Here we are refering to overall market behavior as a whole. In individual stocks, when insider sell individually, it may mean they are rechannelling their funds, but usually when key insiders sell, there may be something wrong.

What if we see a headline showing that in general?

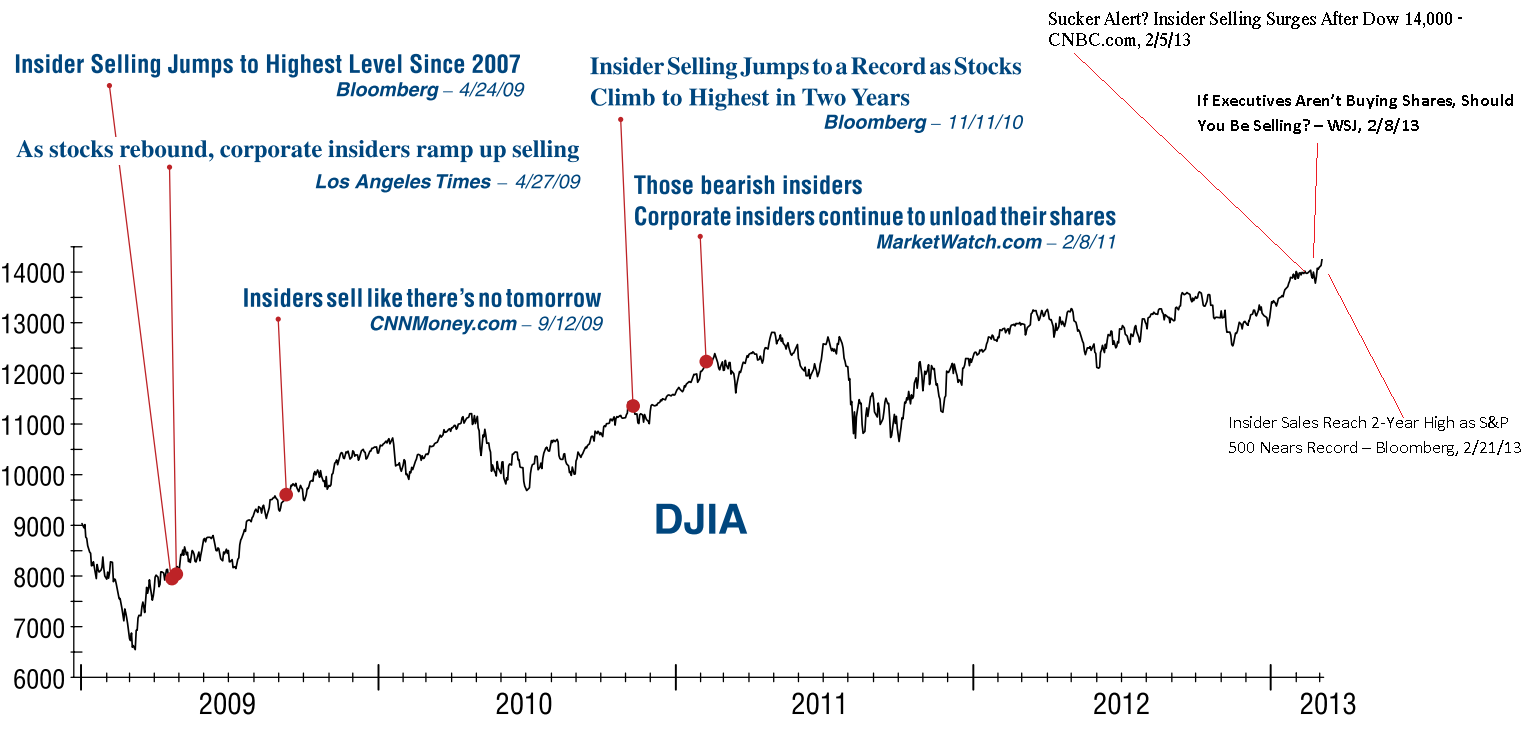

Barry Ritholtz has an article out showing that using these headlines as your market timing tools may not be highly accurate always:

• In late 1982, as the DJIA approached 1050 –a level that had proven a barrier for 17 years– Insider Selling reached its highest (supposedly most bearish) extreme in almost a decade.

• Ironically, by the summer of 1987 corporate insiders had turned into aggressive buyers of their own stock. In fact, Insider Buying reached a record (supposedly

most bullish) level in October 1987… just one week before the 1987 Crash.

• In 1991 Insider Selling spiked as the stock market roared out of the 1990 recession and corporate earnings languished. Everyone was convinced that stocks had disconnected from reality and the insiders were right. Wrong again!That was only the first year

of a 9-year bull market run that would produce the longest period without a 10% correction.

The Big Picture | Is insider selling a concern? | Read here

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Matt

Thursday 14th of March 2013

Got a qn abt your dividend stock tracker, specifically on Sembcorp's FCF. How did you calculate their FCF to arrive at those figures?

Kyith

Saturday 16th of March 2013

hi Matt i believe it is Operating cash flow - maintenance capex. is something wrong with it? do note that perhaps the minority share holdings of sembmarine may distort it.