Every year, this time of the year, I would share with everyone my spending.

This year, we will be carrying on the tradition as well.

Spending is a way we allocate our resources. We have certain leeway what we decide to spend on. Some are wiser spenders than others. If you speak with some, they have an issue controlling their spending.

Is tracking your spending (like me) important? Tracking your spending feels like a lot of work, but here is something to think about.

We have enough prospects who came in, tell us their income and expenses, and were shocked that their expenses add up to such a huge amount.

The number came as a shock because there are some things that, if you don’t put the number on a piece of paper, you might not realize they add up to such an amount.

Tracking spending is not an OCD behavior. It gives you a certain level financial clarity. If you gain insight on how your general spending amount is, you could always stop.

Now let us talk about my 2020 expenses.

How Much Did I Spend the Past Few Years

I wrote about how much I spent every year for the past 6 years.

If you are interested in how the spending evolve, you can read them here:

- 2014: $23,798/yr – A review of my past year’s expenses

- 2015: $22,150/yr – How our family’s $22,150 annual expenses mean for our financial security and financial independence

- 2016: $26,238/yr – My Annual Expense Report – $26,238/yr and its link to Financial Security and Independence

- 2017: $21,723/yr – Annual Expense Report 2017 – $21,723

- 2018: $19,655/yr – Annual Expenses and Financial Security Musings

- 2019: $23,186/yr – Spending Report for the Year

In the first 3.5 years, the expenses were made up of spending for 3 adults. For the next 3.5 years (including this year), the expenses were spent for 2 adults.

Review of my 2020 Expenses

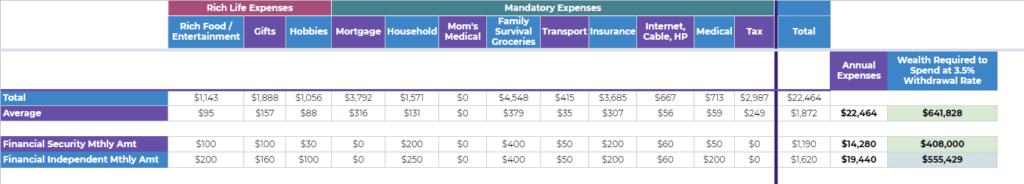

The following table shows a break down of my spending in 2020:

The annual spending comes up to $22,464.

This amount is the 4th highest in the past 7 years. On average, the spending is $1,872 a month. However, you would observe under Total, that the spending varies from month to month.

January will be the month with more gifts due to Lunar Chinese New Year, October is also higher due to a lump sum annual insurance premium.

Here are some of the notable differences compared to the expenses last year:

- Rich food/entertainment was lesser (1.1k vs 1.5k last year) due to COVID-19. Less meetup means less spending on food

- Gifts were higher (2.4k vs 1.9k) because I gave slightly more to charity

- Hobbies were higher ($1k vs $0.27k) than last year because I spend on more frivolous things

- Household spending was less because of the things that broke down costs less (more on that later)

- Transport was 50% lower because of COVID-19

- Handphone and Cable was lower due to a change to cheaper cell phone plans

- Food cost was much higher (4.5k vs 4k) because of food inflation

- Taxes were higher due to more income

- Medical was the same

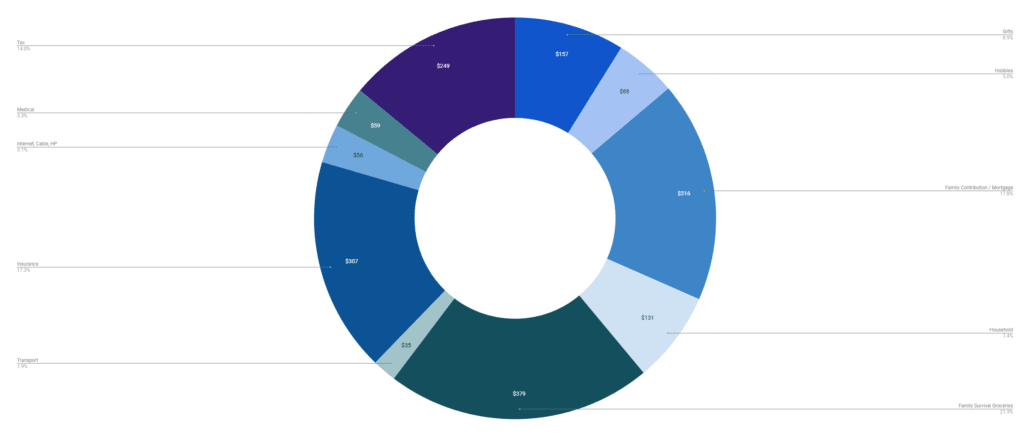

In this pie chart, you will be able to see which are the high impact expenses:

The bigger spending categories tend to be food, taxes, insurance, mortgage, and gifts.

Food

One area that I see very clear signs of inflation is the perishable vegetables. The lock down in Malaysia definitely affected the price of the food.

Because we purchase our vegetables from the wet market, we realize that despite us eating less, our groceries spending trends higher and higher.

The Relationship of My Spending and Financial Independence

Every year, I will relate my spending review and my financial security and independence goals. (More on how much is required to be financially independent here)

There is a close relationship between how much you need to spend and how close you can get towards financial independence.

If you can spend only $10,000 a year and have accumulated $500,000 in a broad-based, diversified portfolio, you may have a certain level of financial security.

However, if you have accumulated $2 million but you require $200,000 a year in spending, then you might have some form of financial security but not a very secure financial independence.

Under Total, I have summarized my annual spending for each category. Under Average, I have divide the annual spending by 12.

I divide this annual expense of $22,464 by 3.5% to get $641,828.

This is the amount that I need to accumulate so that I can successful spend #22,464 on the first year and reliably have an inflation-adjusted income stream for roughly 30-50 years.

This is based upon a 3.5% Safe Withdrawal Rate. I tend to find 3.5% to be a good initial withdrawal rate for you to aim for. It does not always give you an ultra-secure confirm plus chop income stream but it is a pretty good place for me to aim towards. (if you want to ensure you have that ultra-secure confirm plus chop income stream, use a lower withdrawal rate. You wlll need more money but your plan is safer, but you will also need to spend a longer time to accumulate that additional amount.)

Below those two lines I have worked out two seperate set of spending. These are titled Financial Security Mthly Amt and Financial Independence Mthly Amt.

I would imagine that if my life is like ____________________________ , how would my spending looked like?

Financial Security is a spending state where if I struggled to find a decent job, and I have to go into siege mode, how I would spend. There will be some things I would readily cut down and there will be some things that I had to pay and could not cut down.

Financial Independence is the spending state based on how I would live if I choose not to work anymore.

The annual amount is $14,280/yr and $19,440/yr respectively. If I apply the same 3.5% initial withdrawal rate, I would come up to the amount that I have to save. That would be $408k and $555k respectively.

Almost half a million sounds like manageable amount to accumulate to. Yet, there may be naysayers who would question how many can live on this kind of meagre lifestyle.

If you think this is not so safe, perhaps instead of 3.5%, use 3.0%. If you feel not safe enough, go down to 2.5%. If you feel $20,000 a year does not fit your spending plan, go up to $50,000 or $200,000 a year.

You need more, you save more.

In every year’s article, I try to touch on different aspect of my spending. This year, I touched on some of the notable spending for fun and on the household.

I Bought A Lot of Fun Stuff That Individually Do Not Cost A Lot

Some of our hobbies can be fun but cost a lot.

My finances are quite good because the majority of the stuff that I spent on don’t cost a bomb.

Here are the things I bought for fun this year:

- Credit Report 2019 – $6.42 (Probably for the company)

- Redmi Note 8: $235

- Elastic Mobile Phoe Wallet Credit ID Card Holder: $1.54

- Cover for the Redmi: $2.86

- Outemu Mechanical Keyboard Switches: $12.46 (that turned out to be useless as I cannot plug the existing switches out of the keyboard!)

- Wired Mouse: $10

- Oneodio Studio Pro DJ Headphone Over-Ear: $45 (Thanks to Bully the Bear for the great recommendation!)

- Earphone: $2.67 (because it is always good to have some earphone lying around due to so much Zoom and Teams call)

- GSM10 Laptop Battery 4 cells 51 Watt/hour: $56.24 (laptop battery nearly blew up. Got this from Shopee. )

- Microphone: $2.70 (useless. Cannot use)

- Kingston 8GB RAM for Dell Laptop from Shopee: $52

- HDMI to DVI Cable: $15

- 2 x 24-inch monitors from my friend’s company sale: $40 (too bad one spoil!)

- Arctic Cooling MX-4 Thermal Compound Paste to replace dried up CPU cooling compound. From Shopee: $8.40

- Lenovo Trackpoint Replacement x 10: $1.50 (doesn’t fit! useless!)

- Red Amaranth Seeds to grow: $2.50 (doesn’t grow!)

- Logitech K380 Bluetooth Keyboard: $54 (one of the best purchases this year)

- Cover for the Logitech keyboard: $3.88

- Prism 27-inch QHD Monitor from Lazada: $323

- TronSmart Bluetooth Speaker: $66 (good purchase)

- Bluetooth 4.0 dongle: $2.45 (to connect the Bluetooth keyboard to for a computer without Bluetooth capability)

- Lenovo E14 Silicone Keyboard Cover: $4.00

- Cover for the Logitech keyboard: $6.90 (because this look funkier)

- Portable Lamp: $13 (not bright enough)

For some reason, Covid-19 make it quite acceptable to buy something so that you will experience the anticipatory joy of

- When the parcel will come

- Whether the thing will meet your expectation

At least, this is what I felt.

Majority of the purchases were made from either Shopee or Aliexpress. I think it is just so convenient to grab and go with this kind of stuff.

What I Spend on Household Expenses

Every year, there will be something that needs replacing.

If you are planning for your financial independence, I think it will be good to smooth out a fix sum to replace things. This is more important now because majority of the electronic items do not last a long time.

So you would need to replace them more.

This year the household expenses were better because for some reason I did not pay much electricity or utilities bill. Not sure if it is because of COVID-19.

The major appliance that broke down was our Samsung vaccum cleaner that I picked up from a neighbour. The tube was spoiled so I use a masking tape to tape over the slit.

Apparently this vacuum lasted me like 4 years.

The whole world was asking me to buy those robots that run around the home (I heard a few accounts that say it is not very clean when compared to an E-monkey like Kyith). Some were telling me to buy those Dyson or Dyson lookalike handheld vacuum (I don’t trust that the battery would last a long time).

I ended up with a Europace Vacuum that cost me $88.95. I had contemplated getting a second-hand vacuum but in the end, decided against it.

Cheap vacuum like this has it’s own issue in that the small wheels of the broom broke after like 2 months. So I went on Shopee to buy a replacement Brush head for $7.45.

I quite confirm this would be the one thing that readers would be telling me: “Kyith, you have $XX, XXX in residual income and a job that pays $YY, YYY, can you please go buy a more decent vacuum cleaner!”

I also decide to buy a Xiaomi Enchen Hair Clipper for $13.59 so that I can routinely shave my hair off. This is not too bad.

I bought a second-hand Tefal Steamer for $28 so that I can steam vegetables for breakfast. This saved my dad a ton of time instead of stir-frying the vegetables.

In December, I tried to start up the traditional oven that I have not used since Mom passed away in 2017. Like a lot of appliances, if you don’t use it for sometime, they tend to die on you.

I will probably think of whether I would replace that.

In November, the light in our master bedroom and my room suddenly went off. I have no idea why the lights of two rooms will suddenly go funky. So we paid $50 for my dad’s old acquaintance to take a look.

Turns out Kyith didn’t wire a LED light replacement in another room tight enough and it was enough to cause such abnormal behaviour. I was quite thankful because it could be grave enough to cause a fire.

I bought a 10-inch Android Teclast Tablet for my Dad to watch YouTube. That cost me $240.

What is In Store for Next Year

I think for a lot of people, they have been spending more on entertainment to fill the void of not being able to travel.

If we manage to open up next year, then a lot of people would be rushing to travel. It has been some time since I have been out of Singapore so I wonder if I wanna take this chance to go on a overseas trip.

That would probably bring up the expenses.

I am trying some Chinese medicine treatment and likely, that would boost up the expenses next year. My annual spending have not breached $30,000 for some time but I got a feeling next year will be the year that will.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Consume Less Life

Saturday 24th of April 2021

Hi Kyith,

I would to ask how is your experience with your Xiaomi hair clipper? I have been cutting my own hair since 2018 to save money using my own Wahl clipper which costs about $60. So I was wondering if a $10+ clipper is good enough and will last. If it is good enough, I might look to purchase one when my clipper finally dies on me.

Thanks!

Kyith

Sunday 25th of April 2021

Hi Consume Less Life. It is mixed. Compared to my old Phillps one, this one is lighter, cheaper and charge better. However there are little annoyances like when you open up the blade to remove the hair, it does not swivel so the blade might just fall out. other than that I think it is not too bad. thanks for checking with me.

retirewithfi

Friday 1st of January 2021

Parents' allowances form a sizable chunk of our expenses and it wasn't possible last year (2020) to utilize the travel/fun budget for the most part so if we take out those 2 chunks, in absolute dollar terms, we as a couple actually spent less than Kyith last year. Cooking/baking at home most days means we can eat well and enjoy our food and reduce expenses at the same time and cooking/baking can be a good experience by itself too.

However we am looking forward to using the travel budget this year and do more fun activities outside the home.

Happy New Year to all!

retirewithfi

Friday 1st of January 2021

@Kyith,

With retirement, it also makes it possible to spend time on sourcing for cheaper food ingredients within reason and we do spend a lot more time shopping for groceries and we enjoy the grocery shopping experience itself. I am an (extreme) optimizer by nature and like my dollar to go the extra mile by using the appropriate cashback cards or whatever deals to get the best bang for my money.

Kyith

Friday 1st of January 2021

Hi retirewithfi, it is great to know that your family is able to hit lower than me! I think once travel gets better, the demand will be huge. Do you also observe that food ingredient prices have risen?

JD

Friday 1st of January 2021

Reading your article, I did my own! I am curious about your life: You didn't give allowances to parents, or top up their CPF? Is your mortgage just the cash component? Is there SRS? Do you have girlfriend or wife? :)

BlackCat

Friday 1st of January 2021

Wow, you really get by on spending so little. I average around $640 a week for 2 ppl plus 2 furry children.

Happy new year!

Kyith

Friday 1st of January 2021

Wah how come the children is furry hahaha. That is very low! somemore you have 2 furry children!

singvestor

Wednesday 30th of December 2020

(sorry i mistyped - it should be "?" not ".") :)