March 2020 is a bit of a madness.

March Madness is also the name given to National Collegiate Athletic Association Division 1 Men’s Basketball tournament in the United States.

It is no surprise that this very popular grassroots tournament has been canceled.

This sent a very strong message to the people in the United States that COVID-19 is a serious matter.

If you have not been paying attention to the markets, I think you have all the hallmarks of a very good buy and hold investor.

However, chances are, your lives would have been disturbed by the disruption caused by COVID-19 and be at least aware of what is happening in the financial markets.

As we ended March, we are also to review some of the data coming out of the financial markets about this very volatile period.

One of the charts that illustrate the extent of volatility is the one above. The last time we have three 9% moves consecutively was in the Great Depression.

The average monthly volatility in the MSCI World index is 4.2%. The index moved -13.2% in March. This is an almost 3 Sigma event. This is a very rare event.

Not too long ago, Michael Burry, a brilliant and well-known financial figure alerted the public about his concerns that we may be inflating a big bubble by concentrating too much of our money in passively managed index funds.

His comments sparked off an online debate among financial commentators overseas and locally whether we should be concerned about putting our wealth in passively managed index funds.

We also had clients asking us whether there is cause for concern.

A stock market event that happens in February to April is the kind of event that is most susceptible to the unwinding problems Michael talks about. Many derivatives interplay with index funds and exchange-traded funds that are traditionally more buy and hold investments.

In mid-March, the Federal Reserve has to take drastic actions by injecting liquidity into the markets to provide liquidity and currency swap. Had they not moved fast enough, there might be greater distress in the markets.

Throughout this time, what did investors do?

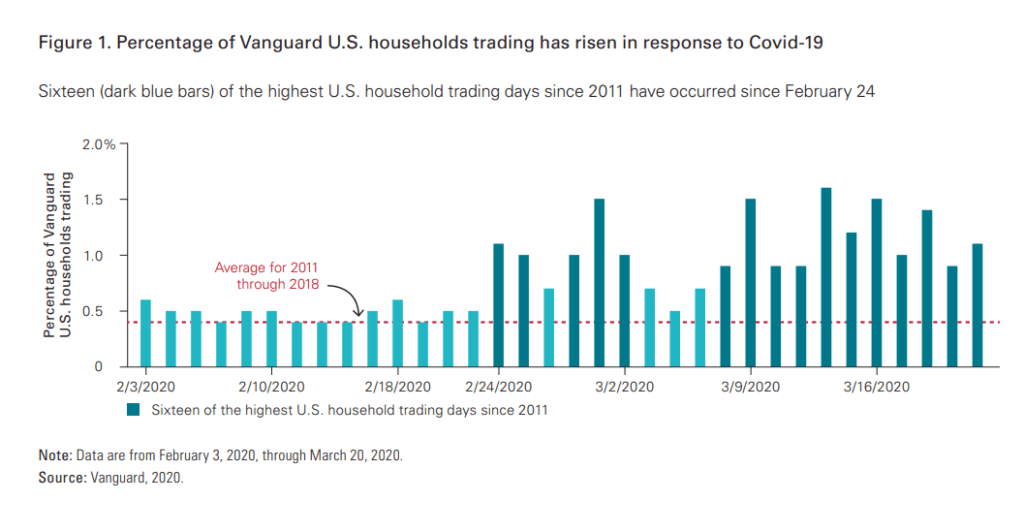

Vanguard published a report that reveals the behavior of the investors in their funds.Source: Vanguard

The market started falling from 19th February onwards. From the chart, we can see that the Vanguard funds experienced some of the highest trading days since they started tracking in 2011.

The majority of the households were making trades.

7 out of 10 households since February 19 have been moving money into equities than cash or fixed income.

However, those who are wealthier have been selling into declines, moving into fixed income.

Another statistic that we may missed from the bar chat is that despite the increase in trading activity, the percentage of Vanguard U.S households trading remains less than 1.5%.

This seems to indicate that majority of the US Vanguard household does nothing during this period.

Eric Balchunas, senior exchange-traded fund analyst at Bloomberg tweeted this chart on the outflows from unit trusts during this period.

Many commentators were questioning the fortitude of passive index investors. They question whether they would suffer from the same behavioral tendency as normal investors when volatility in the market picks up.

The result does show that the Vanguard investors can be a rather unique bunch who seemed to have stronger holding power.

Why is this the case? I am not sure.

Perhaps the advisers recommending them to clients have coached the clients well on how they should look at investing. Perhaps the investors buy into the Vanguard philosophy.

For some reason, Vanguard investors are a resilient bunch.

During the European debt crisis, the S&P 500 lost 20%. Here is an extract from Vanguard’s look at the data back in 2011:

In the first eight trading days of August [2011], including two of the most volatile days since 2008, just under 2% of 401(k) participants at Vanguard made a change to their portfolios. In other words, over 98% stayed the course. Ninety-eight percent took no action. Ninety-eight percent took the long-term view.

There are some lessons that we can learn from Vanguard investors:

- The system to invest can be very simple if you have a long-term mindset and can stay out of your way.

- If you have a plan in place, not doing anything is a reasonable course of action to make. For many investors, they find that they have to do something, which may get themselves into trouble.

The majority of our clients are either in Vanguard or Dimensional funds. The strategy we asked of them is not too different from these Vanguard investors.

The question is whether you would do the same thing as them.

The article you have just read was originally written for Providend’s Think Space .

Think Space is a repository of research that I came across where I work. Some are investing and wealth-building research. There will also be personal and collective wealth management reflections after serving our clients.

I am sharing the article here because I believe that you will enjoy content like this, and it adds value to your investing and money management.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

theFI35

Friday 10th of April 2020

Great article. I have been burned by being over-active and thinking too much. If I had done nothing, most times it would have gone better. I sold Apple, Tesla, and Tencent at rock-bottom prices.

At the same time, I was burned by Starhub, Lippo Malls, and Keppel by being a long-term holder.

I think I would have been much better off investing in Vanguard and forgetting about it.

Kyith

Saturday 11th of April 2020

Hi theFI35,

I think individual stock investing calls for something different. IT is not so straight forward of a "Better off being passive" thing. Its more of a refinement of our when to let it ride and what we should do when things turned. Some we have to let it ride out some we need to just cut them.