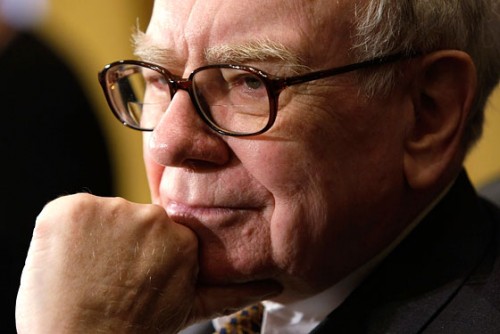

The annual Warren Buffett Shareholder letter is out. You can view it here. It has always been as insightful as reading an investment book, and I would urge aspiring investors to read it.

You can read the rest of the shareholder letters here (from 1977 to present)

You can invest in this insurer and gain access to these capital allocators and business managers, by investing in BRK/B which is around US$115 a share (in US you can buy 1 share and not 1000 shares)

Buffett shares how do you value Berkshire (Page 3):

As I’ve long told you, Berkshire’s intrinsic value far exceeds its book value. Moreover, the difference has widened considerably in recent years. That’s why our 2012 decision to authorize the repurchase of shares at 120% of book value made sense. Purchases at that level benefit continuing shareholders because per-share intrinsic value exceeds that percentage of book value by a meaningful amount. We did not purchase shares during 2013, however, because the stock price did not descend to the 120% level. If it does, we will be aggressive.

If S&P500 is rosy, stay out of Berkshire Hathaway (Page 3):

Charlie Munger, Berkshire’s vice chairman and my partner, and I believe both Berkshire’s book value and intrinsic value will outperform the S&P in years when the market is down or moderately up. We expect to fall short, though, in years when the market is strong – as we did in 2013. We have underperformed in ten of our 49 years, with all but one of our shortfalls occurring when the S&P gain exceeded 15%.

Over the stock market cycle between yearends 2007 and 2013, we overperformed the S&P. Through full cycles in future years, we expect to do that again. If we fail to do so, we will not have earned our pay. After all, you could always own an index fund and be assured of S&P results.

The value managers Todd Combs and Ted Weschler is outperforming Buffett’s selections (Page 5):

In a year in which most equity managers found it impossible to outperform the S&P 500, both Todd Combs and Ted Weschler handily did so. Each now runs a portfolio exceeding $7 billion. They’ve earned it.

I must again confess that their investments outperformed mine. (Charlie says I should add “by a lot.”) If such humiliating comparisons continue, I’ll have no choice but to cease talking about them.

Todd and Ted have also created significant value for you in several matters unrelated to their portfolio activities. Their contributions are just beginning: Both men have Berkshire blood in their veins.

If you are operating businesses, does the political climate matters? My interpretation is that it does to a certain extend, but ultimately, you need only a true north. Buffett just needs to know a country is going to prospect (despite what the doom mongers says) (Page 6):

That kind of commitment was nothing new for us: We’ve been making similar wagers ever since Buffett Partnership Ltd. acquired control of Berkshire in 1965. For good reason, too. Charlie and I have always considered a “bet” on ever-rising U.S. prosperity to be very close to a sure thing.

Indeed, who has ever benefited during the past 237 years by betting against America? If you compare our country’s present condition to that existing in 1776, you have to rub your eyes in wonder. And the dynamism embedded in our market economy will continue to work its magic. America’s best days lie ahead.

The job of the capital allocator, and with that, areas you evaluate your company by (Page 6):

With this tailwind working for us, Charlie and I hope to build Berkshire’s per-share intrinsic value by

- (1) constantly improving the basic earning power of our many subsidiaries

- (2) further increasing their earnings through bolt-on acquisitions

- (3) benefiting from the growth of our investees

- (4) repurchasing Berkshire shares when they are available at a meaningful discount from intrinsic value

- (5) making an occasional large acquisition

We will also try to maximize results for you by rarely, if ever, issuing Berkshire shares.

Why BRK’s railroads and utilities can borrow without BRK’s name coming into the picture, and it tells you the nature of utilities (Buffett also corrects on a certain flawed measure we will use) (Page 11):

A key characteristic of both companies is their huge investment in very long-lived, regulated assets, with these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is in fact not needed because each company has earning power that even under terrible economic conditions will far exceed its interest requirements. Last year, for example, BNSF’s interest coverage was 9:1. (Our definition of coverage is pre-tax earnings/interest, not EBITDA/interest, a commonly-used measure we view as seriously flawed.)

The economic moats of the railroads and utilities (Page 11):

two factors ensure the company’s ability to service its debt under all circumstances. The first is common to all utilities: recession-resistant earnings, which result from these companies exclusively offering an essential service. The second is enjoyed by few other utilities: a great diversity of earnings streams, which shield us from being seriously harmed by any single regulatory body. Now, with the acquisition of NV Energy, MidAmerican’s earnings base has further broadened. This particular strength, supplemented by Berkshire’s ownership, has enabled MidAmerican and its utility subsidiaries to significantly lower their cost of debt. This advantage benefits both us and our customers. (More in the letter……)

On the difference in amortizing intangibles, and if you use EBITDA you are screwed (Page 14):

I won’t explain all of the adjustments – some are tiny and arcane – but serious investors should understand the disparate nature of intangible assets: Some truly deplete over time while others in no way lose value.

With software, for example, amortization charges are very real expenses. Charges against other intangibles such as the amortization of customer relationships, however, arise through purchase-accounting rules and are clearly not real costs. GAAP accounting draws no distinction between the two types of charges. Both, that is, are recorded as expenses when earnings are calculated – even though from an investor’s viewpoint they could not be more different.

In the GAAP-compliant figures we show on page 29, amortization charges of $648 million for the companies included in this section are deducted as expenses. We would call about 20% of these “real,” the rest not.

This difference has become significant because of the many acquisitions we have made. It will almost certainly rise further as we acquire more companies.

Eventually, of course, the non-real charges disappear when the assets to which they’re related become fully amortized. But this usually takes 15 years and – alas – it will be my successor whose reported earnings get the benefit of their expiration.Every dime of depreciation expense we report, however, is a real cost. And that’s true at almost all other companies as well. When Wall Streeters tout EBITDA as a valuation guide, button your wallet.

Our public reports of earnings will, of course, continue to conform to GAAP. To embrace reality, however, remember to add back most of the amortization charges we report.

From his “little” companies, Buffett explains why they are good businesses, and why he failed in some of them (Page 14):

The crowd of companies in this section sells products ranging from lollipops to jet airplanes. Some of these businesses, measured by earnings on unleveraged net tangible assets, enjoy terrific economics, producing profits that run from 25% after-tax to far more than 100%. Others generate good returns in the area of 12% to 20%. A few, however, have very poor returns, a result of some serious mistakes I made in my job of capital allocation. I was not misled: I simply was wrong in my evaluation of the economic dynamics of the company or the industry in which it operated.

The difference between net-nets and value growth is that you can pay a premium for something that goes on for a long time (provided you make sure that it really can!) (Page 14):

Of course, a business with terrific economics can be a bad investment if the purchase price is excessive. We have paid substantial premiums to net tangible assets for most of our businesses, a cost that is reflected in the large figure we show for goodwill.

Overall, however, we are getting a decent return on the capital we have deployed in this sector. Furthermore, the intrinsic value of these businesses, in aggregate, exceeds their carrying value by a good margin. Even so, the difference between intrinsic value and carrying value in the insurance and regulated-industry segments is far greater. It is there that the truly big winners reside

There is a very good Buffett commentary I already posted here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024