The next 6-Month Singapore Treasury Bill (T-bill) auction will take place on 15th September 2022.

You can check out the details of BS22118H 6-Month T-bill here.

If you manage to subscribe before the auction date, you can secure relatively good yields for your relatively short-term funding.

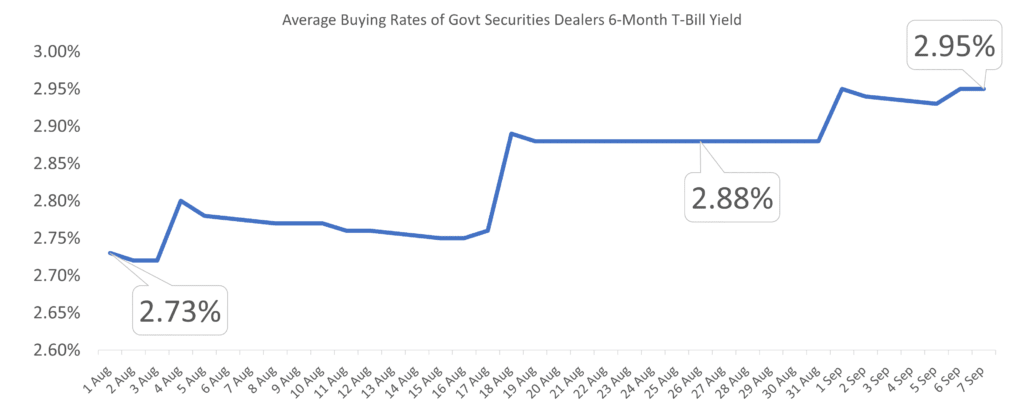

The chart below shows the average dealer buying rates for 6-month treasury yield from 1st Aug 2022 to 7th Sep 2022:

The 6-month T-bill yield has been steadily climbing, and the prevailing yield is closer to 2.95%. This is an annualized yield, which means that when your 6-month treasury bill matures, you would earn half of that or possibly 1.46%.

If you bid for $100,000 in the T-Bill auction (given the historical subscription, you will likely get all you bid for), you will earn $1,460 in six months.

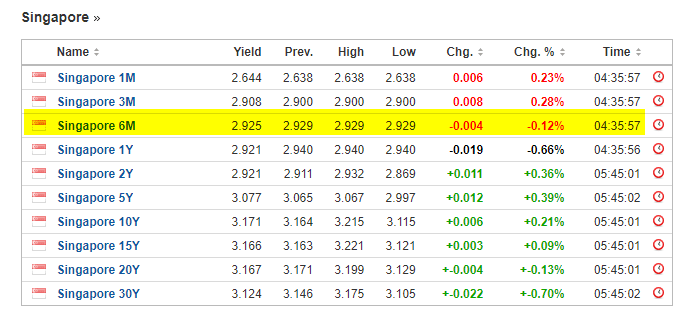

Investing.com tracks the last traded yield of Singapore government securities of different durations. Unless there is a sudden plunge in yields, we are still looking at a yield of around 2.92% (there is every possibility).

Here is how you subscribe to the 6-month Singapore Treasury bill: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds >>

Why Singapore Government T-Bills Are More Attractive than Special Promotion Fixed Deposits

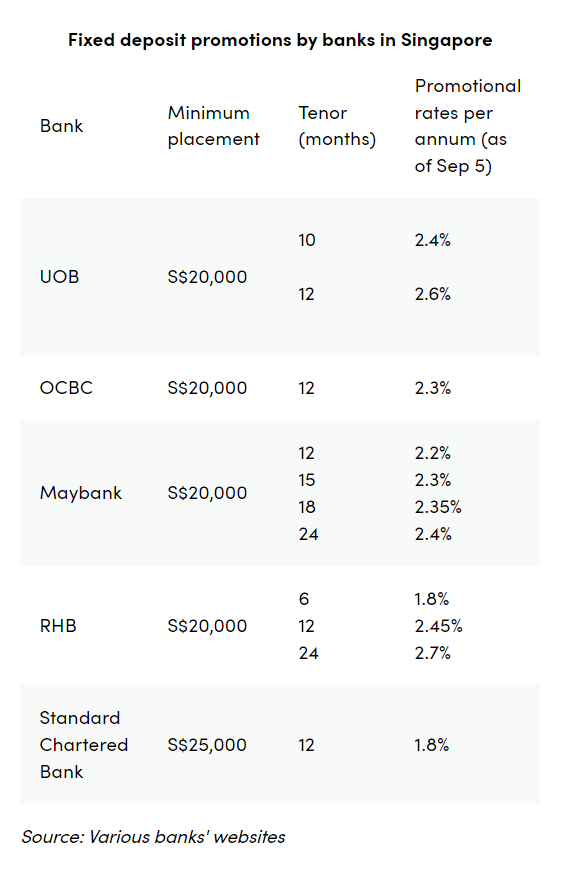

In recent weeks, the local big banks have finally decided to increase the interest they give for borrowing our cash as fixed deposits.

A relative asked me about the UOB fixed deposit deal, and I came across the fixed deposit rates of various banks, consolidated by Channel News Asia:

I think the Singapore T-bill is a more attractive proposition than the fixed deposit offered by them because:

- The interest yield you can earn with T-bill is more responsive to interest rate changes than the banks can provide.

- The credit quality of the Singapore government is as high, if not higher than the banks.

- The lock-in tenor of 6-month treasury bills is shorter than most of the tenors offered by the bank if we consider higher promotional interest.

- The minimum amount of cash to earn a high interest is S$1,000 instead of the higher minimum placement of S$20,000 for fixed deposits.

- The upper limit you can get in one-auction for a retail crowd is relatively high. You should not have problems filling in six-figures worth of cash.

Despite how attractive the T-bills are, do think about the role these instruments play in your financial strategy. Don’t be greedy about the yield and invest a major chunk of your net worth, only to suddenly realize you need the money.

There are two auctions every month, so you can stagger or ladder your money to make your cash stash more liquid. You are not going to time and get the highest yield. The most you can earn this yield is for a six-month duration. Treat this high yield as a good to have.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% - 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% - 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y - 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024