(Click to see larger pic)

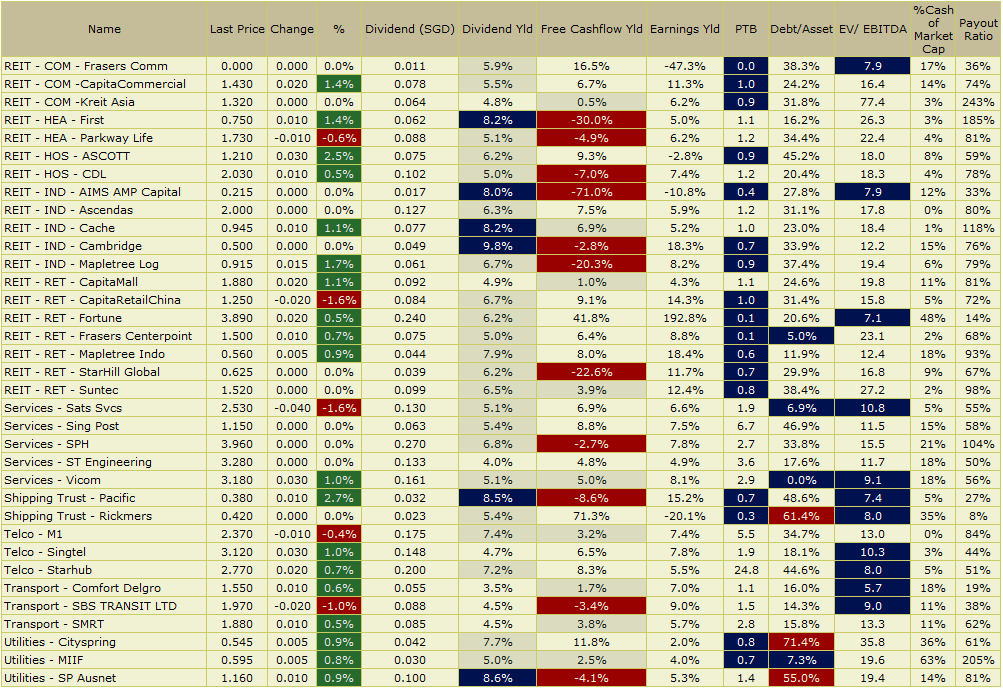

We updated our Dividend Stock Tracker this weekend. To understand more about our dividend stock tracker read this article.

The primary updates are the data in the balance sheets.

We also decide to bring forth net debts to assets to the table. This is because evaluating whether a stock is over leverage is quite important.

We decide also to provide more acute indication as to whether a stock have relatively high yield and whether a stock is paying more than it’s free cash flow yield. A good dividend stock will pay out from it’s free cash flow and not always rely on cash holdings or raise debts.

A caveat that I always make about our stock tracker is that fundamental data is based on annual / quarterly updates so announcements and adjustments made 5 days ago will not be reflected as we will not have the adjusted information.

A good example here is why First REIT has a –30% FCF yield. They just made big acquisitions which will come online at FY2011 annual report so it will not be reflected currently.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

James Tan

Wednesday 24th of August 2011

HI Drizzt,

very impressive website and i hav learnt a lot from you. i was used to invest on unit trust only, so a total newbie in regard to stock. could you enlighten me where to get those fundamental data (preferably free, possible?) beside looking into the annual report of each individual company? thanks a lot!

gregg

Saturday 7th of May 2011

HI Drizzt,

Is SATS good enough to include in our portfolio? I just feel that those service company, yearly revenue is tied to 'service contract' that given to them, share price will dive down sharply if they lost any service contract,eg: Changi Airport......

Frankly speaking, current price $2.56 looks very attractive...

Drizzt

Sunday 8th of May 2011

the chance of losing those are low. but when they lose it, the impact is high.

at 2.56 the yield is only around 5.5%. is that worth the risk?

Jared Seah

Thursday 28th of April 2011

I am vested into the Telecoms and Utilities for income and hard commodities for "growth". Went 1/4 cash since Dec 2010 (took some money off the table).

I am now in the tortoise defensive mode. And I belong to the inflation scare camp.

Lower yields are OK for me since Telecoms and Utilities have stronger pricing power in inflationary environment.

Would Iphone and Ipad fanatics give them up if Telcos raise charges by 10%? I am using you as indicator! LOL!

Drizzt

Thursday 28th of April 2011

hi jared, i am of inflationary camp. but i missed out on starhub as i sold some of them. regretted it. but i believe at certain pt there is deflation. they are join together.

if telco raise 10% my purchasing power need to raise as well. it is a utility to me so there is only so much iwill pay. once you get used to data lifestyle it is hard to turn back.u would realise yourhp subscription neverwentdown.

on utilities, i realise there are no good utilities around. which one are you vested in?

Jared Seah

Wednesday 27th of April 2011

I own 2 stocks in your tracker ;)

But you are right, I do continuously explore other stocks and use your "template" to evaluate them.

By the way, I also use your tracker as a top down sector analysis tool. I benchmark utilities versus telecomes versus reits versus shipping trusts, etc.

I am macro top down growth and income speculator. Not a "true blue" dividend player.

You are very pereceptive!

Drizzt

Thursday 28th of April 2011

Jared, sectors do rotate, and each have their own characteristics.

My tracker currently shows that, Telecoms and Services are very stable in Free Cashflow but their yield do not measure up to REITs. REITs on the other hand have higher yields but higher debts.

What is your favor haha

Jared Seah

Tuesday 26th of April 2011

Hi Drizzt,

Thanks again for the update and continuous improvement in your Dividend Stock Tracker. It's very useful template for me to evaluate which "stock horse" to ride.

Drizzt

Wednesday 27th of April 2011

Hi Jared, no probs, but probably not the kind of stock you are looking for haha.