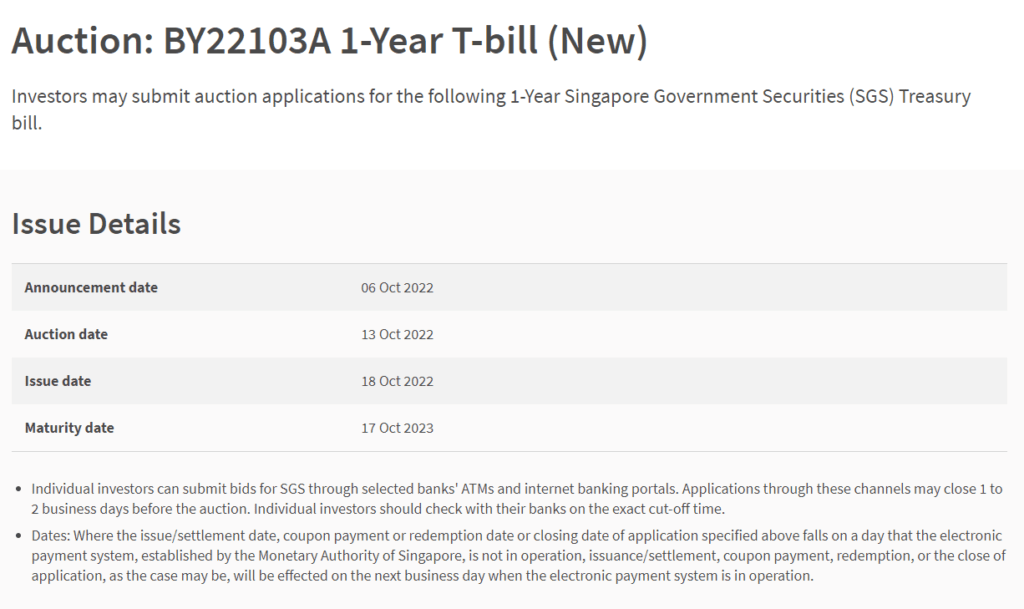

In this cycle, we have both the six-month T-bill and twelve-month T-bill on auction on Thursday, 13th October 2022.

If you wish to subscribe successfully, get your order via internet banking (Cash and SRS) or in person (CPF) by 12th October.

In the past, I have shared with you the virtues of the Singapore T-bills, their ideal uses, and how to subscribe to them here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

In the last issue announced two weeks ago and recently concluded, the current t-bills were trading at a yield of 3.22%. In the end, the cut-off yield for the t-bill ended at 3.32%, which is vastly higher than expected.

If you placed a non-competitive bid, which most of us do, you would have gotten the 3.32%.

The table above highlights the yield current six-month Singapore T-bills trades at. This is to give you a sense of recent yield trends.

Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2023

You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough.

Here are different other categories of securities to consider:

| Security Type | Range of Returns | Lock-in | Minimum | Remarks |

|---|---|---|---|---|

| Fixed & Time Deposits on Promotional Rates | 4% | 12M -24M | > $20,000 | |

| Singapore Savings Bonds (SSB) | 2.9% - 3.4% | 1M | > $1,000 | Max $200k per person. When in demand, it can be challenging to get an allocation. A good SSB Example. |

| SGS 6-month Treasury Bills | 2.5% - 4.19% | 6M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| SGS 1-Year Bond | 3.72% | 12M | > $1,000 | Suitable if you have a lot of money to deploy. How to buy T-bills guide. |

| Short-term Insurance Endowment | 1.8-4.3% | 2Y - 3Y | > $10,000 | Make sure they are capital guaranteed. Usually, there is a maximum amount you can buy. A good example Gro Capital Ease |

| Money-Market Funds | 4.2% | 1W | > $100 | Suitable if you have a lot of money to deploy. A fund that invests in fixed deposits will actively help you capture the highest prevailing interest rates. Do read up the factsheet or prospectus to ensure the fund only invests in fixed deposits & equivalents. |

This table is updated as of 17th November 2022.

There are other securities or products that may fail to meet the criteria to give back your principal, high liquidity and good returns. Structured deposits contain derivatives that increase the degree of risk. Many cash management portfolios of Robo-advisers and banks contain short-duration bond funds. Their values may fluctuate in the short term and may not be ideal if you require a 100% return of your principal amount.

The returns provided are not cast in stone and will fluctuate based on the current short-term interest rates. You should adopt more goal-based planning and use the most suitable instruments/securities to help you accumulate or spend down your wealth instead of having all your money in short-term savings & investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Rudi

Friday 14th of October 2022

hi Kyith, How is the interest calculated? Oct 6 month T bill.

Alan

Monday 10th of October 2022

Hi Kyith Can you share how competitive bid work. Example if I bid for 2.8 percent and result is 3.3 percent Do I have the 2.8percent or 3.3 percent. Also as my bid is way below the auction bid do I have the full allocation. Thanks Alan

Alan

Tuesday 11th of October 2022

@Kyith, Thanks for the information.

Kyith

Monday 10th of October 2022

you shoulid get the 3.3% cut off yield. but the non competitive bidders will be allotted first.

"Non-competitive bids will be allotted first, up to 40% of the total issuance amount. If the amount of non-competitive bids exceeds 40%, the bond will be allocated to you on a pro-rated basis. The balance of the issue amount will be awarded to competitive bids from the lowest to highest yields."