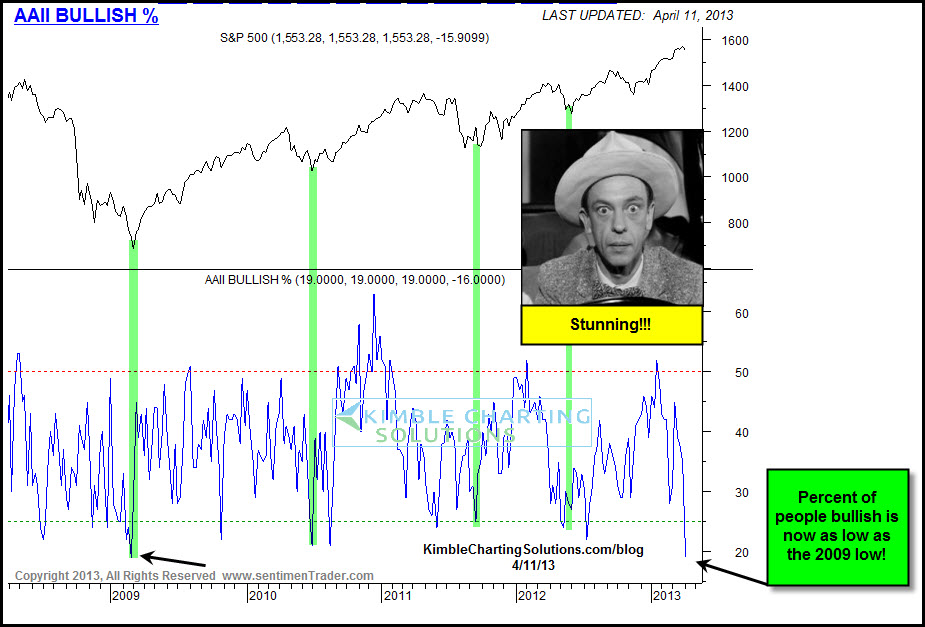

The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months; individuals are polled from the ranks of the AAII membership on a weekly basis. Only one vote per member is accepted in each weekly voting period.

Some how or rather this data makes me wonder if the survey is skewed because a few people are managing a larger portion of the money. they may be bullish while more are bearish.

Definitely not something to use to make a decision upon, considering the sentiments did reach a rather overly bearish proportion in 2008. Still its fascinating.

I think the take away is the market for the next 6 months. So its not like people are factoring a 10-20% correction and ending up higher.

People are thinking it will end up lower.

HatTip | The Reformed Broker | Read here

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024