Currently, local broker moomoo is offering a guaranteed interest of 5% per annum if you deposit money and invest in their Cash Plus account.

At an annualized return of 5%, the moomoo Cash Plus account offers the highest rate.

But what is the catch, and is it worth our time at all?

I think moomoo is providing us with some incentive so that we can try out their Cash Plus account, but I think moomoo has a unique proposition.

Let me try to explain how I look at things from my point of view.

The moomoo Cash Plus Promotion: How the Higher Interest on Your Cash Work

Firstly, some older readers may remember the moomoo promotions I shared in the past. moomoo is a local broker-dealer that entered Singapore not too long ago. It operates under moomoo financial Singapore, which holds a CMS license regulated by MAS (License No. CMS101000)

moomoo operates a cutting-edge mobile-first brokerage, allowing you to trade in the US, Singapore and HK.

For new users who signed up with them, you can earn a guaranteed 5% p.a. for 90 days (3 months) if you sign up and invest more than S$100 in moomoo Cash Plus. If you have signed up with moomoo in the past, you can boost your moomoo Cash Plus return for 30 days if you refer a friend to use moomoo. You can stack six referrals per moomoo account ID, extending the guaranteed interest by six months (180 days).

As the World Cup is around the corner, if you guess the winning team correctly, you can win a share of a total prize pool of S$50,000 in cash coupons.

How much could you stand to earn?

How much you stand to earn depends on whether you sign up as a new user and how many people you refer to moomoo, and how much you deposit with moomoo Cash Plus.

The maximum amount of cash that you can earn this guaranteed 5% is S$10,000.

If you are a new user:

- Maximum investment: S$10,000

- Absolute interest earned in 90 days (3 months): S$10,000 x [(5%/365)x90] = S$123.28

- What you earned as a newly signed-up user with a minimum S$100 investment into moomoo Cash Plus: S$2 cash coupon for ten days (total S$20)

- Total: S$143.28

If you are an existing user:

- Maximum investment: S$10,000

- Absolute interest earned if you make six referrals (180 days or six months): S$10,000 x [(5%/365)x180] = S$246.57

- Total: S$246.57

If you are a savvy Investment Moats reader, the opportunity cost of investing in moomoo Cash Plus may already be relatively high, with the same degree of risk. If you invest in a six-month Singapore Treasury bill, the interest you can earn may already be a locked-om 4% p.a.

And so, the incentive to you is lower. You can do the calculation above but replace the 5% with the difference between 5% and the rate of return you can earn (for example, put in 5%-4% = 1% if the highest risk-free return you can get is 4%).

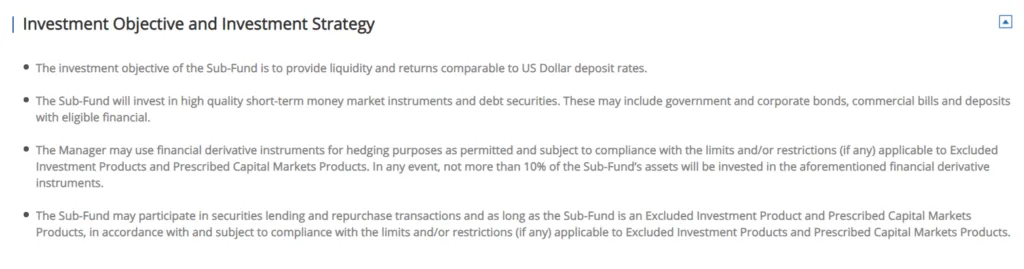

What is the moomoo Cash Plus?

moomoo worked with fund management companies Fullerton and CSOP to use their money market funds to provide a higher return for their clients’ idle cash.

When you deposit money into moomoo Cash Plus, you invest in either:

- Fullerton Cash Fund SGD

- CSOP USD Money Market Fund USD

Both funds are funds in the popular unit trust structure.

What is a unit trust?

A unit trust often referred to as mutual funds in other countries, is a pool of funds invested based on a fund manager’s or management company’s specific mandate.

You pool your money with other investors and invest in a portfolio of assets based on the fund’s stated investment objective and approach. The type of assets can be equity, bonds, commodities, REITs or cash. The investment approach can be active or passive.

A unit trust is quite similar to another similar financial innovation called exchange-traded funds (ETFs). Still, the main difference is that the ETFs are traded on a stock exchange, and the prices fluctuate daily as it is traded whereas a unit trust’s price is only valued once a day, based on the aggregate value of its assets at the end of the day.

There are some advantages in investing in an investment with a unit trust structure:

- You are more diversified than investing in one or two same types of securities.

- You delegate your time to the manager to manage so that you don’t have to do it.

- You delegate to someone with more financial sophistication than yourself to do it.

Fullerton Cash and CSOP Cash as money market funds

The Fullerton Cash Fund and CSOP Money Market Fund are unit trusts that invest in short-term fixed deposits and debt securities. Their investment mandate constrains them to only short-term and safe instruments.

If the fund comprises short-term fixed deposits and debt, the money market funds develop the aggregate characteristics of the underlying assets. This means:

- The capital guarantees and interests the fixed deposits.

- The binding contractual obligation to pay back the principle and coupons of the debt instruments.

The downside of money market funds is the downside of the deposits and short-term investments you make in individual bonds. No matter how high quality, if the bank and issuer default on your fixed deposits or loans, you lose your money.

But the advantage is that even in that very low probability scenario, your risks are diversified because the fund invests not in one bank deposit or one debt note but many.

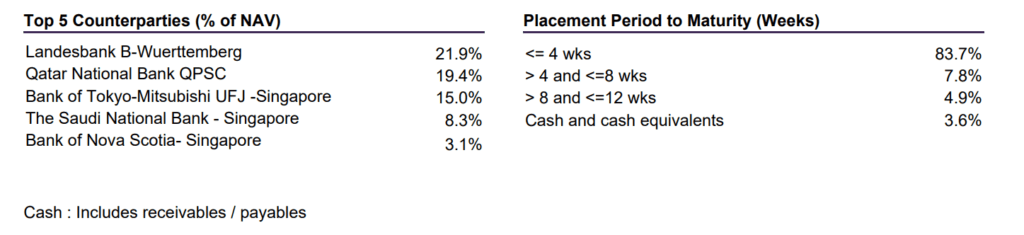

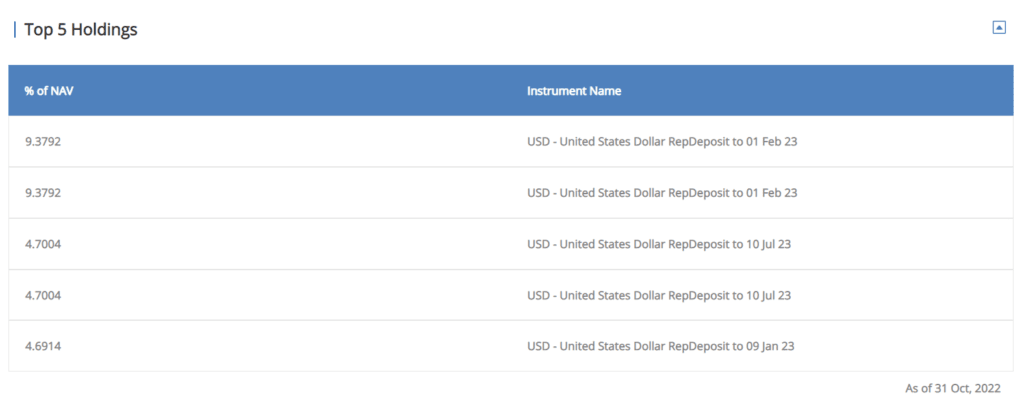

In particular, Fullerton cash fund’s mandate is to invest in Singapore Dollar deposits without mentioning debt instruments. CSOP money market fund does state that they would invest in short-term debt instruments.

Both portfolios are made up of fixed deposits mainly. The duration of the Fullerton cash fund is very short, which means the fund can consistently reinvest into higher-earning fixed deposits (due to the recent increase in interest rates).

What is the return from moomoo Cash Plus?

Your returns will depend on the returns of either Fullerton Cash Fund or CSOP Money Market Fund.

The returns are inconsistent and depend upon the aggregate interest from the underlying deposits.

In August 2022, I wrote that MoneyOwl’s WiseSaver reached a gross yield of 2.27%.

MoneyOwl WiseSaver is 100% invested in the Fullerton Cash Fund, so you can imagine the moomoo Cash Plus returns to 2.27% in August without the guarantee.

Last year, the Fullerton Cash Fund had a gross yield of 0.35%.

That might not be very appealing, but the main reason you invest in a money market fund is for the fund manager to use their scale and find the highest, safe return without you doing it.

Here is the recent gross yield of the Fullerton Cash Fund:

- 29 Sep 2022: 2.75%

- 26 Oct 2022: 3.14%

- 2 weeks ago: 3.45%

- This week: 3.53%

As the fixed deposits mature and reinvest, the yield changes.

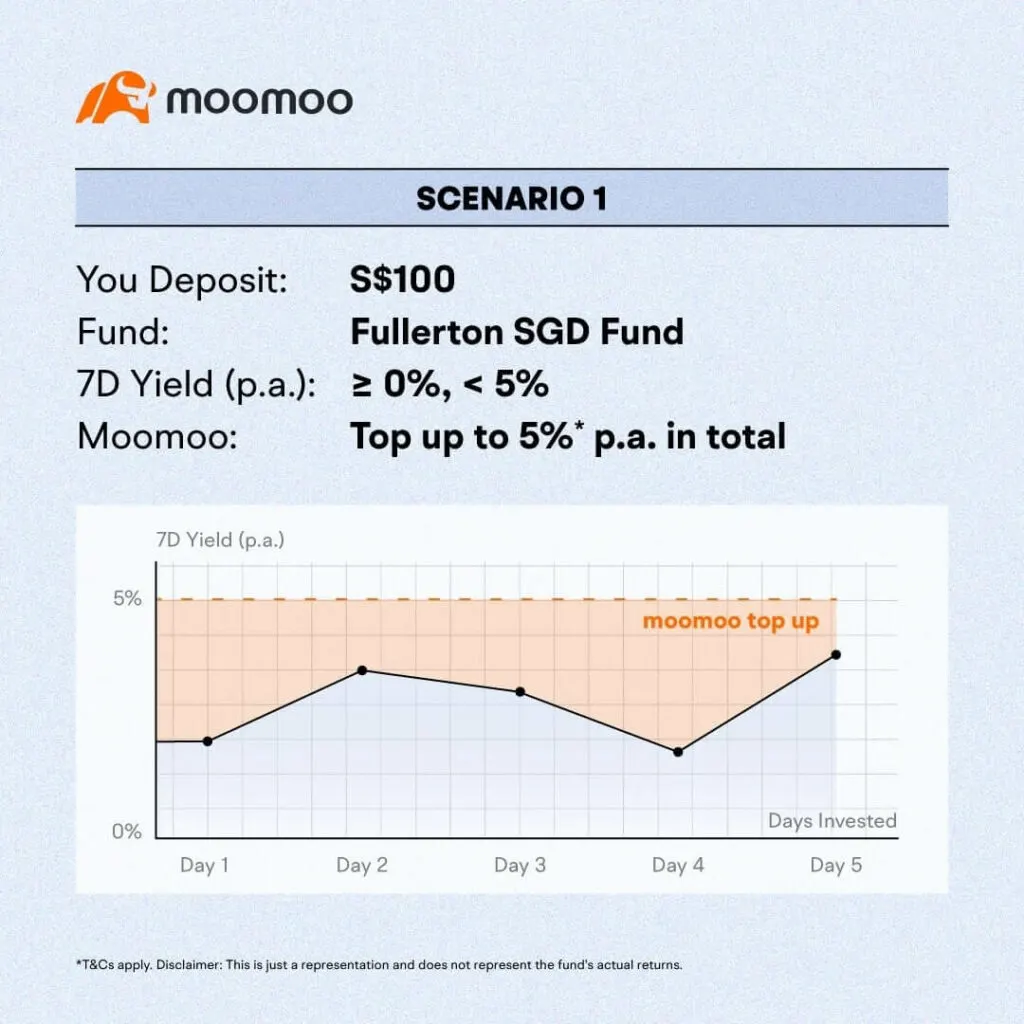

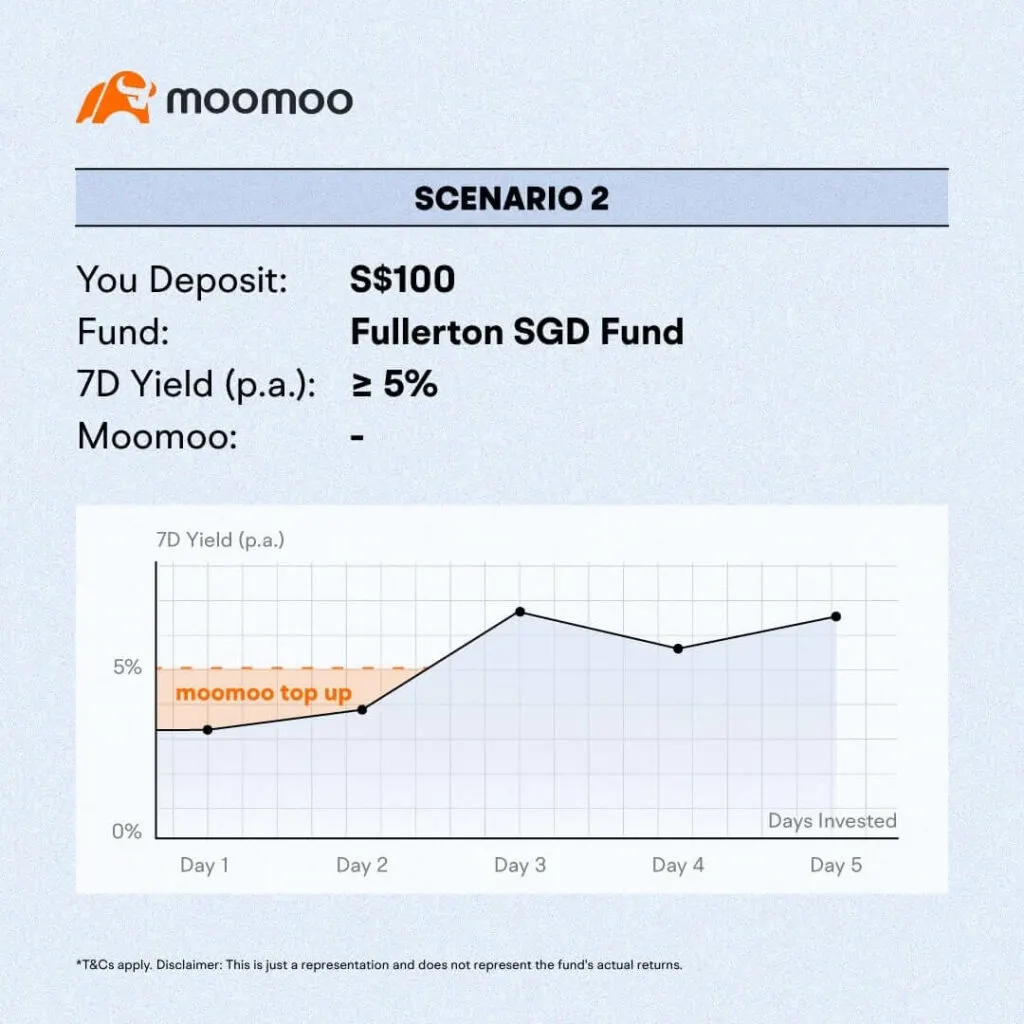

How does moomoo give the 5% p.a. guarantee?

moomoo also does not know what will be the future returns of the two money market funds.

But they are committed to making up for the difference between the returns of the fund and 5%.

If the 7-day yield is lower than 5%, moomoo tops it up.

If the yield is higher, then you will earn a higher than 5% yield.

moomoo Cash Fund is probably the Most Liquid, High-Interest Cash Solution out there!

Perhaps moomoo Cash Fund’s most significant advantage is liquidity.

You can sell and gain access to the money you invest in your moomoo Cash Fund in T+1 day.

If you sell your Fullerton Cash Fund, you can immediately buy SGD stock or IPO with your moomoo wallet, but if you want to sell and put it back into your bank account, you will need T+1 day.

If it is the CSOP Money Market Fund USD, you can get it in your bank account on the trading day itself (T+0).

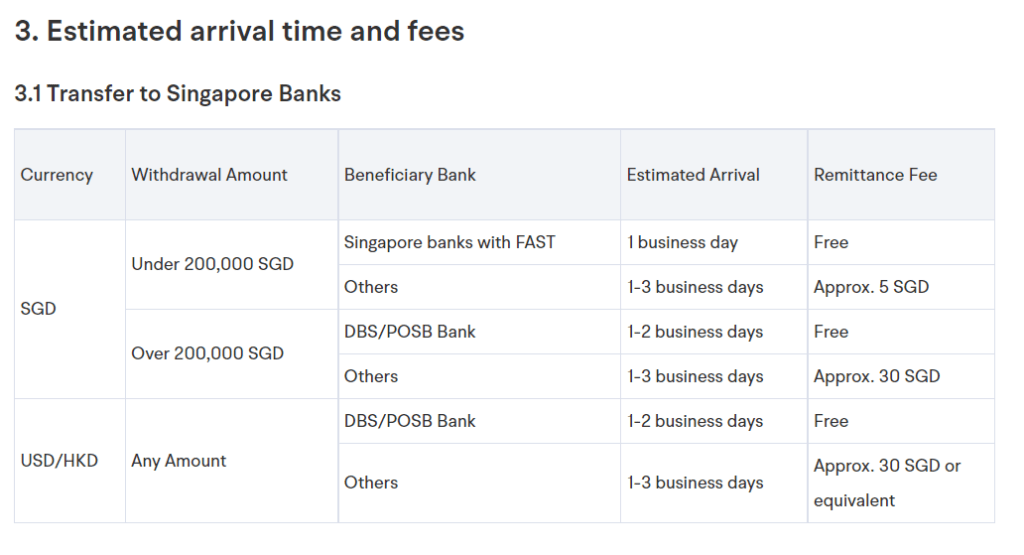

The table below shows the withdrawal arrival time (source):

While it says 1-2 business days, I think the money should reach a local bank within the same day.

This is the most liquid compared to other unit trust distributors, Robo-advisers, or financial advisory firms, usually T+3 to T+5 days.

The Use Case for moomoo Cash Fund’s Outstanding Liquidity

We want to park our cash reserved for investment opportunities but don’t want to earn very little returns. But to get decent returns, we either lock up money longer or take more risks in different forms.

If you wish to invest in US, HK or Singapore stocks through moomoo, you can have very fast liquidity.

This means that you can:

- Park excess monies in the moomoo Cash Fund

- When the opportunity arises, sell part of the moomoo Cash Fund

- Invest in the SG, HK or US opportunities through moomoo

It will be very fast.

I think moomoo can do this because they are providing the liquidity.

The other investing use case:

- Park excess monies in the moomoo Cash Fund

- When the opportunity arises outside of moomoo, sell part of the moomoo Cash Fund

- A day later, transfer the money out to a local DBS account, which should receive on the same day (unless too late)

- Invest in the new venture.

You may miss out on a day of execution opportunity, but it is tough to find something based on unit trust that is this fast. If it is ETF-based, there might be something.

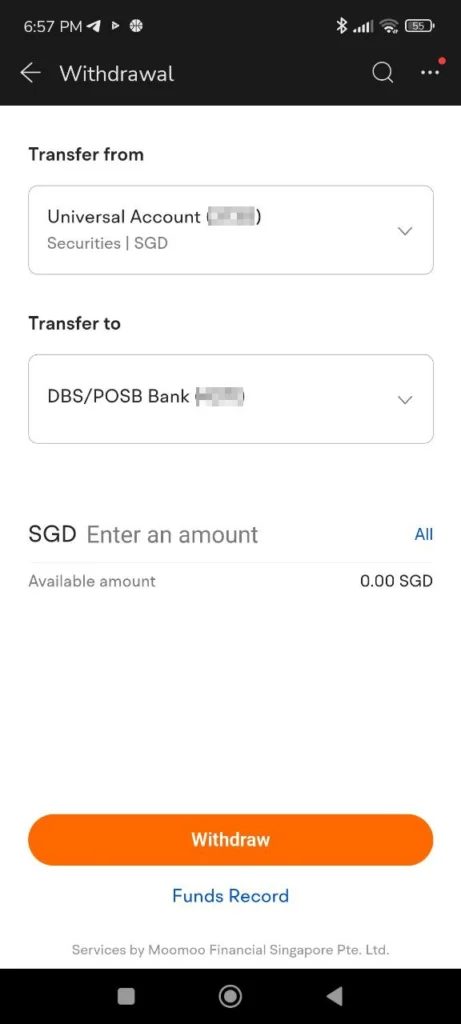

To withdraw, go to the Trade tab and find the Withdraw function (it is hidden deeper, haha)

Where to invest in the Fullerton and CSOP Money Market Fund

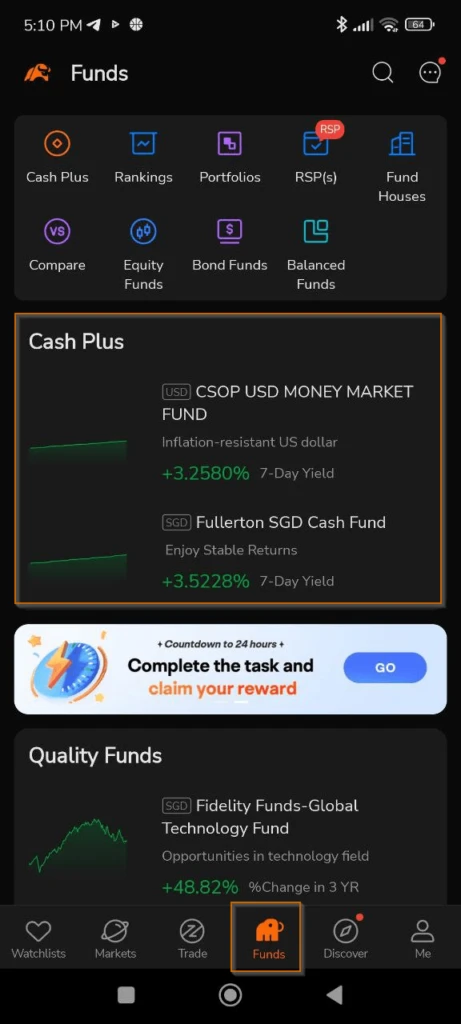

To invest, go to the Funds tab, and then you should be able to see the funds under Cash Plus.

I also realize that now I can get the most updated gross yield for both the CSOP and Fullerton money market fund!

Conclusion

The Fullerton Cash Fund is something I am more familiar with since we did the due diligence when we conceptualized our cash management solution.

In my world, investing in a money market fund is considered safer. While it does not have SDIC protection, it is relatively diversified to prevent a single bank collapse. This does not mean a money market fund cannot go negative.

Investors experienced that during the great financial crisis when some money market funds suffered losses, but they have since recovered independently. It is important to note that money market funds are shorter in duration than short-term bonds, so they are less likely to be affected by unanticipated interest rate changes.

moomoo has thought through our needs and thus managed to link up with not just the popular Fullerton Cash Fund but also provide a viable USD money market fund if we wish to keep our liquid investments in USD. All this is integrated into a relatively comprehensive moomoo trading platform.

If you wish to sign up, you can use my moomoo referral link here.

If you sign up for a new moomoo account and deposit S$2,700/ US$2,000 / HK$16,000 into your cash account, you can still get a FREE share of a US company

Then you can layer on the deposit to moomoo cash plus, which means you can get a total of either SG$186 to SG$333.

This article is written in collaboration with moomoo Singapore. All views expressed in the article are my independent opinion. Neither moomoo Singapore nor its affiliates shall be liable for the content of the information provided. The Monetary Authority of Singapore has not reviewed this advertisement.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024