One of the challenges in managing client’s wealth is to get them enough reliable returns but within a risk level that they can stomach.

Many of us want the compounded returns but often we are taken aback by how ferocious some of the corrections that can take place.

Investing in a portfolio of bonds, or for the more adventurous people, one or two individual bonds used to be able to give you decent returns with low volatility.

The problem is with bond yields as low as it is now, I wonder if we can trust historical rolling returns to repeat themselves. If we project returns going forward using the current yield, then forward returns are going to disappoint.

Over the weekend, I got a chance to hear the ETF solution pitch from Innovator ETF on the Animal Spirits podcast.

Their range of buffer ETFs seems to be a unique product that advisers can add to their portfolio or be used to specifically address a particular financial goal.

In this article, I will explain more about Innovator’s implementation, how it works, and what are the different ways we can use this range of ETFs.

The Risk and Return Profile of Traditional Equities

Traditional equity portfolios have a risk and return profile similar to the Undefined investment above. Your return potential is unlimited on the upside. However, in theory, you can expect your investments to go to zero.

We probably want the unlimited upside but we cannot stomach the fall to zero so well.

What are Buffer ETFs?

Buffer ETF is an exchange-traded fund (ETF) that owns a basket of options, which gives a returns profile similar to its underlying index or underlying ETF, but with a capped upside and buffer downside.

There are 4 main components of a Buffer ETF:

- The Market Index

- Upside CAP

- Downside Buffer

- Outcome period

The Market Index

The buffer ETF sought to capture the returns profile of an underlying index, or an underlying ETF.

In Innovator’s case, they offer Buffer ETFs that give exposure to Growth, US small-cap, international developed equities, emerging markets, US Equity.

On this component alone, the ETF makes use of options to give us exposure to the index. If the underlying is emerging markets, then just like the emerging market index it should not do well this year.

Upside CAP

While the index may enjoy unlimited upside, the upside of a buffer ETF is capped. This means if the upside cap is 15%, and if the index earns 25%, you will only earn a max of 15%.

Downside Buffer

The appeal of the buffer ETF is its ability to limit your downside.

It is able to limit your losses but not make you not have losses.

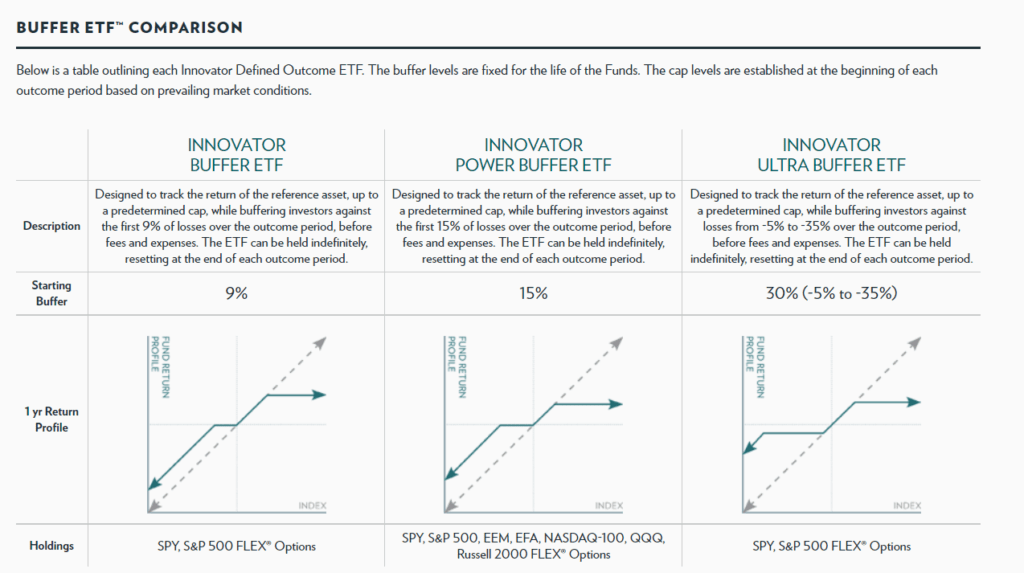

Innovator’s Buffer ETF have 3 different buffer: 9%, 15% and 30% (-5% to -35%).

Suppose we start with the 9% buffer.

If you hold the ETF and the underlying index suffer a loss between 0% to -9% from the price at the inception, you will suffer zero loss.

However, if the loss is greater than -9%, then you will suffer the excess loss.

For example, for that particular year, the loss is -15%.

The buffer ETF will limit your loss to around -6%.

Thus, it’s not foolproof and as you will see later, there is a cost to downside protection.

Outcome Period

Unlike normal ETFs which can exist for a long time, these ETFs exist for a limited duration.

You can think of them like your 1-3 year NTUC Gro Capital endowment.

Innovator issues these ETFs ever quarterly. Each ETF have an outcome period of 1 year.

Can you buy them in the middle of the duration where the ETF run? Yes, you can. But your loss profile will be different.

`How Buffer ETF’s change the Returns Profile of your Investments

We can contrast the improvement to the returns profile of our investments in the diagram below:

The first thing is that all three ETFs in this case study has a 1 year outcome period.

Their upside is Capped to different degrees. Their downsides are buffered to different degrees as well.

For the 9% and 15% ETF, you will not take a loss if the downside is rather contained. For the 30% ETF, you will take a -5% loss, but after that, if there are further losses that amount to -30%, you are protected.

The 30% one is for the really risk-averse, or someone who could stomach a small loss but want to buffer against a really catastrophic loss.

The 9% and 15% Buffer ETF is for the risk-averse who wishes to take their chance and assume returns fall within the normal range, and so the max loss is around -15%.

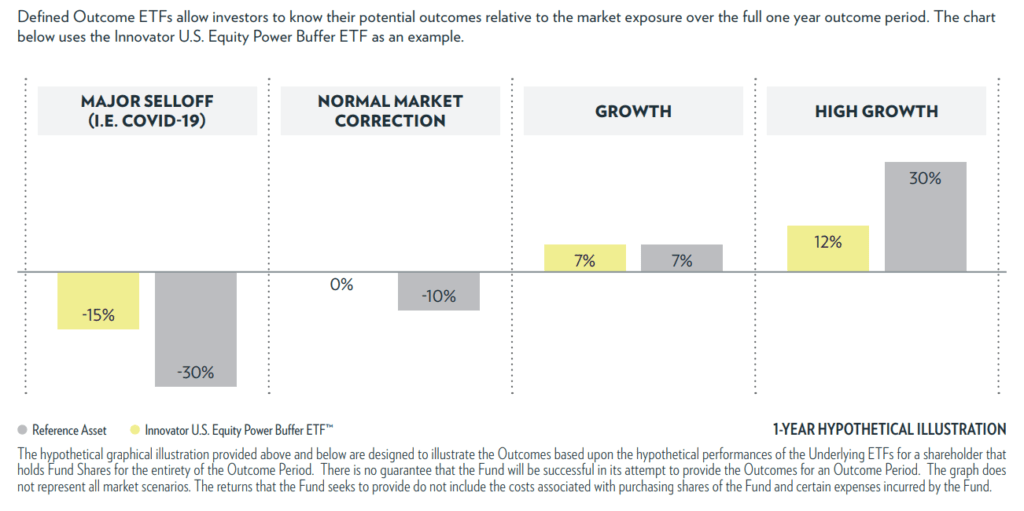

Here is another illustration of how a 15% Buffer ETF perform in different returns regime:

If there is a major sell-off amount to -30% if it works the way it does, your loss will be limited to -15%. This is because the 30% loss exceeded the 15% buffer.

If the loss is only -10%, it is within the buffer and so you take 0% loss.

If your return is 7%, which is below the 12% CAP, your return is 7%. Lastly, if the underlying index returns 30%, your return is capped at 12%.

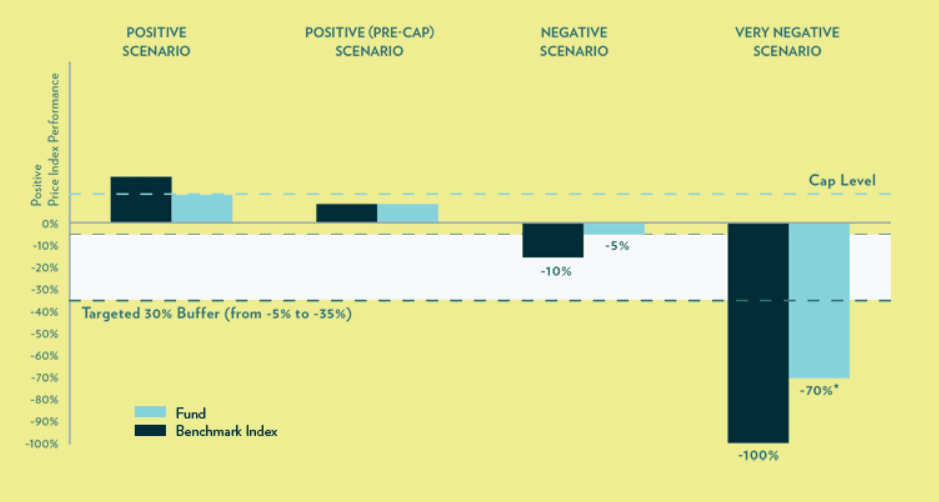

Here is a case study of the 30% Buffer ETF in different regimes:

I will not elaborate too much on this but only talk about the negative scenario. If the index loses -10%, you will still take a -5% loss.

How does Buffer ETFs Work?

In short, you can create a product with a specific risk profile with options.

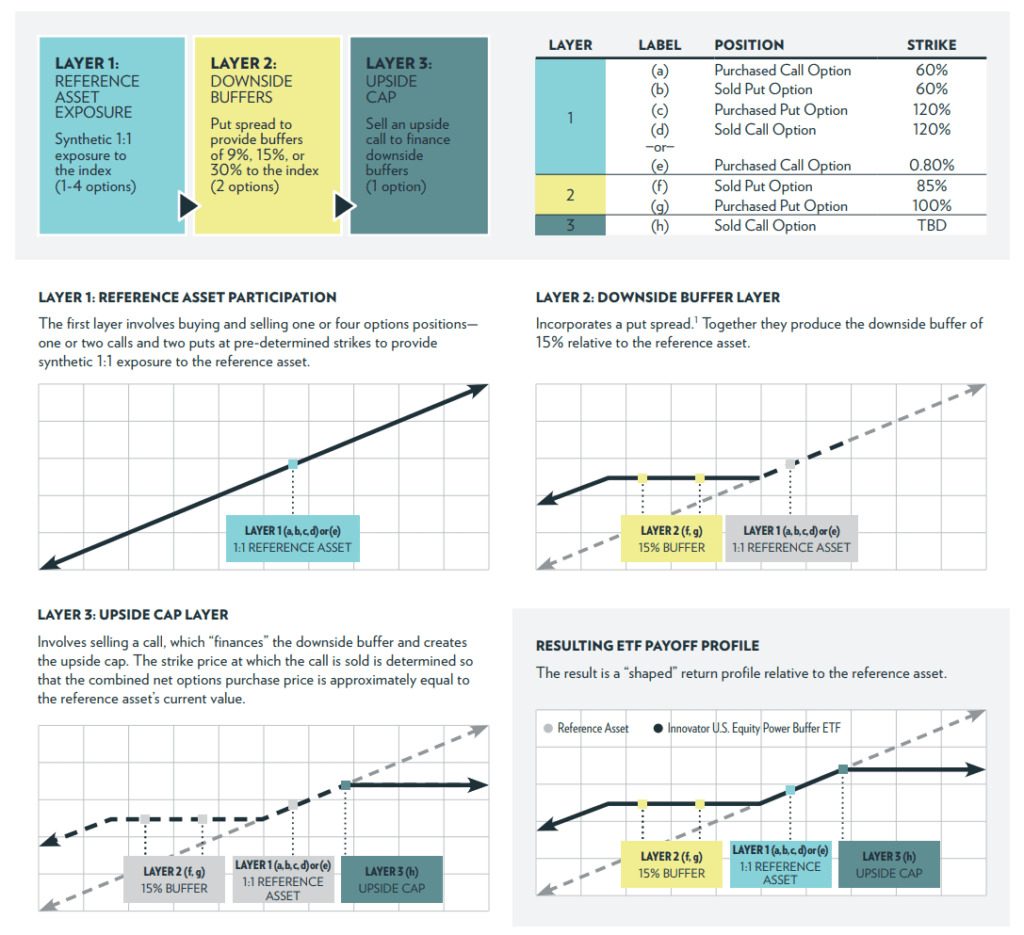

The following diagram tries to illustrate how a buffer ETF is constructed:

We can look at it in 3 different layers.

The first layer uses either a call option that is in the money to give us exposure to the price movement of the underlying index.

The second layer gives us protection. This is done by purchasing an at-the-money put option (for the 9% and 15% buffer ETF) and selling a further out-of-the-market put option.

This is what we will call a bear-put spread. It is cheaper compare to buying a put at-the-money outright.

Now normally, with these two layers, it is quite a power but why do we need to cap the upside with the third layer?

Because that bear-put spread is not cheap. It has to be financed by selling a call option to earn the premium. That premium is used to offset the bear-put spread.

So this is how it is constructed. If we know this, actually we can construct our own.

Private banks have been helping their clients construct something similar.

The Buffer ETF’s offered by Innovator ETFs

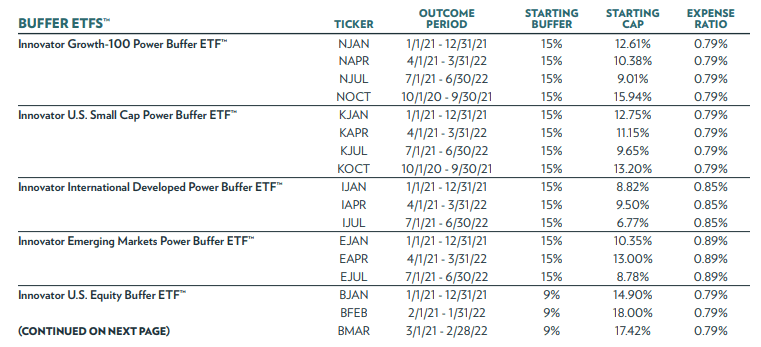

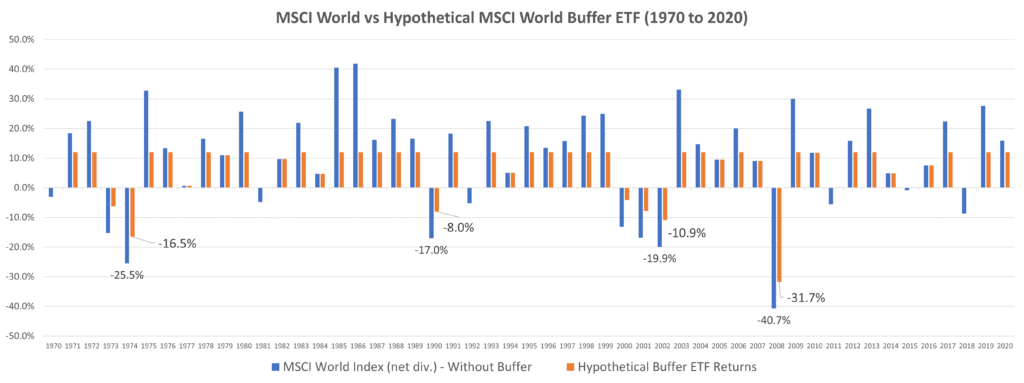

If we observe the ETFs offered by Innovator, we can understand some parts of the ETF better:

The first thing you will notice is that they have ETF cater to different geographical segments. They also release or roll over the ETF every quarterly.

The 9% have the highest starting CAP while the 30% have the lowest starting CAP. My interpretation is that the bear-put spread for 30% buffer ETF is so expensive that we need to sell a call that has a higher delta which usually has higher implied volatility, and commands a higher premium.

This means that there is no free lunch. The 30% buffer ETF protect a larger range of downside but that protection means what you can earn is lower.

It is whether a 6-8% a year max return is good for you.

Finally, we can see the expense ratio to be 0.79%. This is not the lower expense ratio but if you compare it to its comparison, I think it is rather reasonable.

There is also a Laddered Buffer ETF where they roll all 12 Innovator US Equity Power Buffer ETFs into one fund of funds.

Why there is a possible role for such a product and would appeal to clients.

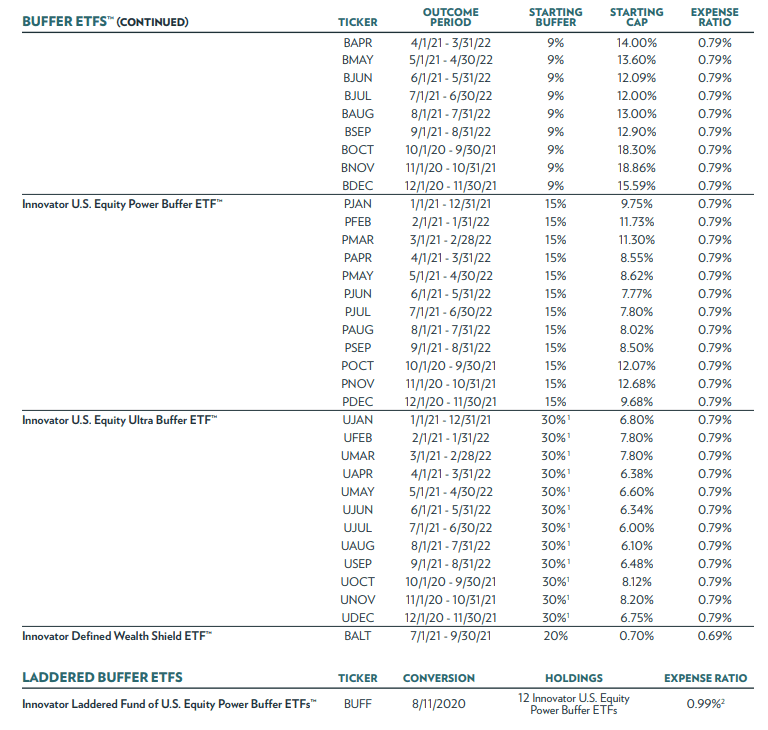

Innovator tries to explain why a defined outcome ETF is better.

The histogram shows the range of 1-year returns for the US markets.

A lot of the returns is between +20% and -14.7%. 66% of positive returns are on average 10.1%.

Our aim for our portfolio is to have a high kurtosis where the returns are a bunch up together so the range of expected returns is not too variable.

And this is the goal of the histogram. (focus on the 0% to 10% and 10% to 20%.

Here are the value proposition of the buffer ETF:

- They believe clients don’t need a super high return, but they are averse enough to protect the downside at the expense of this inflation.

- If you are able to match the maximum downside with the client’s true risk tolerance, then clients will be able to stay invested much better.

- If clients can stay invested better, they have higher conviction. Instead of money on the sidelines, they can be invested more.

- While there is less upside, the reality is that we may get some sort of the old bond returns… which is very decent and very controlled in volatilty.

It is no wonder that greater than 90% of Innovator’s Buffer ETF users are the registered investment advisors (RIA).

They are probably the people that most understand the place of this better than others.

How would the Returns Profile Look Like?

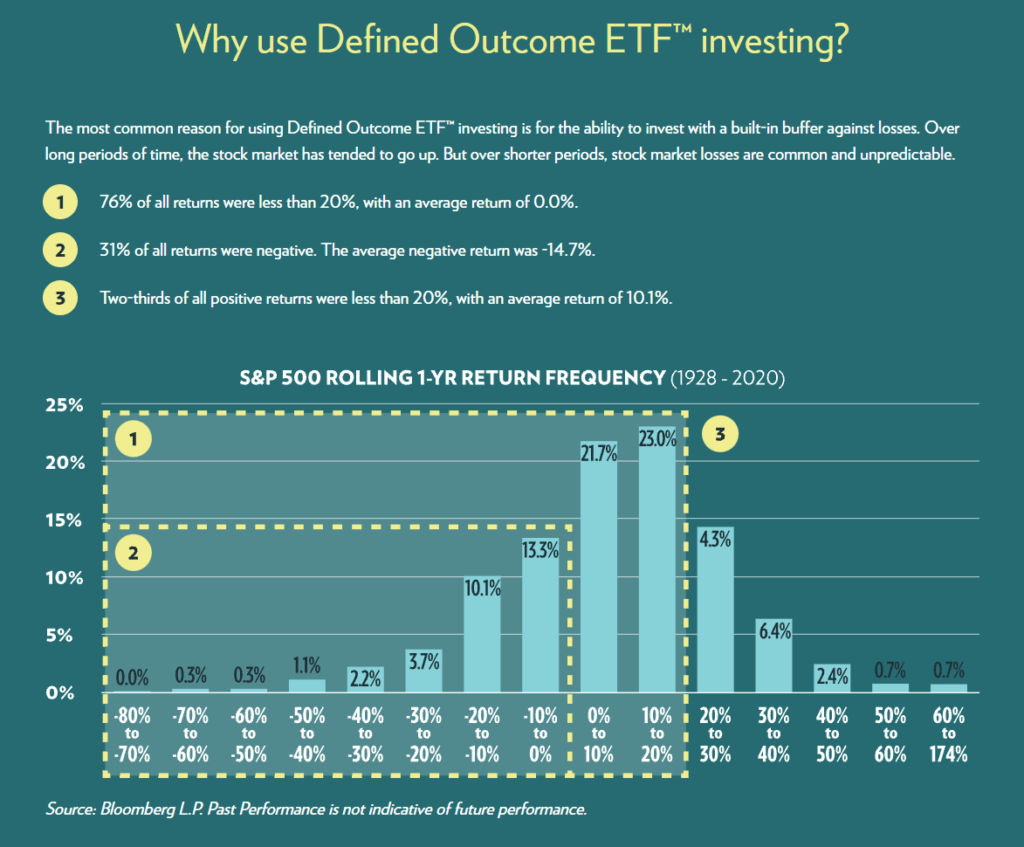

If Buffer ETFs work the way it should, then it should work on some MSCI World data.

I model the CAP of 12% and Buffer of 9% on the MSCI world and see how it would do.

We have 51 years of MSCI World calendar returns.

Firstly, there were more up years than down years. So this protection is really to help those who are risk averse stay in the game. If we take out the outliers of -40% and -25%, in most years, you cut the drawdown by 50% most of the time.

Compounded average growth (1970 to 2020):

- Without Buffer: 8.97%

- With Buffer: 5.92%

Almost 3% less. That is a big difference.

Annual standard deviation:

- Without Buffer: 17.11%

- With Buffer: 9.03%

9% is lower than a balanced fund but much higher than a portfolio of aggregate bonds.

So why not just get a portfolio of aggregate bonds? I think there is a case if future bond returns is going to be low, and you need a higher returns profile.

We are probably expecting lower equity returns in the future so the case is even with lower equity returns, we still do it better than a balanced portfolio or bonds.

Should we add Buffer ETFs to our Portfolios?

I think this is a good question.

ETFs like buffer ETFs is like a new age ETF. Traditionally, we do not have it in our portfolio.

But that is the thing. Buffer ETFs exist to address unique problems that traditional finance struggle to tackle: slicing some upside to protect downside.

But if you would want to capture the natural compounding nature of equities but still balance your risk tolerance, then the default securities to use is a mixture of low cost equity funds or ETFs with high quality bond funds or ETF to balance your risk level.

I am still wondering about Buffer ETFs have a role given the returns versus risk profile that I see.

I think whether we should consider using it goes back to the investment philosophy we use in Providend in what we add or subtract from our portfolios:

- Valid driver of economic returns. Investment solution should have a sensible way of obtaining that returns or show a sensible reason to obtain alpha. In a Buffer ETF case, the underlying is capturing price returns, which has an economic case, and traditionally there are strategies that layer derivatives to risk manage the portfolio. So it somewhat passes this.

- Evidence of return and performance. We want to know if this strategy have worked in the past, despite sounding good on paper. I think we have enough evidence of the long term return of price. The problem is a large part of returns come from dividends, which is not earned from using options as an exposure. It remains to be seen whether historical execution of this strategy yields decent risk adjusted returns. This is probably something to look into.

- Good implementation. What sounds good on paper may not be executed well. We look at cost of execution, the quality of execution and how scalable this solution is. What is working against a firm like Innovator is that we would probably need more time and feel about their implementation. However, I think their implementation may be more efficient than a lot of the traditional implementation out there.

- Practical considerations. Some investment solutions may be weaker in the above three areas but it does bridge client’s practical needs in some ways. I do see Buffer ETFs having that possibility because it is fucking difficult to get people to sit on their investments to reap the returns. Something that is able to help with that in some ways can be helpful.

Traditionally we see something similar to this.

The private banks have their own implementation of “Air Bag” structured products. Manulife Signature’s Indexed Universal Life have a similar idea.

The ETF wrapper has a lot of efficiency. It is more transparent, tax efficiency for US investors and the cost should be lower than private banks and the cost structure of a universal life policy.

The great thing is that for Singaporeans, these ETFs are listed in the US and you can buy them. Because they do not pay out a dividend, you do not have to worry about the 30% dividend withholding tax.

Unfortunately, because they are incorporated in US, they are less efficient in terms of estate taxes.

Would Buffer ETFs Suffer with Greater Demand and Competition?

I thought about the evidence-based part, and the implementation, and I can’t help but wonder whether Buffer ETF will follow the same dynamics as most traditional investments.

If something is real good, or has a good risk to reward characteristic over a competing asset class, the demand shot up to an extent that the returns versus risk moderates.

We could see this work out in the underlying options market.

- There is greater demand for downside protection. If liquidity reduces and less supply of downside protection, cost of downside protection may go up.

- But to fund that downside protection… more people are writing calls relative to the demand to buy calls.

- More call supply versus call demand drives down the premium earn and the only way to earn enough premium to fund the bear-put spread is to go closer to the current strike price, which means… your CAP on the Buffer ETF is lower

So what this means is with greater competition, and under certain options market dynamics, the risk versus reward may be moderated away… just like the aggregate bond market, or equity market.

In the end, Buffer ETFs may work well in some market scenarios (where the options market is favorable) and in some risk versus return scenario this would be no different from the traditional asset class.

I think there needs to be more reading up and more review of how the Buffer ETFs perform.

How to fit Buffer ETFs into the Portfolio?

There are a few implementation ideas:

Replace a 33% allocation of a 50%/50% equity and bond portfolio with a buffer ETF port. This reduces the volatility of the equity allocation by giving it some downside protection.

It does not have to be 33% but to calculate that downside protection together with your bond allocation that matches your risk tolerance.

If the Buffer ETF, maintains its upside potential, then you should get a slightly better returns profile than a balance portfolio in the past.

As these ETF have a limited duration, if you manage to hit the returns early, you could roll your money to a newer Buffer ETF, this would protect some of your downside.

For example suppose you hit the upside cap of 12%. You could sell out of the ETF, and rotate to a newer issue of Buffer ETF where the upside cap is not reached and still get some downside protection (do note that your downside protection is not 9% of the price you purchase but price when the ETF was issued, so you might take greater than 9% losses)

Finally, we can see someone going to retirement to have a greater allocation to these ETF, with a different set of Buffer for downside protection.

The risk of a 30% downside is bigger than capturing high compounded returns.

So it might be wise to use a 30% Buffer ETF.

Conclusion

If you are interested, you can listen to the Animal Spirits podcast here.

Innovator does have other ETF ideas and likely I will think about them when I have the time.

There are some implementation that I find uncomfortable. Asking near retirees to have a greater allocation to a bag of options does sound damn risky.

But I wonder if this is due to our lack of sophistication speaking.

I do find it accepting that if we are looking for ways to risk manage our portfolio, we think about using options to protect our downside.

However, for most people, the issue is whether you have

- the sophistication to know how to risk manage

- the quality of execution

And I think in the future we will see more of these kind of financial innovations.

Some will be quite bullshit. Some may be applicable. We just hope that more comes to our shores.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

BlackCat

Sunday 3rd of October 2021

Another option: when bonds make sense (due to negative real rates), gold may help stabilize a portfolio during corrections.

Kyith

Monday 4th of October 2021

Hi BlackCat, thanks for dropping by. I think we should expect Gold to do well. but it isn't now... which makes me question sometimes things may not always work the way we want.

BlackCat

Sunday 3rd of October 2021

*don't* make sense

Jack

Saturday 2nd of October 2021

Is the etf quote BUFF? Thanks!

Kyith

Saturday 2nd of October 2021

I think if you observe one of the image, there is a list of ETF names.