A couple of weeks ago, I sat down with my CEO to discuss the topic of advice. This is part of their Money Wisdom series.

They wanted to sit down with real people and discuss their money stories and their relationship with financial advice over the years.

You can check out my interview with him here on YouTube.

We discussed some topics that… perhaps is slightly more sensitive:

- Growing up, my money beliefs.

- Dealing with frugality when you already have the money. Will I spend my money? The inner thoughts when I think about spending.

- Am I confident about managing my own money?

- How should really frugal people really learn to spend their money?

- Any poor money decisions?

- Do I have an adviser that I speak to when I need to make financial advice?

- What do I consider as good financial advice?

- Under what circumstances will I pay for advice?

- Not everyone wants to manage their wealth so tightly forever. Why I choose to pivot my investment strategy away from dividend investing? How does it feel like selling off all the stocks at one time and pivoting? How has that change things?

- Dealing with different philosophies between Providend and Investment Moats. Both investment and wealth management.

- Should people do wealth management themselves? Should they pay for advice?

I think without Chris, this podcast interview can really go haywire, so credit needs to go out to him for controlling the interview. I would also like to thank Helen, Jialing and Nataly for incepting the idea and doing the post-processing.

There is something that I hope to flush out better.

At 32 minutes, I dived into taking risks and earning returns and maybe it might not be very clear.

In general, to earn a good return, we have to take on risks, and we hope to get compensated with returns by being exposed to the risk.

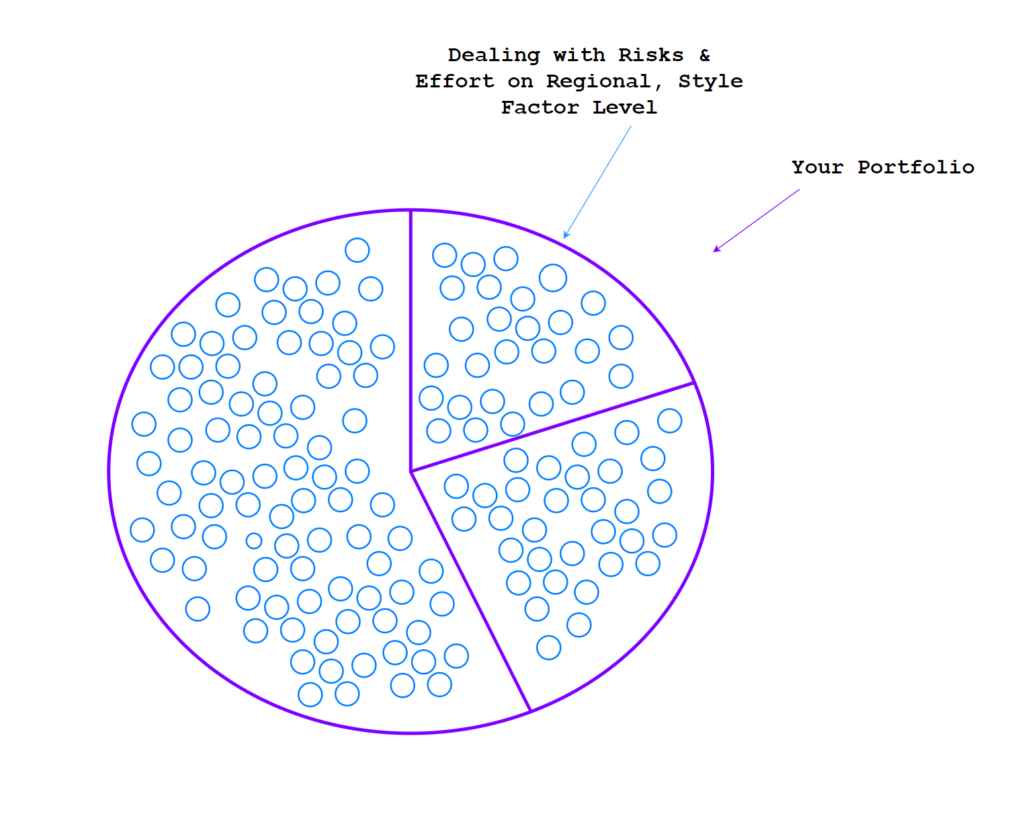

So when we create our portfolio, we can visualize having a plate of different risk assets. These can be individual securities such as stocks and bonds, or managed funds, or portfolios such as unit trusts and ETF.

Instead of looking at your portfolio as potential returns, you can also look at it as risk exposures.

If you run a concentrated portfolio of 10 or 20 stocks, your individual company risks are higher. And you hope to be compensated for taking on that risk.

Volatility is higher, the risk of large capital impairment is also higher.

The risk of being wrong is higher.

Your fate hinges on your investment decision-making.

When we go one level higher, we accept that we are going to be expose to less risks.

We don’t have to worry about a single company, or a sector, or a region going bust and impairing our portfolio. Because we insulate ourselves from that risk, the potential returns also shrink.

But we are still being expose to risks because if we have a lot more companies or bond securities, we are still taking on risk, and we hope to capture the returns of these many companies and bond securities over time.

But the difference is the degree of effort.

Do you wish to hold the job of a portfolio manager plus wealth manager, or hold mainly the job of the wealth manager?

The potential returns might be less, but so is the effort.

Even with effort, it does not mean your returns proportionately is higher.

So I choose to forgo the idiosyncratic (or the risks related to individual securities) risks, to have a better balance of things.

Hope this helps.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

revhappy

Monday 22nd of May 2023

Nice to hear your voice :)