Currently, there are two Singapore Government Securities that are going to be auctioned soon that you might be interested in.

One is a six-month Government Treasury Bill, and another is a five-year Government bond.

These treasury bills and bonds issued by the Singapore government are relatively safe in the spectrum of financial securities. You might want to read my article on how to buy these government securities when they are first issued (such as this recent announcement) here.

BS22117S 6-Month T-Bill

The first issue is the fortnightly treasury bill issue. The auction’s end date is on the 1st of September. You have five more days to think about it.

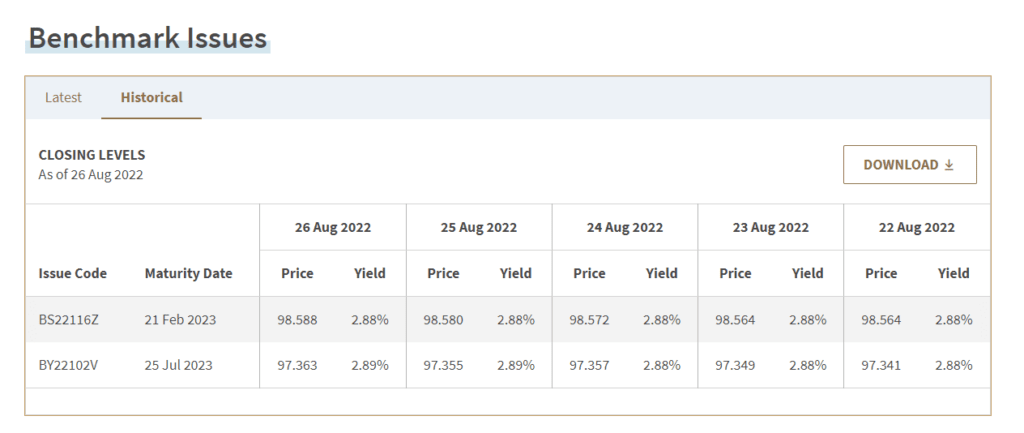

The table above shows the price and the yield some of the bonds were trading in these few days. Currently, the market yield is about 2.88%, so it is will likely be the range you may get.

These treasury bills are pretty good for short-term liquidity. A good suggestion may be to form some sort of treasury bill ladder.

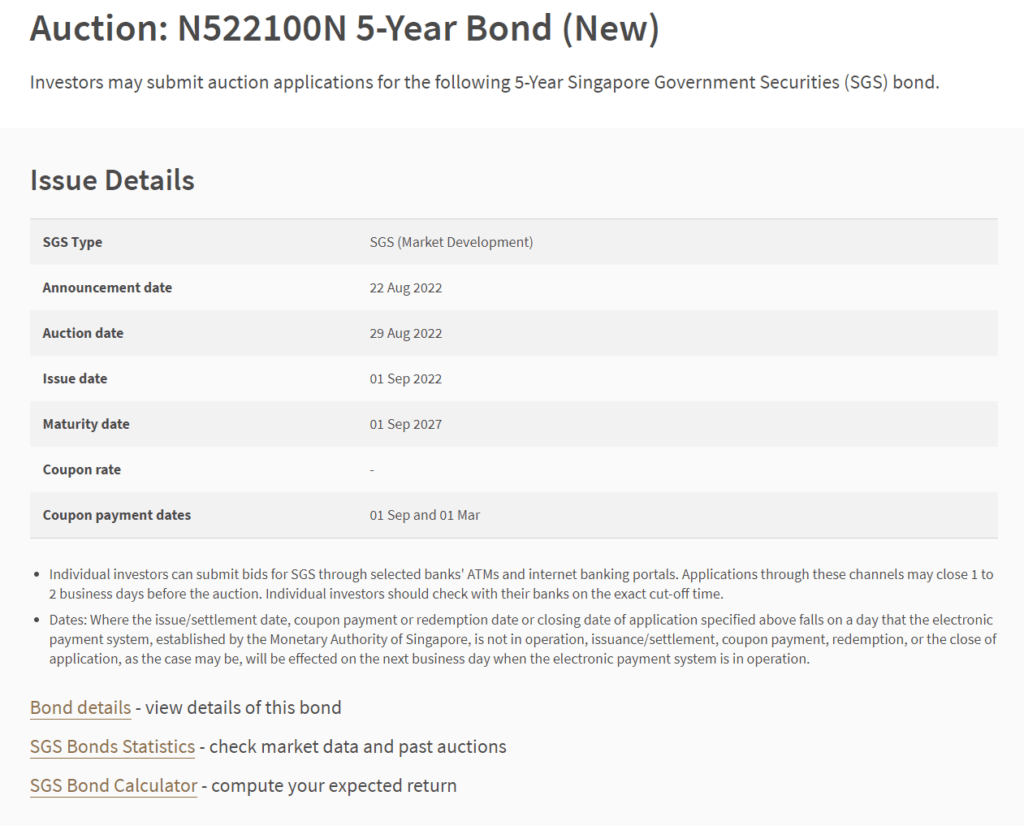

N522100N 5-Year Bond

The other issue is a longer tenor government bond issue. The issuer credit quality is excellent, but since the tenor is five years, you take on duration risk. Thus, you would have to consider your goal of investing in this intermediate duration bond carefully.

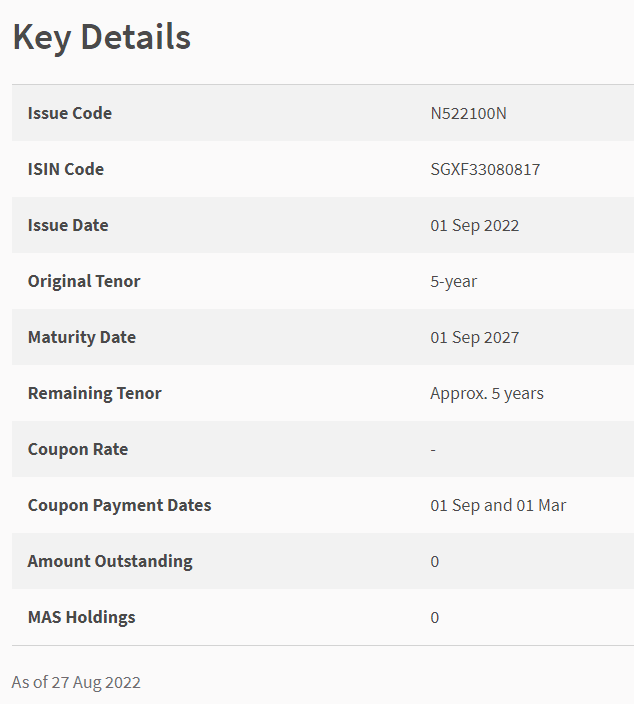

Here are more details about the bond.

The table above shows the average buying rates of 5-year bond yield by government securities dealers starting from August 2021 to July this year. What you will get would roughly depend on the prevailing yield 5-year government securities are trading at.

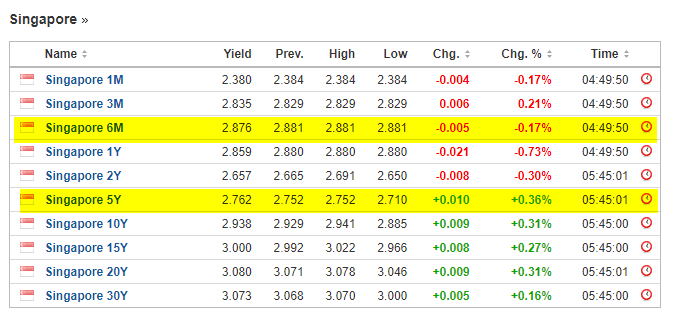

Per Investing.com, we can see the prevailing yield for different government bonds of various duration.

We are probably closer to 2.75% if the auction is done today.

A five-year government bond is suitable for some financial goal that is less inflationary, and you want to ensure you will have every single cent five years later and not a single cent less.

More details of both auctions can be found on MAS’s website here.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Joel Chan

Thursday 15th of September 2022

The recent auction for Sep 15 is out here. Auction: T-bill (mas.gov.sg)

What then is the yield on purchase of these T bills. There are so many yields involved: average yield, median yield, cut off yield. The cut off and average yield varies by 0.5% too.

Kyith

Sunday 18th of September 2022

if you are doing non-competitive bid, focus on the cut-off yield. that is the yield to take note of.

Sel

Tuesday 30th of August 2022

Followed yr instructions on application of T Bills. When I clicked Non Competitive, a msg pops up saying that I may get a negative interest. Will it happen?

Keith Tan

Monday 29th of August 2022

For 6month SG T-Bills, how do you sell in the secondary market. The persons in the banks don't seem to be interested.

Kyith

Tuesday 30th of August 2022

Do you mean that you asked them how to sell in the secondary market?