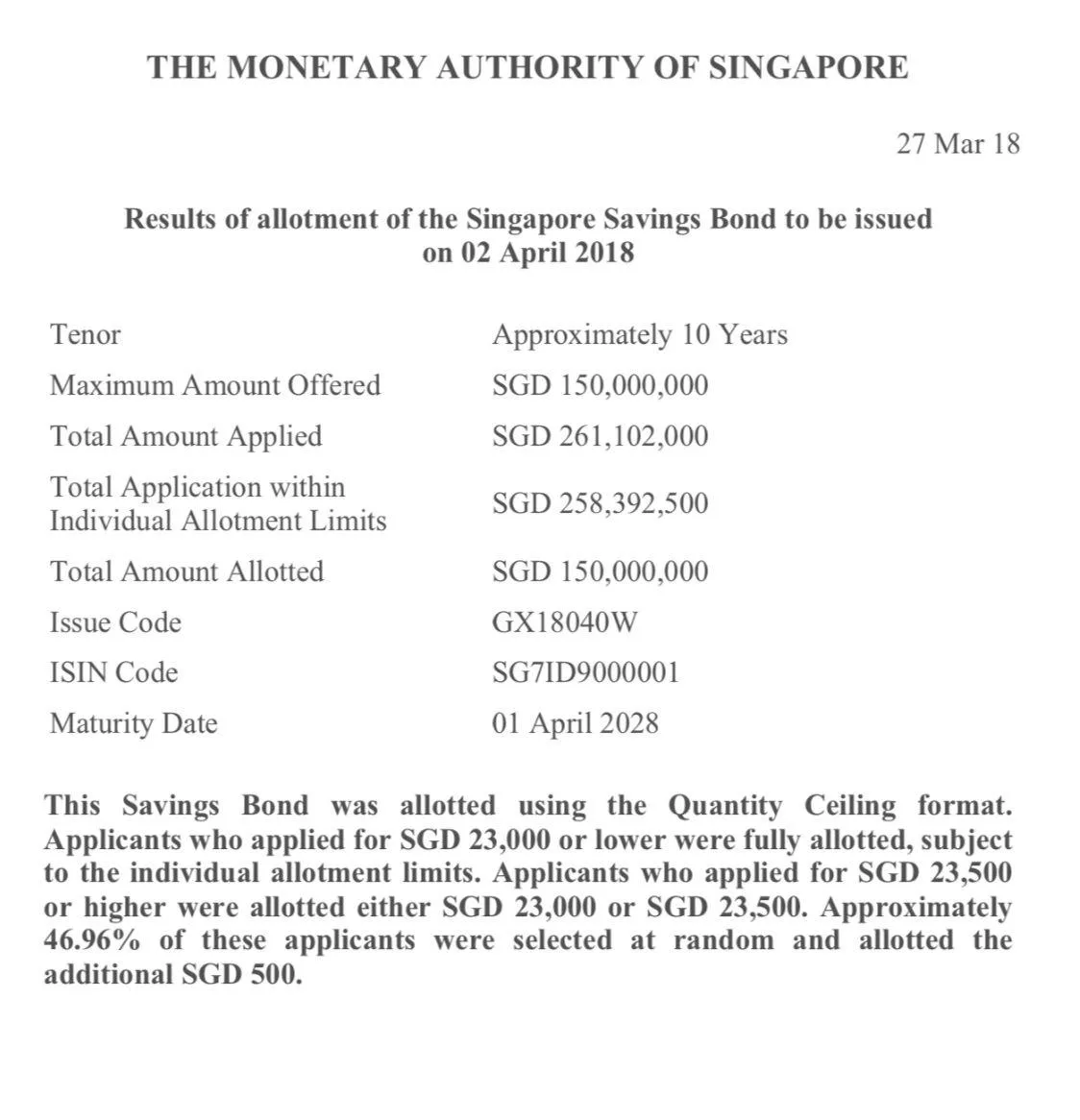

The application for the April 2018 tranche of Singapore Savings Bonds is closed and we have the application results.

It would seem that this is the second tranche that is oversubscribed.

It seems we are not getting all our fills.

This is a far cry from the days were the SSB was under-subscribed.

This is surprising to me because, I thought the reason for the low interest was due to low awareness that there is such a product out there.

Turns out this might not be true.

It is just that the Yields were not Attractive! When the yields are attractive, people flock to it.

Here is where I talked about the April 2018 SSB Bonds.

The 1 year duration yields 1.42%.

The most attractive deal out there, is not the hurdle savings accounts in my best short term savings for 2018. The Citibank MAXIgain is a combination of 12 0.1% counters and a base 80% of 1 month SIBOR rate. The current SIBOR is around 1.25% (20 Mar 18) so this gives the MAXIgain 2.2% if you fulfill all 12 counters.

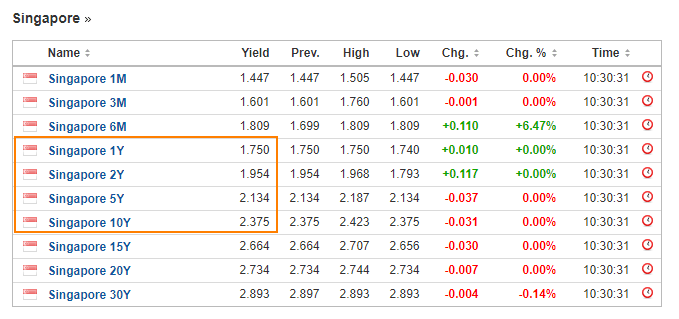

The above table is the prevailing Singapore government securities trading prices.

From the looks of things, May 2018 tranche is going to get real popular.

While I do not expect it to be 1.75%, it should be much attractive to a lot of people.

It would seem that the yield is also flattening.

As with all things, always look at the big picture.

If you only have $5000, at:

- 1.2%, you get $60

- 1.5%, you get $75

- 1.8%, you get $90

It is not going to make a lot of difference. Just find your “enough” point and run with it. When you sell it, it will cost you $2 bucks. You won’t lose a bunch of money.

What about Kyith’s $50,000 in Feb 2017 SSB?

So I keep some of my portfolio that I have not deployed into the markets in Singapore Saving Bonds.

I bought them last year in the Feb 2017 tranche.

The interest table is as below:

The average return shows the average rate of return over the duration that I will get. So for example, if I kept this SSB for 4 years, my average rate of return per year is 1.7%.

The 2.32% shows what I will get in reality for that year. It is increasing, because it is giving you part of the return you should be getting in the previous 3 years. (they will not give you the average return in cash straight away, because if they do, why would you keep the bond for 10 years? You would sell it off immediately!)

So since I have it for second year, technically if I see out this bond for year 2, my average return is 1.28%. But I will get 1.52% this year.

These amount will still be less than the 1.75% upcoming, technically I would lose $235 odds by switching.

In terms of the long end, its 2.44% of what I own versus 2.37% now. Not too much of a difference.

I think what I will do, if I choose to have a higher allocation of my net worth in cash, is to apply for more SSB in the future.

However, if I am holding more than $50,000 I will not sell.

It really depends on whether there are good buys in the equity and crypto-assets. If there is, its more sensible to put money into risky assets then the safe bonds.

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024