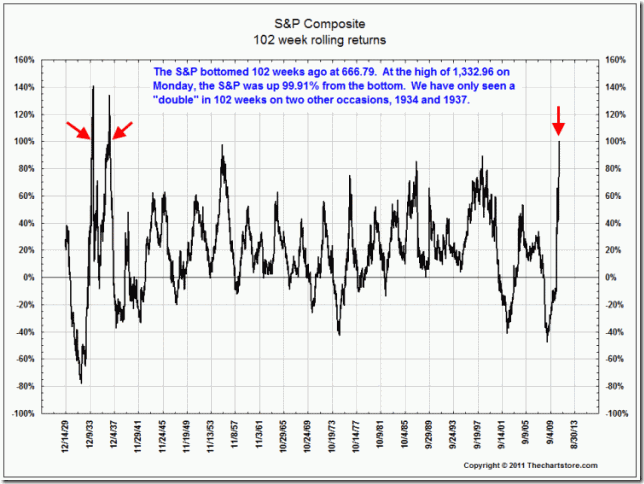

We have had good run since putting in the bottom at 666 in April ‘09. Barry Ritholtz highlighted the Chart Store’s S&P Composite 102 Week Rolling Returns here.

The commentary pretty much explains it. In a follow up, Ritholtz provided another data set which shows subsequent returns from these 102 returns greater than 100%

You would notice that most of the returns are pretty abysmal. As noted by a reader on his site, these data might not prove much as we could probably include those % change from 90% to 100% in to see if its as abysmal.

But for investors I would think it is a good caution to be vigilant about this rally.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024