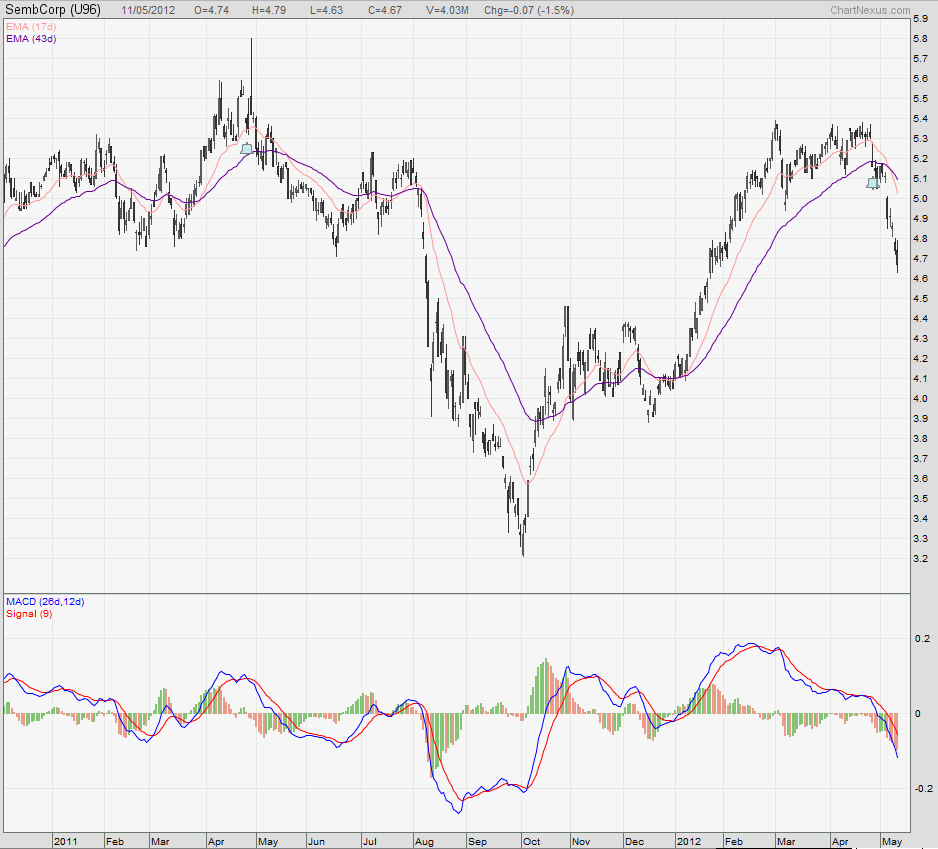

If there are some blue chip stocks that I would snap up in a further draw down, Sembcorp Industries (SCI) would be one of them.

For a bit of its total return history you can view it here.

Sembcorp is undergoing some sort of mini transformation. It owns 60% of SGX listed Sembcorp Marine (SMM), which builds oil rigs and drill ships. This have become its main profit generator and made it a darling among speculator.

In recent years, Sembcorp have aggressively try to build up its utilities portfolio. What happens is that SMM generates the cash flow, pays out the dividend to SCI, SCI leverages on this to build and develop utilities around the world.

Utilities are probably more recurring in cash flow, and perhaps they are preparing for the inevitable when the oil rig craze die down.

The recent 2 quarters have evidently show the cash flow from the utilities coming in. So much so that its full year utilities profit should be able to pay for its existing dividend. The dividend payout ratio is around 30%.

That is rather good. And probably more utilities coming online.

Debt wise we know that that SMM is net cash, this utilities assets is estimated to amount to 3.3 bil and their net debt is 1.1 bil. This make their debt to asset ratio of 33%. This is much lower than many utility and infrastructure plays such as MIIF, SP Ausnet and Cityspring on my dividend stock tracker which typically hovers around 50-60%.

Its trading at a PE of 10 times. really undemanding for a blue chip. Although the dividend yield is low, we view SCI as a growth stock, which will give the odd special dividend.

The upside of this switch to utilities, is that in the future, these utilities may be spin off into infrastructure or utility trusts, which SCI will further stand to benefit from.

Do a bit of homework into this to see if you agree with me.

I have added SCI to my dividend stock tracker as well, so you guys can tune in daily to its change in valuation and yield.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

john furlong

Wednesday 6th of January 2016

the only cloud on the horizon would be if semcorp industries gave substantial guarantees for the 60pc owned marine company

Kyith

Wednesday 6th of January 2016

hi John, SCI is in a difficult situation. The story have changed a fair amount. the problem is that its utilities division is not matured yet to show that there is at least some value in SCI. how can they guaranteed the marine division?

Juan

Tuesday 19th of March 2013

Bought at $5.51 around oct 12. Will it ever get back at that level? Juan

Kyith

Tuesday 19th of March 2013

Hi Juan, thats rather high, but look at the business, if earnings sustain one day it will climb back there. the chances of growth are much higher than that of sph.

Eileen

Monday 14th of May 2012

What othr blues are you keeping your eyes on? How about Keppel Corp whose price keeps dropping ?

Keen

Drizzt

Monday 21st of May 2012

hi Eileen, many kepcorp is one but i favor Sembcorp industries, dairy farm, and the telcos

Drizzt

Monday 14th of May 2012

hi B not sure if you are trading but that is still a good gain. for me i would hope to see expanding earnings.

hi james that is a good level. we have to see how drastic is the sentiment. don't watch the news behind it, watch the reaction to it.

James

Monday 14th of May 2012

I'm targetting the 4.46 support level. See if it gets near there :D