Wes Crill, the head of investment strategists at Dimensional, brought to our attention some interesting changes in Russell Investments’ latest reclassification of stocks.

Two and a half years ago, the FAANG stocks were the set of companies that seemed to provide us with safety and returns as we tried to survive the pandemic. Their business model and network effects made them more resilient during the hard times compared to the old school economy stocks.

Russell recently reclassified Meta (formerly Facebook (F in FAANG) and Netflix (N in FAANG) from a growth stock to value stock during their annual reconstitution event.

In hindsight, the largest and strongest companies are not immune to weakness.

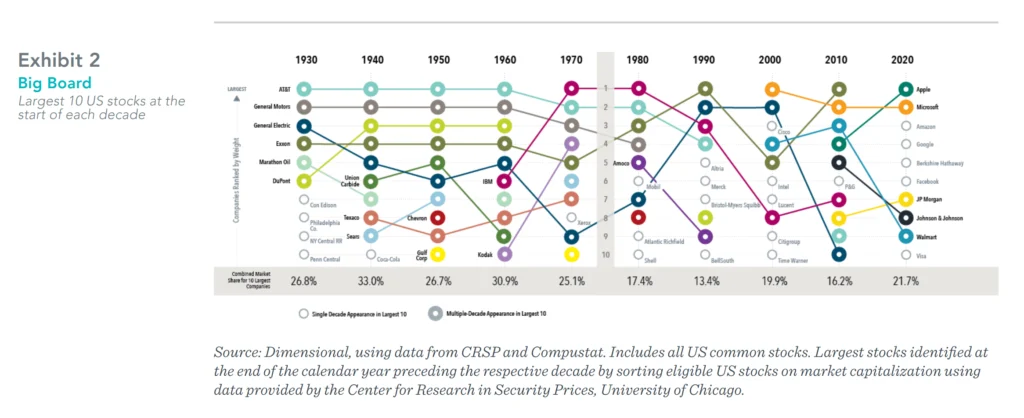

Wes provides this outstanding data chart providing empirical evidence of the largest stocks before and after becoming the ten largest stocks:

In 94 years of US history, we can aggregate the total return performances of the ten largest stocks three, five and ten years before they became big and after they became big.

If you can spot the stocks that will become the ten largest before they are large, you will get great annualized returns of 19% and 24% yearly. However, after they became the largest, performance was very different.

We tend to buy these “blue chip” companies because:

- They appear safer

- We judge them by recent returns (perhaps three to five years or even a two-year horizon)

- They are more well known

History does show that the largest companies do struggle, and these psychological biases may be why partly there is a value premium.

Despite their size, I don’t dispute that the current batch of tech companies is extraordinary in their ability to deliver revenue and profit growth. Apple, Google, Microsoft and Facebook delivered a very large proportion of S&P 500 earnings, and if they are delivering so many earnings, it can be challenging to address them overvalue based on price and narrative.

History shows us that some, not all the FAANG stocks can remain the biggest companies just like AT&T, General Electric, General Motors and Exxon for decades.

If we put these two data points together, it does look like while they can be big, it doesn’t mean we get the most bang for our buck.

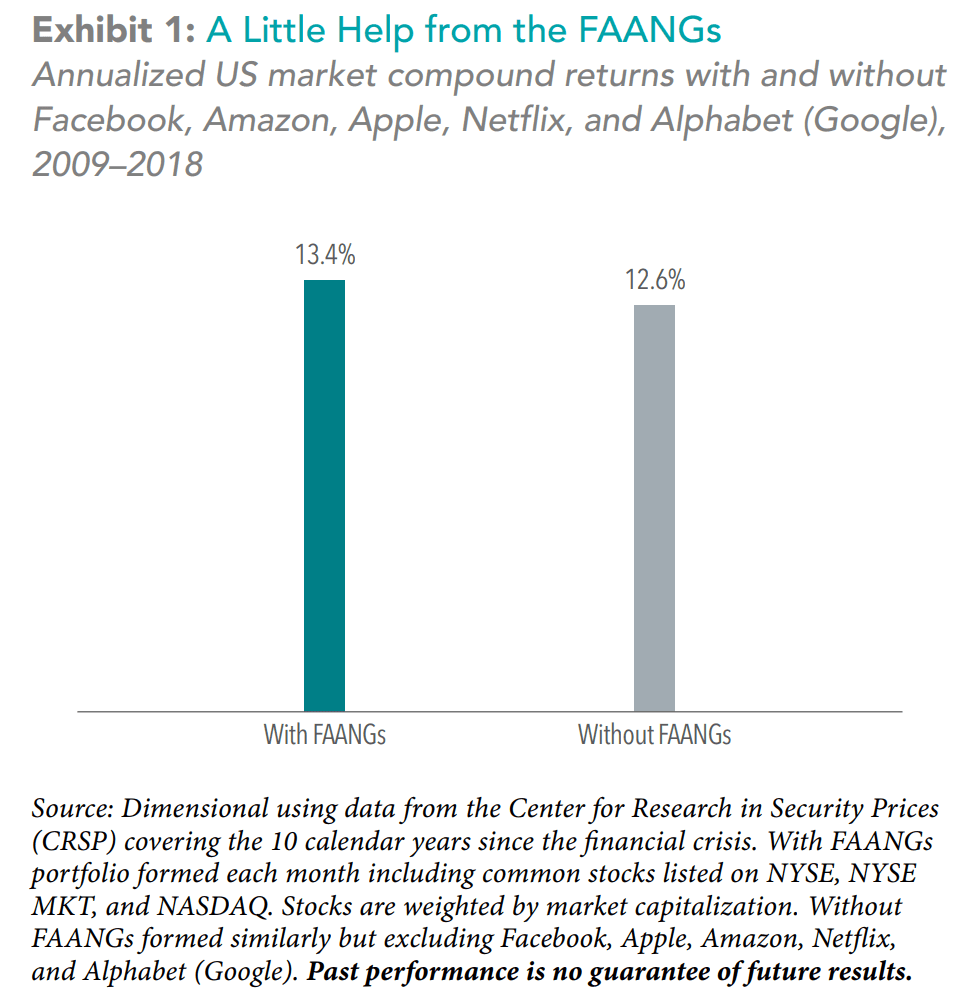

If we frame things from the opposite side, not having FAANGs in your portfolio, or underweighting them did not hurt the returns from 2009 to 2018.

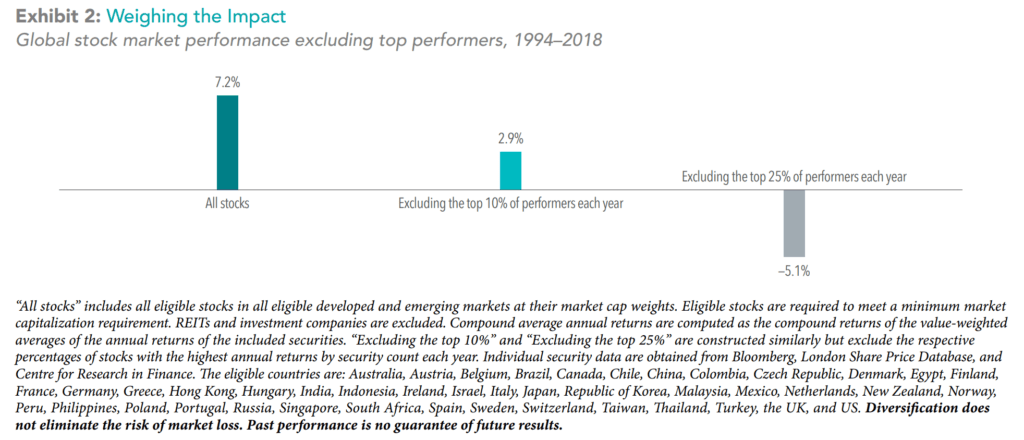

What drove returns are a small group of top performers each year. If you exclude the top 25% of performers each year, your returns would look drastically different from the market.

Spotting the top performers seems important, and we often debate about whether we can do that well consistently. As a former active stock picker, I think you could still do well if you missed out on the top performers. You may perform decently because you do not buy-and-hold and will consistently attempt to rebalance from stocks that show fundamental weakness to other high conviction companies.

But that is still a challenging game to play.

Dimensional’s data illustrates why its core funds are much more diversified than the typical index ETFs. They don’t just wanna mitigate the risk but also to capture the returns.

The best “blue chip” stocks to buy, that exhibit the criteria that most of you are looking for may still be a low-cost, systematic fund. My colleague Bryan wrote a great article on this a year ago: The Best Blue-Chip to Buy Now.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024