Temasek’s subsidiary Azalea last week lodged the prospectus for a new tranche of Astrea bonds.

You can start applying for Astrea 7 bonds starting today at your local bank’s ATM just like how you would apply for a Singapore listed stock’s initial public offering.

But should you apply?

What is the Astrea Bond Series About?

I have written about Astrea bonds twice in the past. You can check them out because a large part of how the Astrea 7 would work is similar to the older Astrea issues:

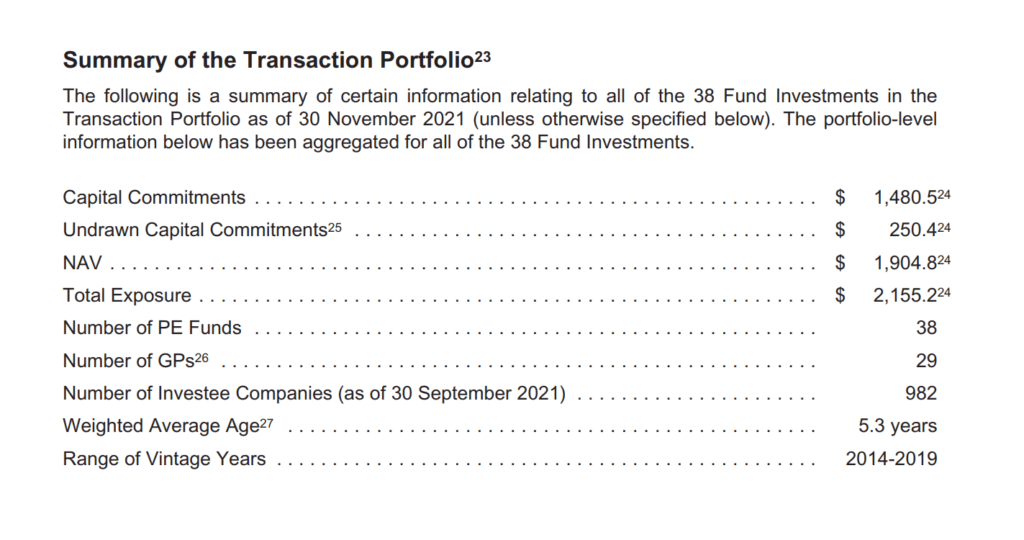

Astrea is a series of bonds that are issued by a holding company that also held private equity funds as assets. The bonds will rely on the cash flow from the underlying companies in the private equity funds to pay the interest coupon. In this issue of Astrea 7, the bonds is tied to 38 PE (private equity) funds owned in Astrea VII.

A normal bond is issued by the government or corporate and the quality of the bond is tied in a way to the financial standing of the issuing entity. The financial standing of Astrea is tied to the quality of the underlying assets, in this case, the 38 private equity funds.

As there are 38 funds, the bonds are more diversified, but because private equity traditional purchase their underlying business with leverage and takes them privately, the risk level is also different. Investors of private equity often are looking at a 20-30% internal rate of return and so the risk taken should not be underestimated. Thus, the diversification balance off the risks of a blowout.

In the past class A-1 will be available to the retail to invest with a lower minimum account. This time, the Class A-1 and B are available for retail to apply with a minimum of $2,000 (one is in SGD and one is in USD).

There are three classes of bonds offered from A-1, A-2, and B, similar to the past.

Each class has different seniority with the A-1 most senior and the B the most junior. The seniority determines the priority of claim on cash flow and in the case of default and liquidation (touch wood), the amount of Astrea 7’s capital you may be able to recover.

You can and should read the prospectus of the Astrea 7 to understand more about private equity and the risks associated with the bond if you have not.

Link to the Astrea 7 preliminary prospectus.

Like its predecessors, I think Temasek would like the retail Singaporeans to benefit from this bond and so there are safeguards built in place to ensure that the Class A-1 bond will get access to the cash flow to payout.

You can take a look at the priority of payments below:

This priority of payments explains how the cash in the operating accounts would be utilized. It will be used to pay taxes and expenses first, followed by the management fee, then to pay the credit facility payments before paying the interest for Class A-1 and A-2 bonds.

Aside from that, there is a Class A Reserve set aside as a sort of sinking fund to save money so as to pay future interest payments if there is a cash flow crunch in Astrea 7.

This is probably not normal and shows the secondary objectives of this bond issuance to benefit the general retail investors who are attracted to this.

Examining the Attractiveness of the Astrea 7 Bonds

The following table shows the details of the three classes of Astrea 7 bonds:

| Astrea V Class | Minimum | Coupon / Yield to Maturity | Years to Maturity | Call Date | Fitch Rating |

| A-1 | S$2,000 | 4.125% | 10 | May 2027 | A+sf |

| A-2 | US$200,000 | 5.35% | 10 | May 2027 | Asf |

| B | US$2,000 | 6.0% | 10 | May 2028 | BBB+sf |

The bond coupon or the current yield to maturity is indicated during the issue.

Most likely, when the bond starts trading, the yield to maturity will be much lower.

This is because past Astrea bond issues have been so popular as the retail sees this as a safe bond but yielding more than 4%. So they would bid it up so much that the yield to maturity would compress.

During its tenure, you will get a coupon payment equivalent to those shown semi-annually. When the bond matures after 10 years, you will get the last semi-annual coupon payment and your principal back (if the bond does not default).

A-1 and A-2 classes have a mandatory call at the end of 5 years. B class has a mandatory call at the end of 6 years. This means that Astrea can forcefully redeem back the bonds, and give you back the capital and any outstanding coupon payments.

If the bonds do not get called, the coupon interest will step up by 1%.

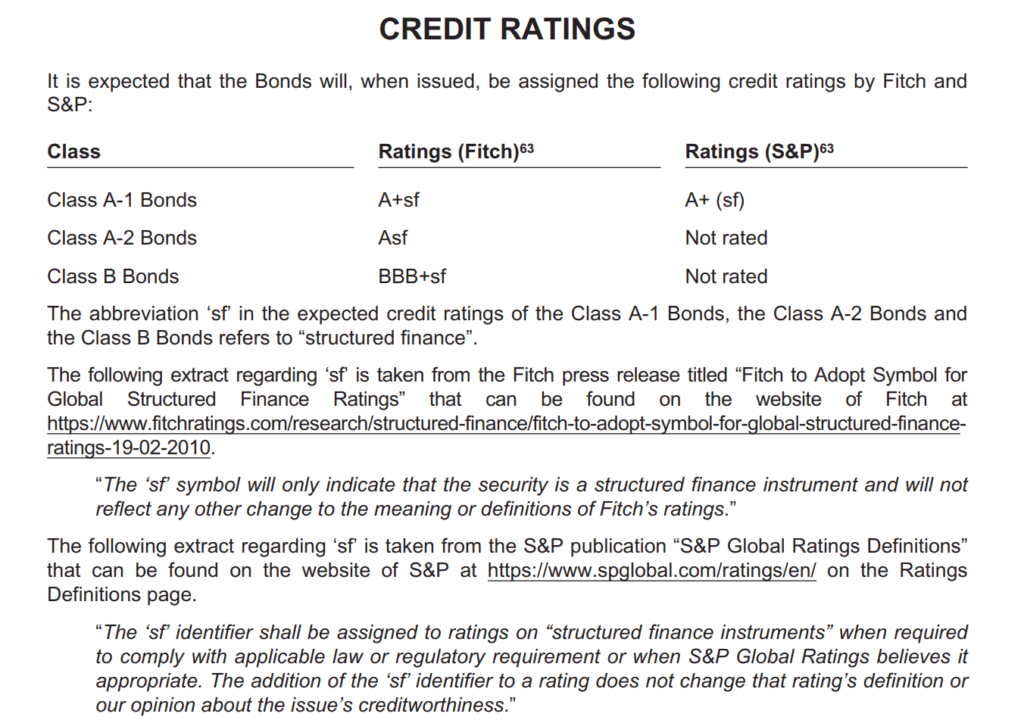

The sf in the Fitch bond rating indicates that this bond is rated on a different scale than normal bonds and that this is a structured financial product. This is so that we do not be confused that the A+ rating for A-1 is equivalent to the A+ rating of a normal bond.

The yields look very attractive especially the Class B at 6.3% but you need to be aware that the return may be indicative of the risk in that bond issue.

So here are some basics:

- The longer the duration of the bond, the riskier is the bond (greater interest rate risk, opportunity cost due to inflation)

- The lower the credit quality of the bond, the riskier is the bond (junk bond yields more than a high-quality Singapore government bond)

- If the bond is in another currency, you are taking on more currency risk or currency fluctuation and so the coupon should be higher to indicate the risk as well.

This bond at 10 years should be considered an intermediate-term bond. The A-2 and B are denominated in USD and so part of the higher coupon is to compensate for the difference in currency and the other part is due to lower credit quality.

Honestly, I think this bond would be called back in 5 years, so technically it is more like a 5 year bond than a 10-year bond.

A day ago, NTUC FairPrice issued the following bond:

| Bond Issuer | Minimum | Coupon / Yield to Maturity | Years to Maturity | Rating | Seniority |

| NTUC FairPrice Co-operative | S$250,000 | 3.75% | 7 | Unrated | Senior Unsecured |

NTUC is a government-related entity and since investors know how safe government entities are, they usually save on the money and do not get a bond rating. This bond is senior unsecured and has a tenure of 7 years yielding 3.75%. Its current yield-to-worst is 3.4%.

The Astrea bond Class A-1 should be comparable to the NTUC bond since both are SGD bonds. We can assess which bond is riskier. The Astrea Class A-1 bond has been longer in duration and based on the initial guidance would yield higher than the NTUC bond.

I would think that the Astrea bond is still riskier than the NTUC FairPrice Co-operative bonds but not by too much.

In the spectrum of risk versus reward, it leans closer to the NTUC FairPrice Co-operative issued bond than away from it.

We can also compare the Astrea 7 to how the Astrea 5 is currently trading to assess the attractiveness of this issue.

The following table summarizes the information we know about the Astrea 5 (from Bondsupermart):

| Astrea V Class | Yield to Call | Yield to Maturity | Coupon | Years to Maturity | Call Date | Fitch Rating |

| A-1 | 2.1% | 3.9% | 4.35% | 6 | Jun 2023 | A+sf |

| A-2 | 4.1% | 4.37% | 4.50% | 7 | Jun 2024 | A+sf |

| B | – | 5.65% | 5.75% | 7 | – | A-sf |

Most likely, the Astrea 5 bonds will be called back in 1 to 2 years.

I noticed that the credit quality of Astrea 7 Class A-2 and B are lower than the Astrea 5 issue based on Fitch Rating. But aside from that, the term of the Astrea 5 is shorter than the Astrea 7 but the yield is also lower, so we cannot really assess the quality difference between Astrea 5 and 7.

But if Astrea 5 Class A-1 is trading at 3.9% yield to maturity with 6 years to maturity and NTUC FairPrice is trading at 3.4% with 7 years to maturity, that gives an indication that the market is telling us the Astrea bonds are riskier than NTUC FairPrice.

Notable Information about the Private Equity Funds

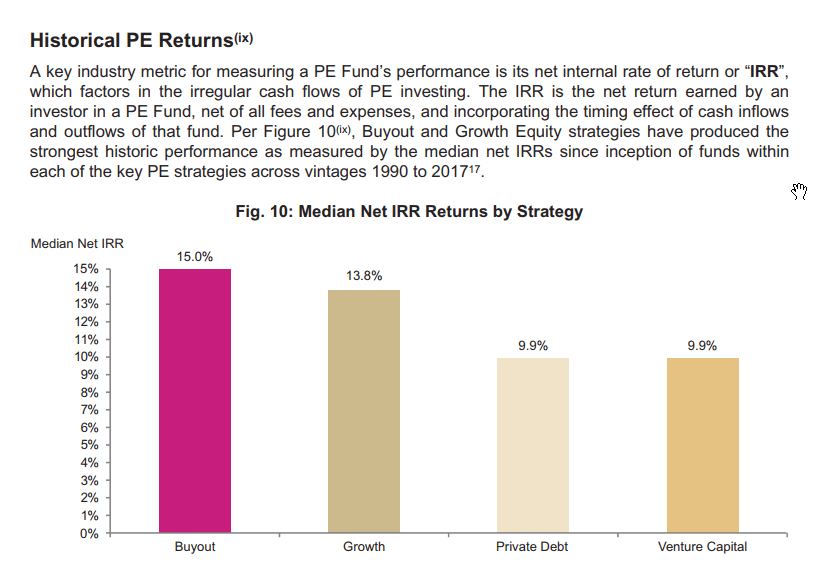

This table give us an indication of the range of IRR that is expected of typical private equity funds if you have access to them and choose to invest in them. The IRR looks higher but we cannot just compare the returns of these PE funds directly to your equity and bond mutual funds.

Different Astrea is tied to a different group of PE funds and each PE fund invests in companies bought during different time periods.

The Vintage Years will give us an indication and this set of PE funds has a range of vintage from 2014 to 2019.

Like the public equity markets, the private markets also go through periods where the general cohort is cheap or wildly expensive.

I would like to think that based on the time period, this set of PE funds has invested in businesses at higher prices, less margin of safety, and the potential IRR would be lower than the previous set of PE funds tied to the Astrea 4 and 5.

This might explain partly the lower Fitch Rating of the Astrea 7 compared to the previous Astreas.

But I think it is also safer in that… they did not include those companies bought after or during the COVID pandemic, where the valuation of the private markets might have gone bonkers.

General information about the bond rating.

This page is interesting in that they tried to simulate what happens if the distributions were reduced if the performance is as the funds are below the median and if those two things occur at the same time.

They used Monte Carlo to simulate 10,000 different portfolios and see how many of them were able to meet the bond obligations.

We can observe that with a 10-year time horizon, the simulation shows almost all the portfolios are able to meet the obligations even if we have a GFC type scenarios where the distributions from the underlying companies dropped by 50% in the first year and 25% thereafter.

But if we assess the likelihood to meet obligations within the 5-year bond call window, then there is some possibility that Class A-2 and Class B may not be able to meet that obligation.

I don’t trust Monte Carlo simulation for a lot of things but I learn how to use it: As a layer of the rule of thumb what the result says.

In this case, the protection mechanism put in place for A-1 makes it rather safe while under some historical distress, Class A-2 and B are risky, which explains the higher yield.

The Last Word

The Astrea bond issue tends to be rather hot and usually, we won’t get much if we apply for it. So you might want to explore getting it in the secondary market when it is listed.

Once it is listed, you can buy it like how you buy a stock traded on the SGX.

You would just need to find the ticker symbol.

Depending on the demand, the bonds should trade at a lower yield to maturity, so don’t assume you will get the yield in the table I published above.

Now, instead of just being able to get access to Class A-1, now we can get access to Class B as well but you should note that Class B is riskier than the previous Class B issue.

These bonds are suitable if you wish to have them as part of your portfolio to do some sort of asset-liability (financial goal) matching.

For example, you have a financial goal that you need the money in 5-6 years’ time. These bonds will fit that purpose.

But don’t think these bonds are the safest thing in the world just because Ah Gong is part of this and you put 100% of your net worth into it. Based on the vintage, this range of PE funds valuation-wise may be riskier than previous sets. Be diversified, even in your bonds!

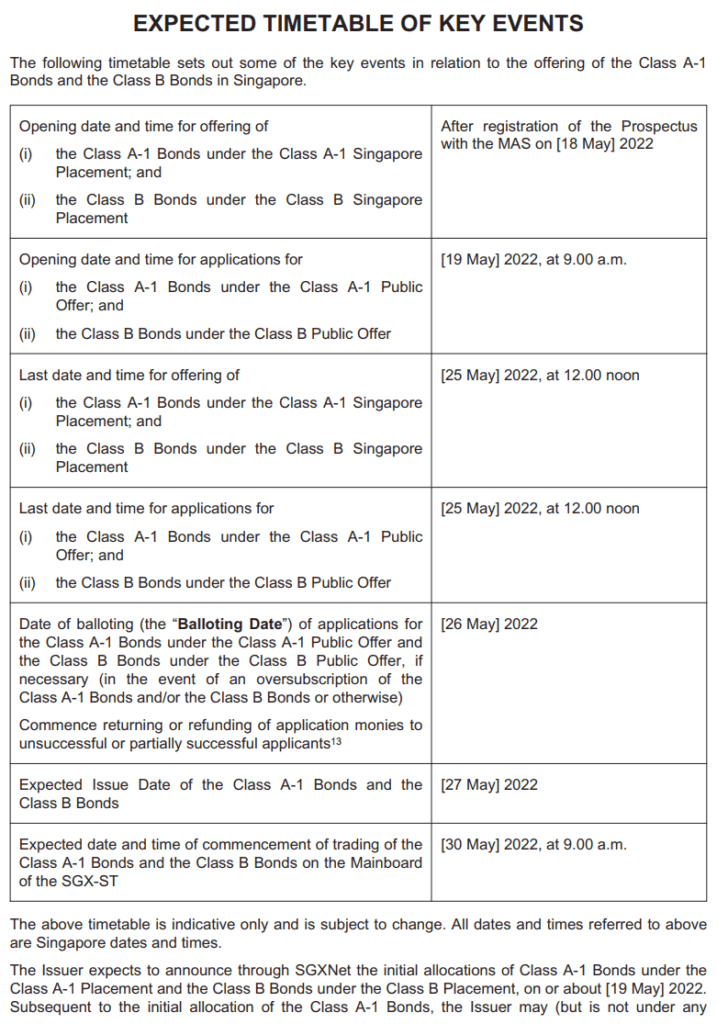

Here is the timetable:

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Grace

Tuesday 19th of July 2022

Hi Kyith,

Thanks for the analysis, it was useful for me. I cannot seem to find their tickers in Interactive Brokers though. Is it V7AB and V7BB?

Chia Loy Wah

Saturday 21st of May 2022

Very well analysed n written. Thanks

Nelson

Thursday 19th of May 2022

Hi Kyith,

Thank you for this detailed writeup which was very helpful.

I think there was an error for the minimum sum for a Class A-1 offer. The minimum is $2,000 (not $1k)

Class A-1 Public Offer Each application must be at least S$2,000 or higher (in multiples of S$1,000). Applications under the Class A-1 Public Offer may be made from 9.00 a.m. on [19 May] 2022 to 12.00 noon on [25 May] 2022. Applications must be by way of Electronic Application, in accordance with the application procedures set out in Appendix B.

james ong

Thursday 19th of May 2022

@Kyith I did not see the prospective in the SGX website, may I know when it was published? Thanks

Kyith

Thursday 19th of May 2022

Wah ok thanks Nelson! I always thought its $2000 but some parts of it showed $1000.