My December Dividend Income portfolio have been updated in the side bar.

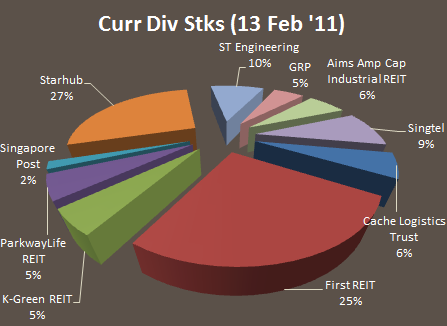

The biggest change to this is probably the deployment of a full 10% into:

- First REIT through Rights issues

- Purchase of Singtel at $3.07

In 2010, I collected $3494 dividends. I think it is far from my aim of $10,000 this year but will continue to work hard towards it. likely case I cannot leave the allocation to be 50% cash.

I run a free Singapore Dividend Stock Tracker available for everyone’s perusal. It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

Latest posts by Kyith (see all)

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

meng

Tuesday 28th of June 2011

Hi Drizzt You got a great Tracker But noticed some of the latest listings and some older counters are missing are missing a) Perennial b) Maple Commercial c) FSL d) India Bulls, etc

Drizzt

Saturday 2nd of July 2011

hi meng, Perennial Maple Commercial is quite new. I will try to add FSL to it. India Bulls i will not be adding it.

mikh

Monday 31st of January 2011

Hi Drizzt,

Pardon the late response. Had forgotten which section i left my comment. Yes, i asked bcos the lumpy nature had bothered me. Just like you i do not depend on it for the moment, but might do in the future. The other part was about the time value of money and cash flow opportunity costs. A stock that pays me 2cts per qtr is better than one that pays me 8cts a year. I've wondered how significant this can be and getting paid at different intervals by different stocks had confused my tracking as well :)

That said, kudos for the dividend tracker as well.

Drizzt

Monday 31st of January 2011

hi mikh, it will even be better if they pay every month dun you think. thats what i observed for US companies. I hope you can build up a larger portfolio in 2011. what are ur goals in 2011?

Yvonne

Saturday 29th of January 2011

Will you tell us how much you invested in order to get $3494 of dividend? In another words your % yield? Great blog. Thanks for making the great dividend tracker. Very helpful!

Drizzt

Sunday 30th of January 2011

Hi Yvonne, I believe it came up to SGD 50k. Thats about 6.9% its disappointing really. I believe you can do better than me Yvonne.

mikh

Friday 21st of January 2011

hi Drizzt,

Read about your dividends collection. It's not alot for you at the moment but going into the future, i just wonder if you think it'll be an issue of being lumpy esp with many companies having similar financial year-ends; granted some have quarterly payments.

Drizzt

Sunday 23rd of January 2011

hi mikh, I will expect that most international dividend companies pay dividend in quarterly or half yearly and they will be lumpy. But as i currently do not need them for subsistence it is still ok.

will this be an issue for you?

geemoz

Tuesday 18th of January 2011

Hi,

Your Dividend Stock Tracker page seems not being updated. The Last Price seems incorrect.