When some of our readers got financially conscious, they have already accumulated a large sum of money through different means.

A common fear is that they would invest a lump sum at the poorest time and they would have to sit through an unknown period of pain before seeing their money break even.

So they would like to find an opportune time to invest. However, the opportune time just would not come along.

Then, when the markets start running, they will have FOMO (fear of missing out), and would invest at a high.

All of us have different behavioural make-up when it comes to investing. If you are not in a hurry to capture the returns, the sensible thing to do may be to practice diversification through time by time-segmenting your investing in 2-3 different portions over 2 to 3 years.

I have not discover any great time-segmentation strategy but I do think if you have a lump sum and if you tranche it within a single year, that might not make much of a difference.

Of course, if you time segment over 2 to 3 years, half or 33% of your money may not capture the return. This is a missed opportunity. You will have to accept that as the trade-off to a more peaceful mind.

Psychologically, you may feel more comfortable adding during market drops rather than highs.

If we are more comfortable investing when the market declines, how frequent would we get these opportunities?

There is a Decline Every Year in the S&P 500. The Magnitude is hard to Guess

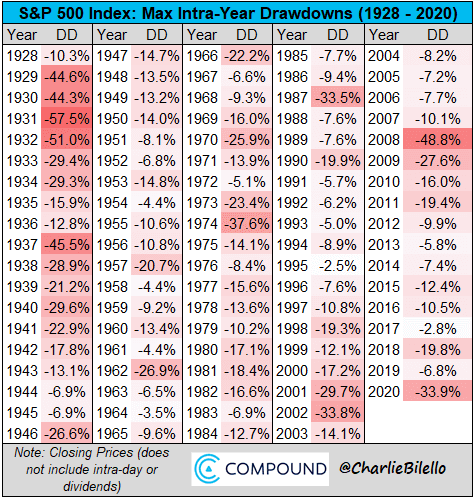

I came across this data from the Compound Advisers which show that every year, there is a drop in the S&P 500:

If you would like to invest in a drop, you would love the 1930s because the drops are so frequent and so drastic. Psychologically, it is likely I would not be able to pull the trigger.

I think in emerging markets, we would get more opportunities of this magnitude to invest a larger sum.

In the recent 10 years, you will get those greater than 10% drops, but we cannot often predict the magnitude.

The opportunity cost can be large. Imagine waiting for that 15% drop in 2013, 2014, 2017 and the drop never came. The markets continue to go up.

Markets do go up more than they go down, and waiting for the fat-pitch hurt us when we missed opportunities as well as when we lose money.

The Juiciest Yet Frequent Enough Declines Maybe 10% to 20% Declines

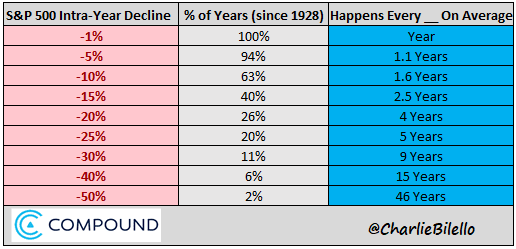

If we review the frequency of decline, 1% and 5% drops are very frequent. Almost every year there is one of that magnitude.

The uncommon one are the 10% which occurs every 1.5 years.

The 15% to 20% drops are the ones that a lot felt meaningful enough to put in a large chunk. But they are less frequent (2.5 to 4 years).

If that 15% to 20% drop do not happen and the market compounds 10% a year during that period, you would missed out on 27% to 46% of gain just by waiting for that fat pitch.

On $1 million, that will be $270,000 to $460,000. If the market drops 20% after that, you would still be positive. You will just be back to square one.

Instead of compounding at 10%, if the compounding was 6%, your missed opportunity cost would be between 15% to 26%.

The Magnitude of Declines for Event-Driven Declines is also Cloudy

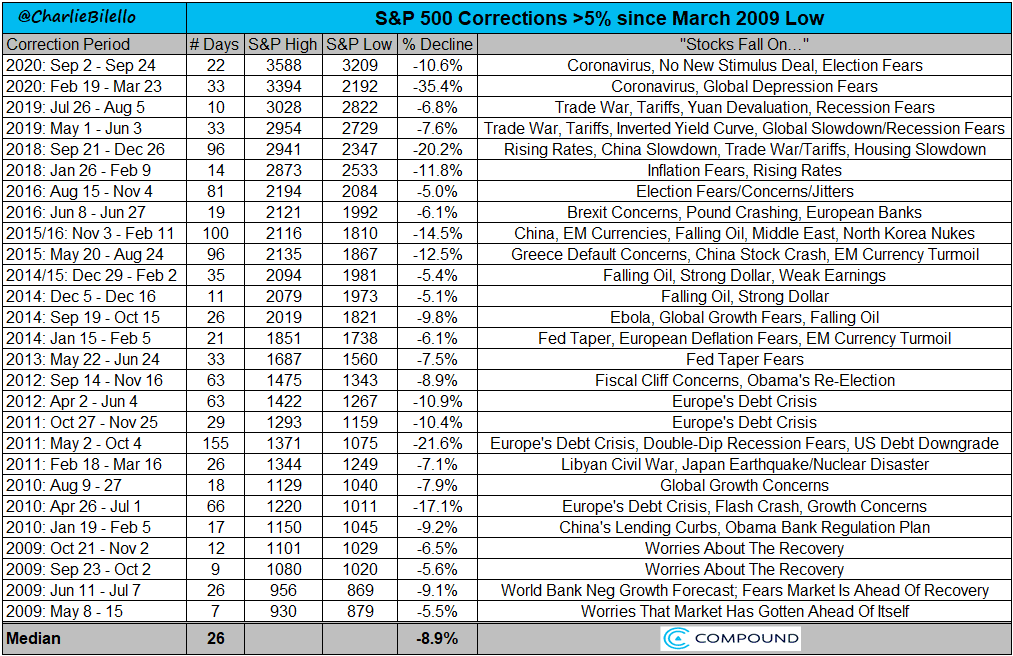

If we map the declines in the S&P 500 to specific events in the past 11 years, you would observe that there are declines but the order of magnitude differs.

Out of the 27 events, 10 of those events resulted in a decline with a greater than 10% magnitude.

Waiting for the large decline can be rewarding but if we wait for too fat of a pitch, we might end up staying out longer.

The longer you stayed out the fear of missing out develops.

Conclusion

If the market goes up, we can ignore the market noise and just invest. However, all of us are made up differently.

There is an opportunity cost for missing out on capturing returns over time, but it can be challenging to sit through volatility for some people.

I think we will have to learn to size our portfolio (between stocks and bonds/cash) so that we can stay invested to capture the return.

Finally, the frequency of event-driven declines and market declines may differ for emerging markets. While the markets today tends to be driven by the US market, there are events that affect different markets specifically.

The volatility of other markets may differ. I suspect you would get a meaningful decline more frequently.

However, it is likely we have no idea on the order of magnitude of the decline.

For more gems on active investing & portfolio management you can look at the Active Inveesting section below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Wednesday 27th of January 2021

2020 is a good test. If by end-Mar 2020, you hadn't utilise anywhere close to 50% of your warchest, then chances are you're better off DCA-ing.