According to the seasonal performance of the markets, it seems we cannot afford not to invest in the markets for the last 3 months, especially November.

Here is the average 1-month per cent change in the Dow Jones Industrial Average from 1880 to 2012:

From this chart, it seems we have to stay invested from October to the end of January.

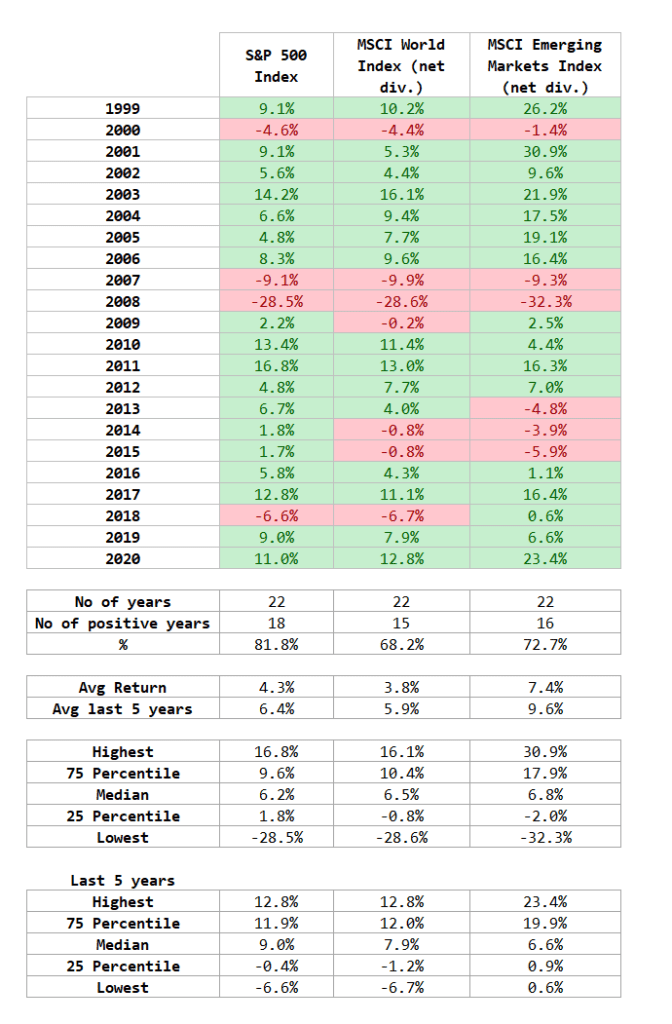

I was in the mood, so I dug up the performance of S&P 500, MSCI World and MSCI Emerging Markets in these 4 months from 1999 to 2020:

There are 22 periods during this analysis. The majority of this four-month period (1st Oct to 30th Jan) is positive.

There were more negative occurrences for MSCI World and Emerging markets compared to S&P 500.

Average returns have been positive, with Emerging markets having higher returns.

However, this period is not foolproof. I think most four-month periods were rather livable except for the four-month during 2007 and 2008. That is some nasty drawdown.

I was surprised that only one out of 1999 to 2002 was negative during October to January. I would have expected more since this is one of the more shitty bear markets in recent memory (by virtue of how big of a psychological grind it was)

If we only count the last 5 years, the lowest cumulative returns are about 6.6% to 6.7% for the S&P 500 and MSCI World.

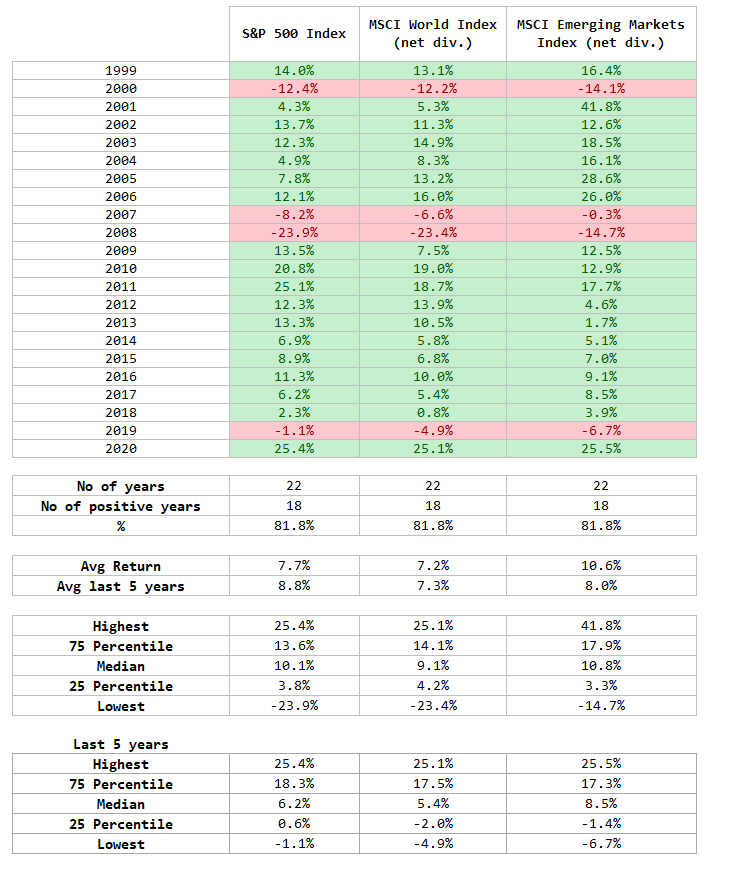

Since I am on a roll here, why not take a look at the performance of “buy-in October and sell before May”?

So I tabulated the data from 1999 to 2020 below:

There are 22 periods. 81.8% of those periods are positive.

2000, 2007 and 2008 were periods where this strategy didn’t work so well. Or rather, this strategy does not completely eliminate downsides.

The average return is very respectable.

What is amazing is that the return at the 25th percentile was not very high, but still positive.

If there is a conclusion to be made, it is that quantitatively, missing out on returns by not being invested during these two periods are going to hurt returns if you hold a strategic long-term portfolio.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Monday 27th of September 2021

Plenty of analysis of US stocks generally conclude that buy & hold over the long term will beat Oct-Apr investing.

Sell-in-May strategy "works" only if looking at price-only index, ignoring dividends & transaction costs which isn't realistic.

E.g. https://www.forbes.com/sites/rickferri/2013/04/08/busting-the-sell-in-may-and-go-away-myth/

However this strategy may be suitable for those who care more about volatility & don't mind lesser returns over the long run. Example those with shorter time horizon, or those with less of an iron stomach.

Maybe an alternative to 60/40 portfolio in light of unattractive bond fundamentals & valuation???

E.g. https://gbr.pepperdine.edu/2014/12/is-go-away-in-may-a-good-portfolio-play/

Volatility, red days/weeks/months/quarters/years, crashes, -30++% portfolio drawdowns are the price to pay to capture the very large long-term returns.

Kyith

Monday 27th of September 2021

Thanks for the links sinkie. Will read them later.