[Hat Tip Ritholtz.com]

So what is the CAPE? From money terms site, here is a good explanation:

The cyclically adjusted PE ratio (CAPE) is a modification of the PE ratio to account for the effect on profits of the economic cycle.

The PE ratio calculated at any point in time is affected by the current state of the economy. This effect is, of course, particularly strong in the case of cyclical shares.

The simplest, and most widely used approach is to use a simple average of annual EPS over a long period, usually ten years. It is also common practice to adjust the EPS into real terms, essentially making this a long term PE corrected for inflation. Only the EPS needs adjustment, not the price.

The cyclically adjusted PE often compared over several years to look at historical trends and, especially, to identify the level it would go to if it reverts to mean. When doing this each year’s number is calculated using the previous ten years, so the end result is a moving average.

The cyclically adjusted PE is most commonly used as a measure of the level of markets. The expectation is that it will revert to mean, so the current level is a good indication of whether markets are over-valued or under-valued. This use of CAPE is similar to how Tobin’s q is used. They can be used in conjunction to see whether they both provide the same signal: they tend to do so, and graphs of the two are often very similar.

Unlike q, cyclically adjusted PE is also useful as a valuation ratio at the level of particular shares. In this context, it is just the long term PE, possibly adjusted for inflation. It would not be usual to look for mean reversion in this contest, and it is used in much the same way as other variants of the PE ratio.

It looks a pretty well adjusted PE ratio that doesn’t just take the latest country earnings figures.

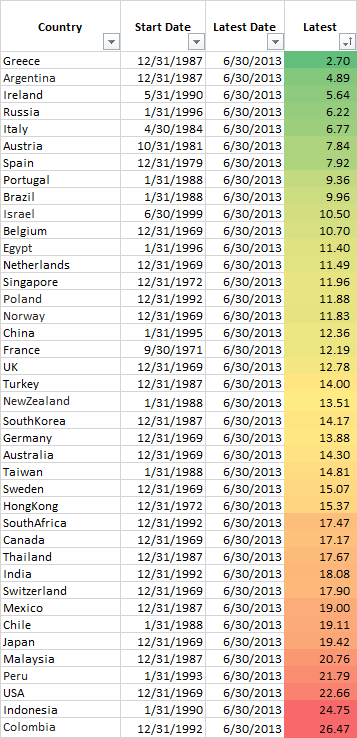

In this case Singapore looks pretty good!

Indonesia, Thailand and Malaysia on a tear versus historical and perhaps that is why they look much more expensive than Singapore.

But from this it does seem to bold well for the country.

My thoughts are that if Singapore remains a big export nation and continues to export to USA, with the strengthening of the USD, the manufacturers may do better.

That is, if manufacturing is still an important Singapore engine.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Ser Jing

Saturday 6th of July 2013

CAPE's actually a slight modification of Ben Graham's use of a rolling-10-year-average-earnings to calculate his PE ratios. Graham didn't adjust for inflation (I think), but Robert Shiller did adjust earnings for inflation, thereby coming up with CAPE.

Some opponents of CAPE state that the shorter business cycles on average now - about 5 years - makes CAPE a moot point because it was meant to smooth out business cycles which apparently, was longer in the past.

Cheers, Ser Jing

Kyith

Saturday 6th of July 2013

thanks for the insight. still i feel that way the E is still backward looking and we are suppose to estimate forwards where the earnings may be shifting in a different direction.

my take is PE valuation seems to be very backward looking unless you can accurately forecase a country forward GDP well