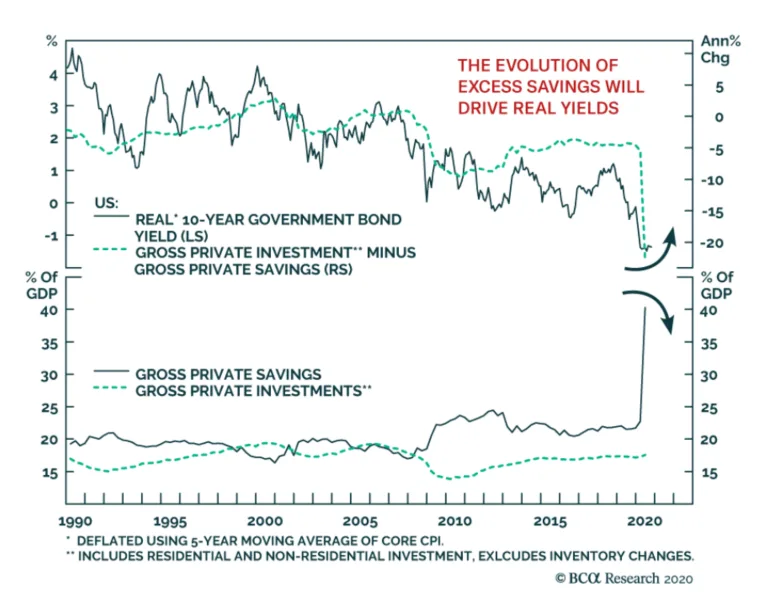

With the FED having a mandate to hold the short-term interest rate for a prolong period of time and their willingness to let inflation run above 2%, it make us wonder if interest rates would ever tick up.

BCA points out that in the past 30 years, there has been a strong link between major moves in real 10-year yields and the amount o fexcess savings in the economy.

Currently the gross private savings have been very well boosted by the fiscal stimulus but also that people tend to become more prudent when things are uncertain.

As people’s salary regain traction and consumer sentiment recovers, it is likely the savings rate will decline and perhaps yield might start moderating upwards.

I am thinking less about the REITs but more about whether the insurance companies and the finance company can finally have some yield spread to play with so as to earn some interest income. This would change the picture for the financials and insurance company as to whether there is a catalyst for the share price to do well.

BCA have this idea for people to remain overweight global equities in your core positions but it would be good to pair with a portfolio of stocks to short. These are the stocks who are particularly vulnerable if the market corrects.

So the list above is a group of stocks which in their opinion was overbought, have rallised more than 60% over the past 6 months. They also overlay technically and fundamentally (moved far above their fundamentals)

In my opinion, you got to have some strong fortitude to short a list of these things. A lot of them just need some good earnings announcement to really kill the short.

Still, I hope people understand that they are not taking a uni-direction view about the markets but that they have a core portfolio that are long. Misunderstanding this and taking a uni-direction would be akin to a very strong form of betting.

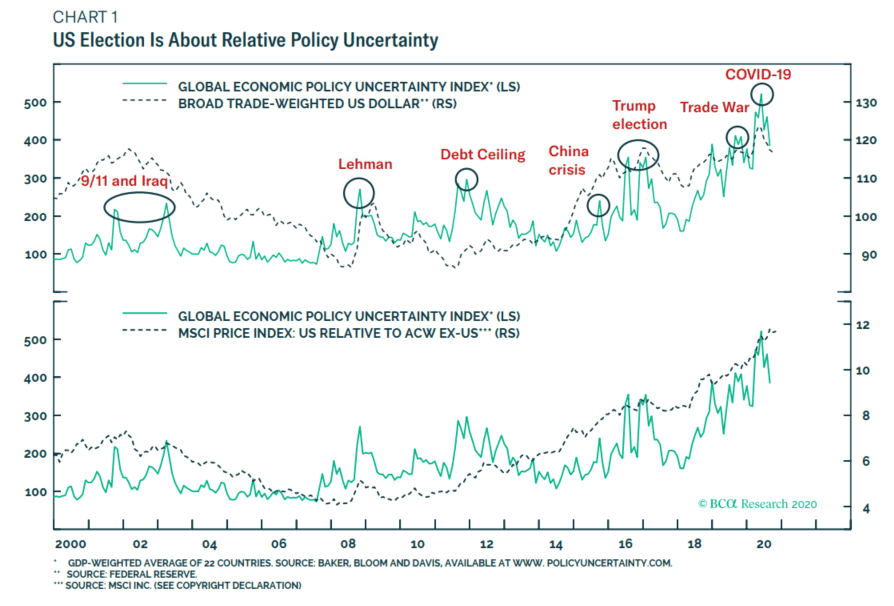

BCA provides some interesting data on the correlation between global uncertainty and US equity outperformance. As you can see, we have gone through a long period of uncertainty, which gets more uncertain as the years went by.

This increase in uncertainty have exacerbated the dollar bull market and market outperformance.

Sometimes, we like to wait until the coast is clear, then we invest. But if you look at this chart, it seems to indicate the higher the uncertainty, perhaps there is a risk premium, and this drives the performance of your portfolio.

You wait until the coast is clear, then it might be the real peak.

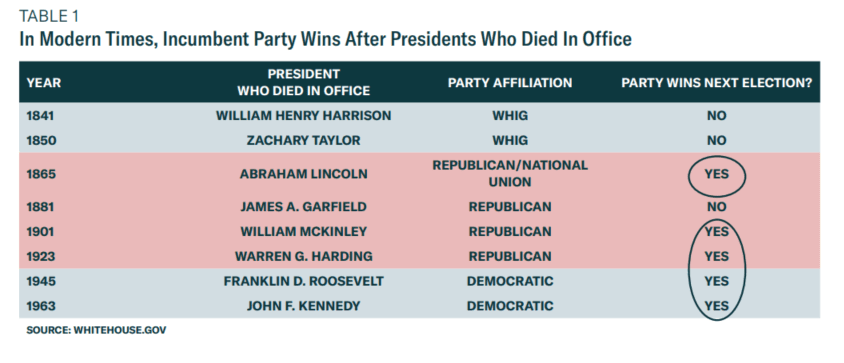

President Trump now has Covid-19 and it became a thing that could move markets. The stock market actually came down 1 day. I think him being infected actually signifies that not many places are safe more than anything else.

In anycase, BCA has this very cute statistic.

In modern times, the incumbent party has won the election in every instance in which the president died in office.

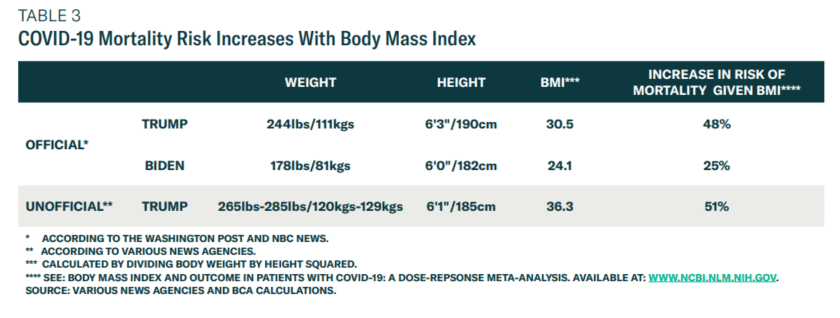

It seems folks that are more on the heavy side, runs increase risk of dying from COVID.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024